Whales alert: 32 billion DOGE transacted to rack up $4.4 billion in volumes

Dogecoin whales are an interesting entity as they make an appearance very rarely during a bear market and then go back into indolence to only reappear a month later.

Dogecoin whales are back

That is the case with March, as 48 hours ago was the first time since February’s spike that DOGE whales were active again, and the total DOGE volume moved around on chain shot up to $4.4 billion. But unlike the previous spike, this rise lasted for a day longer, during which cumulatively about 32 billion DOGE was observed to have been transacted.

Dogecoin whale volume | Source: Intotheblock – AMBCrypto

This kind of behavior is surprising since these whales used to be very active during the initial rally of November, and since they also occupy almost 50% of the entire DOGE supply, some movement is expected out of them. But just like the retail investors, they once care to be active during an opportune moment.

Dogecoin supply distribution | Source: Intotheblock – AMBCrypto

The reason behind this spike could have simply been the 5-day long rally Dogecoin noted over the week since, on the developmental front, the meme coin continues to stay true to its nature by doing nothing new.

The price action, on the other hand, after failing to break the previous downtrend wedge continued to remain stuck under the downtrend attempting a breakout after a month. Although the possibility of the altcoin achieving it seems to be very slim.

Dogecoin price action | Source: TradingView – AMBCrypto

And even if DOGE does test it as support, the coin has the long-standing resistance of $0.192 in its way before a recovery could begin in a true sense.

Plus, the coin will need more than just cues from the broader market since such signals haven’t been particularly effective in the past. Furthermore, price indicators aren’t displaying bullishness either.

The Average Directional Index (ADX) crossed the threshold of 25.0 once since 2022 began, which is why neither of the uptrends has been able to gain strength to last longer than they have. This is another reason why, unlike other altcoins, DOGE is on a straight path downward instead of noting some fluctuation. (ref. Dogecoin price action image)

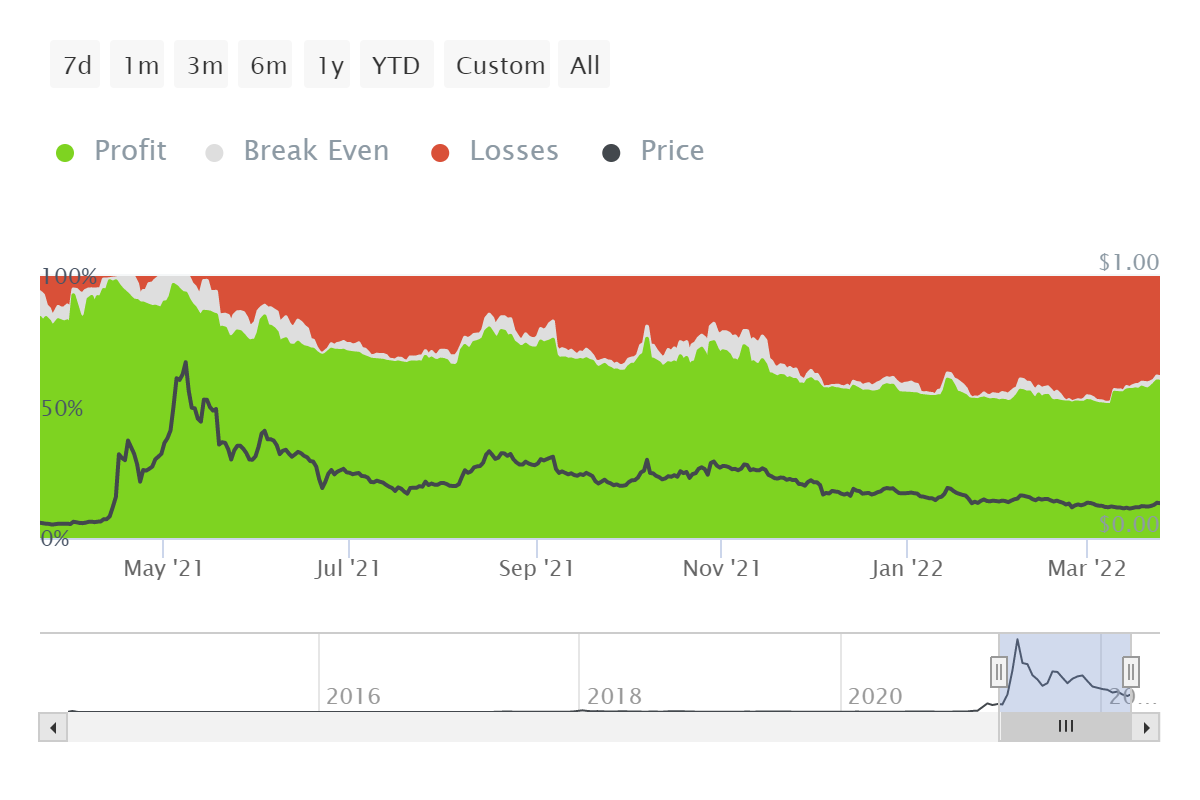

Regardless, a rally doesn’t concern about 2.29 million DOGE holders since their supply is already in profit. It is the other 38.61% holders that are in dire need of rescue, which would come only when the downtrend is first invalidated.

Dogecoin investors are mostly in profits | Source: Intotheblock – AMBCrypto