Voyager: As FTX.US acquires all assets, the future of VGX still remains a mystery

The crypto brokerage and lender Voyager Digital faced severe tides since it filed for bankruptcy proceedings on 6 July 2022. Impacted by the collapse of Three Arrows Capital (3AC), Voyager Digital, in a 22 June press release, informed its users of its 15,250 BTC and $350 million investment exposure to 3AC.

But could the sail see a ‘peaceful’ voyage now that the platform found a place to call home?

Bon Voyage

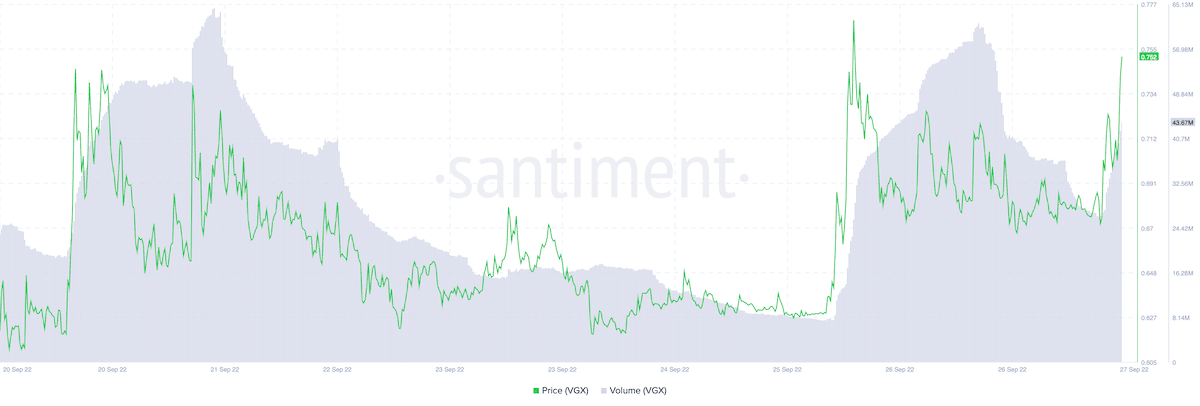

VGX, the native token of the failed crypto brokerage firm Voyager Digital, rallied by 20% during the intraday trading session. At the time of writing, the token traded around the $0.7 mark after witnessing a fresh surge on CoinMarketCap.

Meanwhile, the token saw significant trading activity ongoing at press time. The trading volume for the VGX token was up by more than 50% in the last 24 hours. At press time, the trading volume reached around the 45 million mark.

VGX’s daily active addresses too saw a similar picture on the same platform. Indeed a steep incline after the network fell by 88% in August. Apart from this, crypto twitter showcased some affection as well as bullish projections on Twitter to mark the uprise.

But what really helped the cause?

A place to call HOME

As per the previous report, Voyager confirmed that it had received multiple bids for its assets as part of its restructuring process. Finally, we have a winner as confirmed by the crypto lender platform on the social media platform.

Today, after a competitive auction aimed at returning maximum value to customers, @FTX_Official US was selected as the highest and best bidder. Press release linked below. More information about what this agreement means for customers to follow.https://t.co/OmOd7pvSza

— Voyager (@investvoyager) September 27, 2022

FTX, one of the largest exchanges, won the auction for the assets of bankrupt crypto brokerage Voyager Digital Ltd. with a bid of around $1.4 billion, Voyager announced on 27 September. The bid also included “additional consideration that is estimated as providing approximately $111 million of incremental value,” according to official press release.

“FTX US’s bid maximizes value and minimizes the remaining duration of the Company’s restructuring by providing a clear path forward for the Debtors to consummate a chapter 11 plan and return value to their customers and other creditors,” said the statement.

Now, the proposal is subject to court approval processes, including a creditor vote. A hearing on the matter is slated for 19 Oct0ber at 4 p.m. EST.

Having said that, one question arises: what’s the future look like for the VGX token now?