Whales and Seniors and a look at how AAVE has been since the DeFi Summer

AAVE seems to be riding a wave of whale-like popularity. This, at a time when AAVE has been on the receiving end of many developments. Indeed, a deep analysis of some of the altcoin’s metrics could give us a glimpse of how AAVE’s ecosystem is really doing.

A ray of hope

The number of “whale” addresses in AAVE recently hiked to a significant level on the charts. According to whaleStats, the popular whale tracking platform, AAVE is now one of the top-10 purchased tokens among the 500-biggest ETH whales over the last 24 hours.

JUST IN: $AAVE @AaveAave now on top 10 purchased tokens among 500 biggest #ETH whales in the last 24hrs ?

We've also got #FTX Token, $BAT, $MKR & $iETH on the list ?

Whale leaderboard: https://t.co/tgYTpOm5ws#AAVE #whalestats #babywhale #BBW pic.twitter.com/Dyt7M5QbTg

— WhaleStats (tracking crypto whales) (@WhaleStats) September 30, 2022

In fact, a previous report revealed significant whale interest in AAVE too. As per the same, AAVE whale addresses holding between 1k and 1 million AAVE tokens were up to 54.5%. These addresses have never held this amount of AAVE in the past.

This increase in whale addresses might be attributable to new AAVE features, especially on the DeFi front. In fact, Aave is today one of the big giants in DeFi with $8.7 billions in assets locked across 7 networks and over 13 markets.

Aave has also been making good progress in terms of TVL, with its V3 protocol growing since May. Although there has been some volatility after August’s peak of $1.67 billion, the TVL seems to be picking up momentum again. The total value locked, at press time, stood at $1.17 billion on the charts.

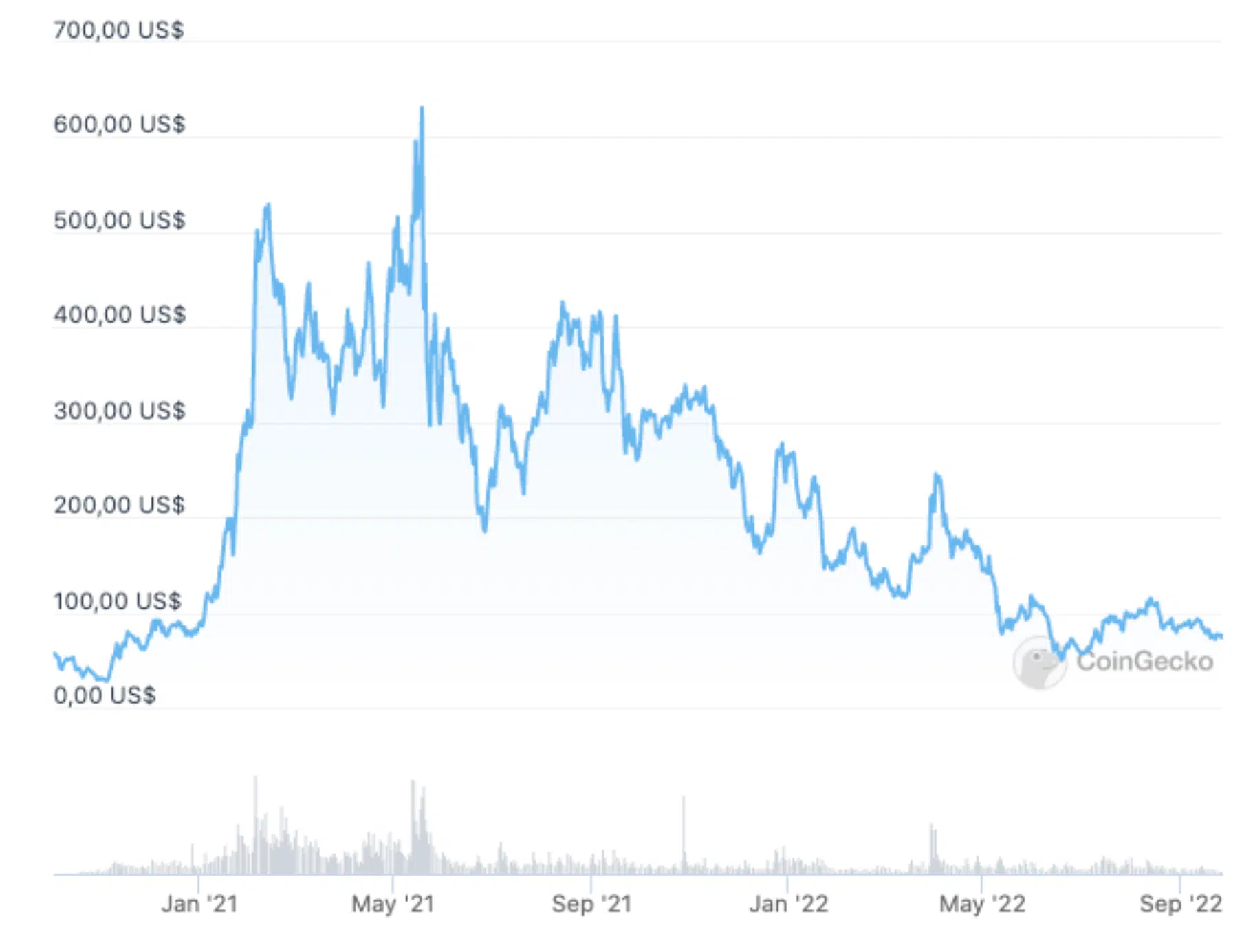

Here, it’s worthing pointing out that the token’s price exploded during the DeFi summer. Alas, since May 2021, it has been falling dramatically on the charts.

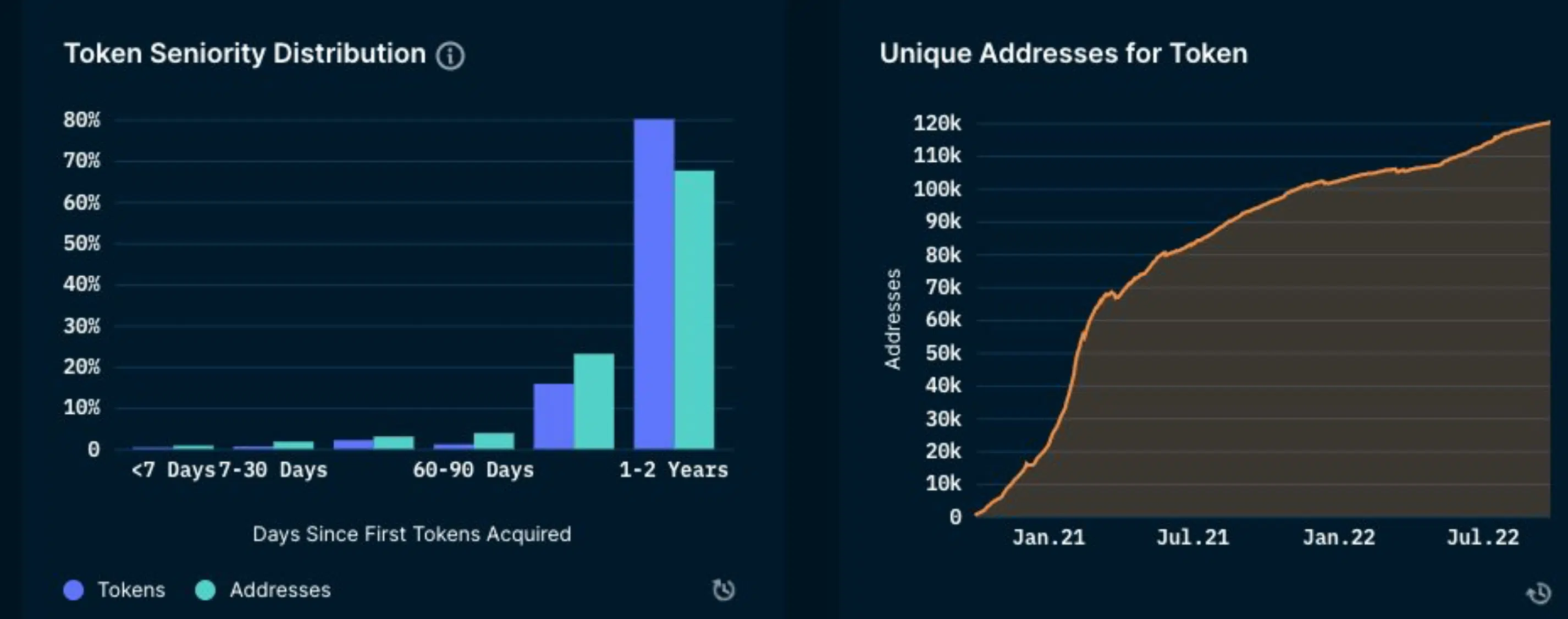

In terms of seniority distribution & unique wallets too, the platform had an interesting story to narrate.

Consider this – Most of the tokens are held by investors who entered around 1-2 years ago.

“Those who entered about 2 years ago will surely be in profit (AAVE was ~$50). Then, those who entered a year ago are at a loss since AAVE was ~$300 at that time” – This was Nansen’s recent analysis of Aave, one re-shared by CTF Capital.

Knocked out for a bit?

However, smart money balances and holdings (wallets that are very active and prolific) narrated quite a different story, as can be seen from the tweets below –

6/ Smart Money Holdings

Among the best known players we see Defiance (which last month had an outflow of $1.7 MM in tokens), ParaFi, Fenbushi, Alameda and Dragonfly as the important ones. This is tracking only wallet holdings. pic.twitter.com/80mkgbLLbQ

— CTF Capital (@CTFCapital) September 30, 2022

Additionally, it’s worth highlighting that AAVE’s price has been correcting on the charts of late. At the time of writing, for instance, AAVE was down 2%, with the altcoin trading at a level just shy of $75.