WAVES: FOMO won’t work for a sustainable rally; here’s what will…

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

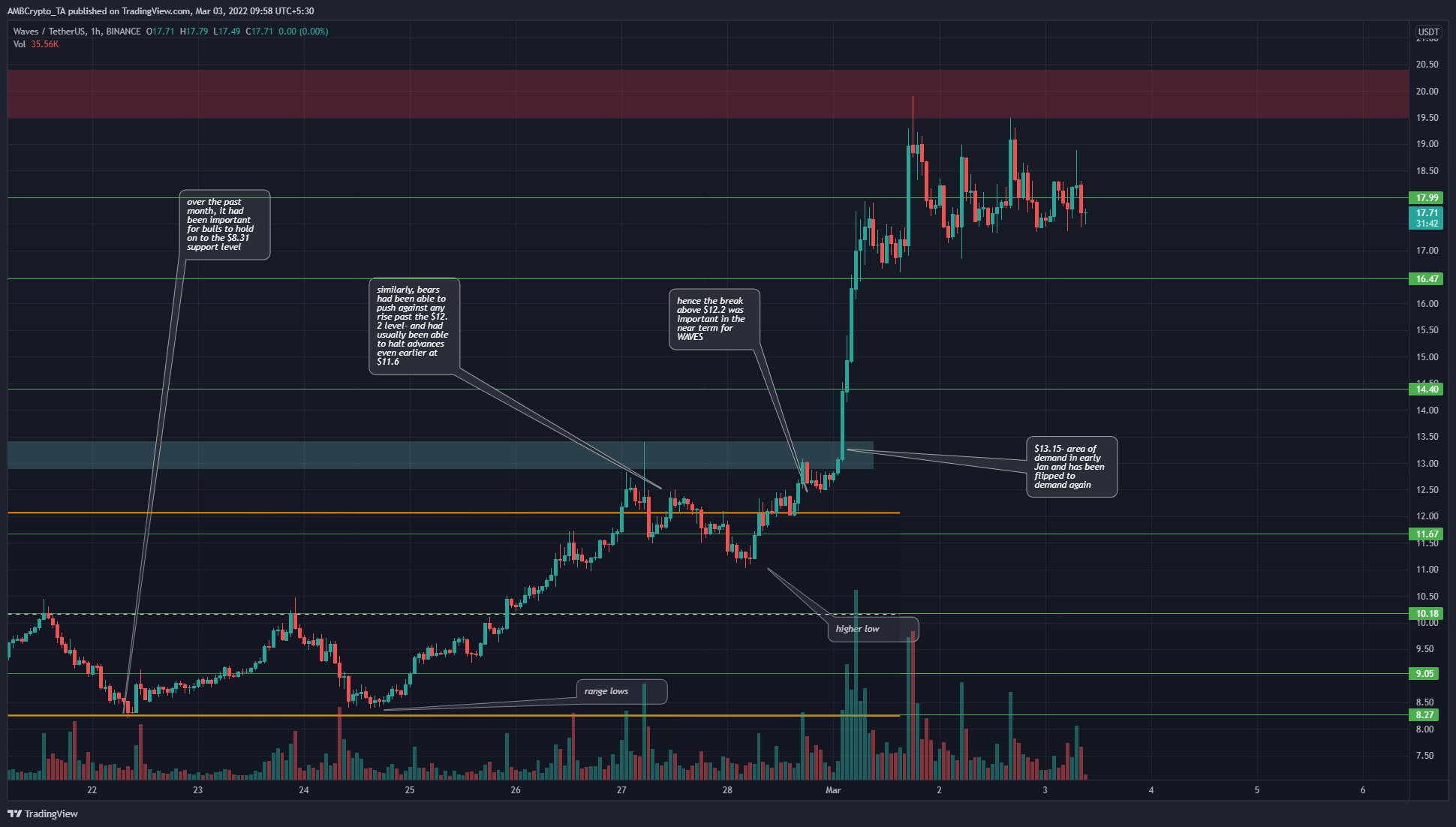

When Bitcoin dropped to $34,800 nearly ten days ago, WAVES hit its range lows near $8.4. Since then, WAVES has registered gains of nearly 115%. Demand shot through the roof when the coin broke out past the $12-level. Now, after these exorbitant gains, would the price retrace to collect liquidity to the south before its next leg upward?

Or can it rocket past the next band of resistance as well?

WAVES- 1 hour chart

Since late January, WAVES has traded within a range whose lows and highs lay at $8.4 and $12.15, respectively. Over the past week and a half, the price has bounced from the range lows on the back of heavy demand and broken out past $13 to trade at $17.71, at the time of writing.

Price is always attracted to liquidity. In the context of WAVES in the near term, this means that the $16.4, $14.4, and $13 levels are places that WAVES could retrace to in the days to come. On the other hand, so long as Bitcoin can stay above the $42,000-level, the upside to WAVES also looks good.

Therefore, there are two routes to consider – A risky, aggressive buy near $17.5 hoping demand would arrive once more and drive WAVES past the $20-resistance. The more measured and reasonable approach would be to wait for a retest of the $16.6 and $14.4-areas to use these tests of support as buying opportunities. However, there is also a chance that such a retest might not materialize.

In either case, the $20-area (red box) offered significant resistance and would be the next level where bears can be expected to hold strong.

Rationale

The hourly RSI tried to stay afloat above neutral 50. It displayed a hidden bullish divergence a couple of days ago, but the uptrend could not continue as the $19-$20 area offered good selling pressure.

The Awesome Oscillator has also been hovering near the zero line over the past 24 hours.

Conclusion

While WAVES has posted colossal gains in recent days, it could be overextended. A retracement would be a healthy outcome in the days to come. And, $16.6 and $14.4 are levels to watch for and see if demand arrives once again.

On the contrary, if $20 is flipped to support in the next few days, a buying opportunity would arise once again.