What BTC ETFs second-highest weekly outflows of 2022 hint at

Bitcoin has the highest demand out of all the crypto assets in the world. However, this week, it was surprising to see that the king coin was first in line to bear the brunt of investors’ panic exit.

However, these weren’t direct investments as the outflows were registered onto the multiple Bitcoin-based Exchange-Traded Funds (ETFs).

How did BTC do last week

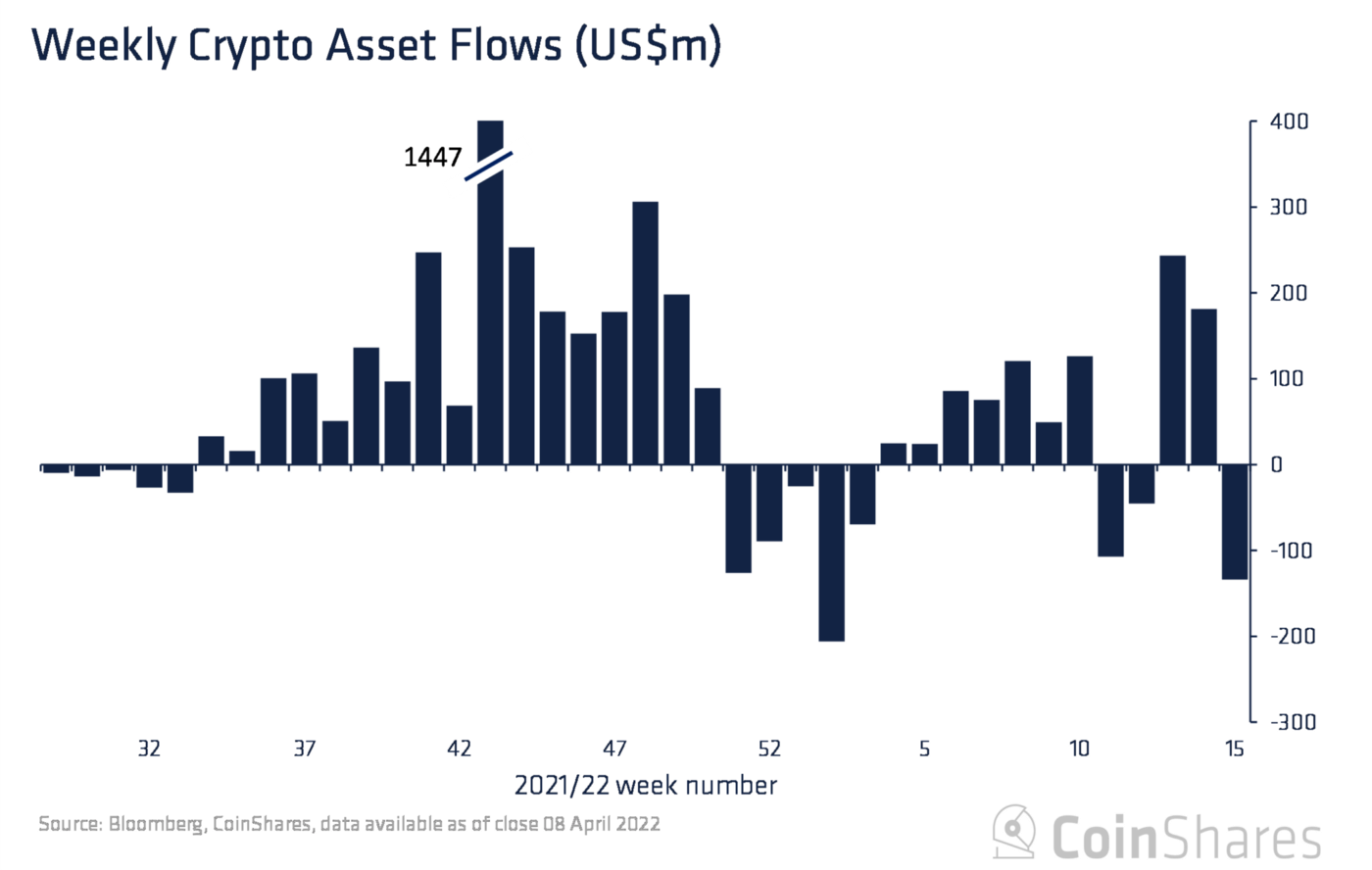

The weekly net flows for Bitcoin were at -$134 million this week. This indicates the highest outflows noted by institutional investors since the beginning of 2022.

Weekly net flows marked the highest outflows for the second time this week | Source: CoinShares

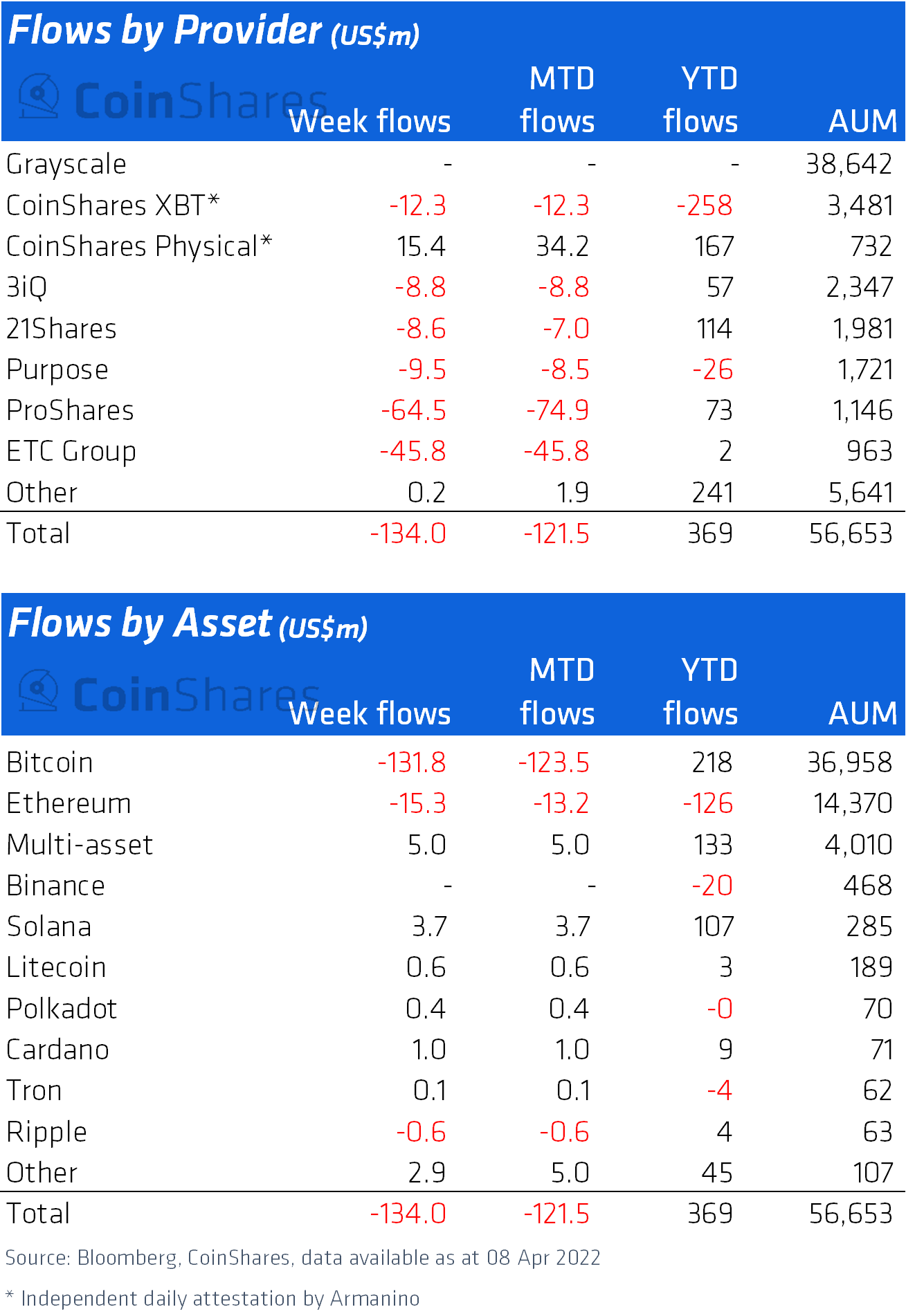

But unlike always, the outflows were not distributed amongst other assets. Instead, this time, Bitcoin was solely responsible for 97.7% of the outflows observed.

This is because rather than altcoin-based investment products, ETFs, took a hit this week. Following this, the price of the king coin plummeted.

Bitcoin ETFs marked high outflows this week | Source: CoinShares

For the most part of this year, it was Ethereum that led the outflow parade week-on-week, whereas Bitcoin used to register inflows mainly. Even last week, BTC had the highest inflows of all the assets at $144 million.

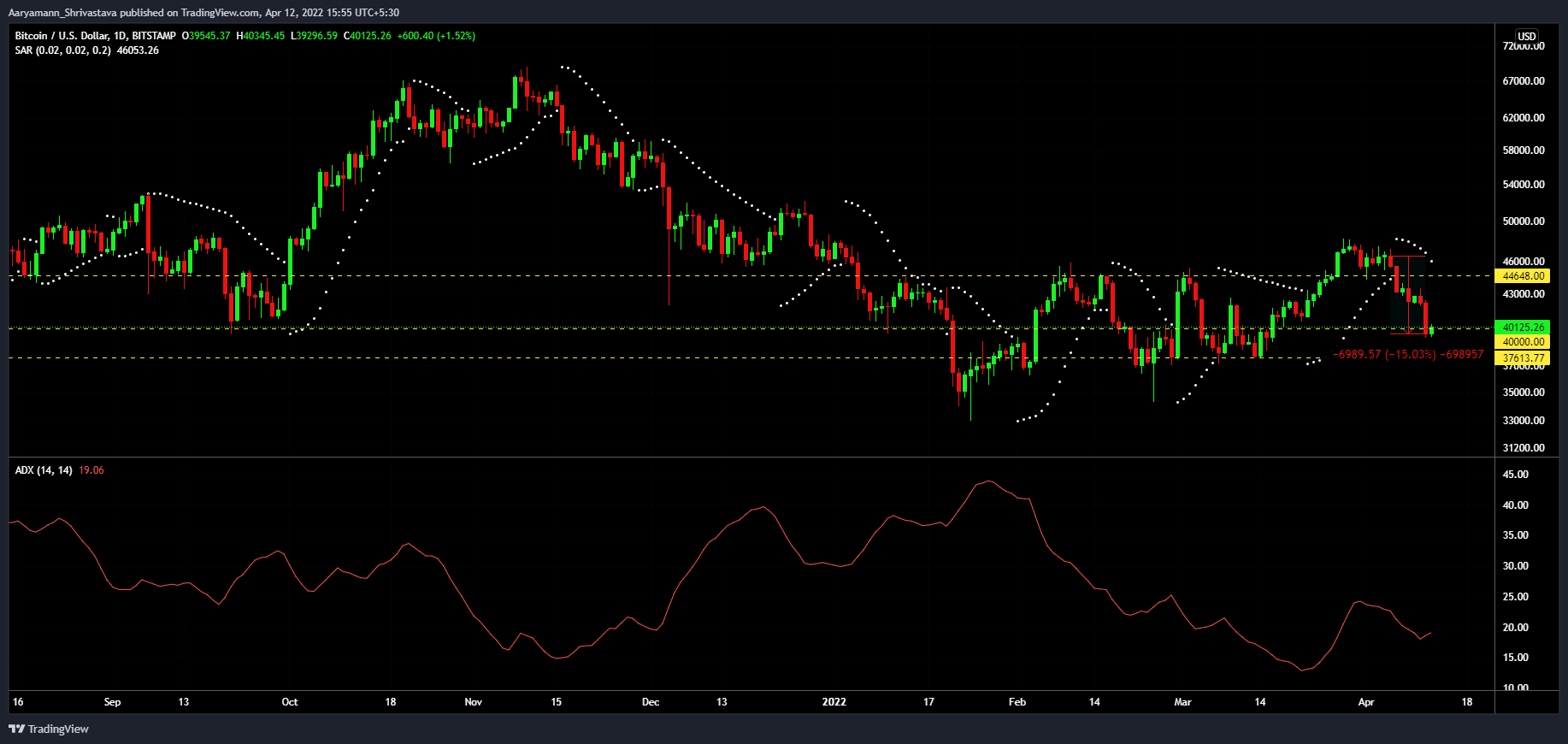

This makes sense as the market suddenly took a turn for the worse in a week. Consequently, Bitcoin ended up below $40k on 12 April.

Although at press time, BTC was above that level. It was trading at $40,158. However, this still does not rule out the possibility of another drop.

Bitcoin price action | Source: TradingView – AMBCrypto

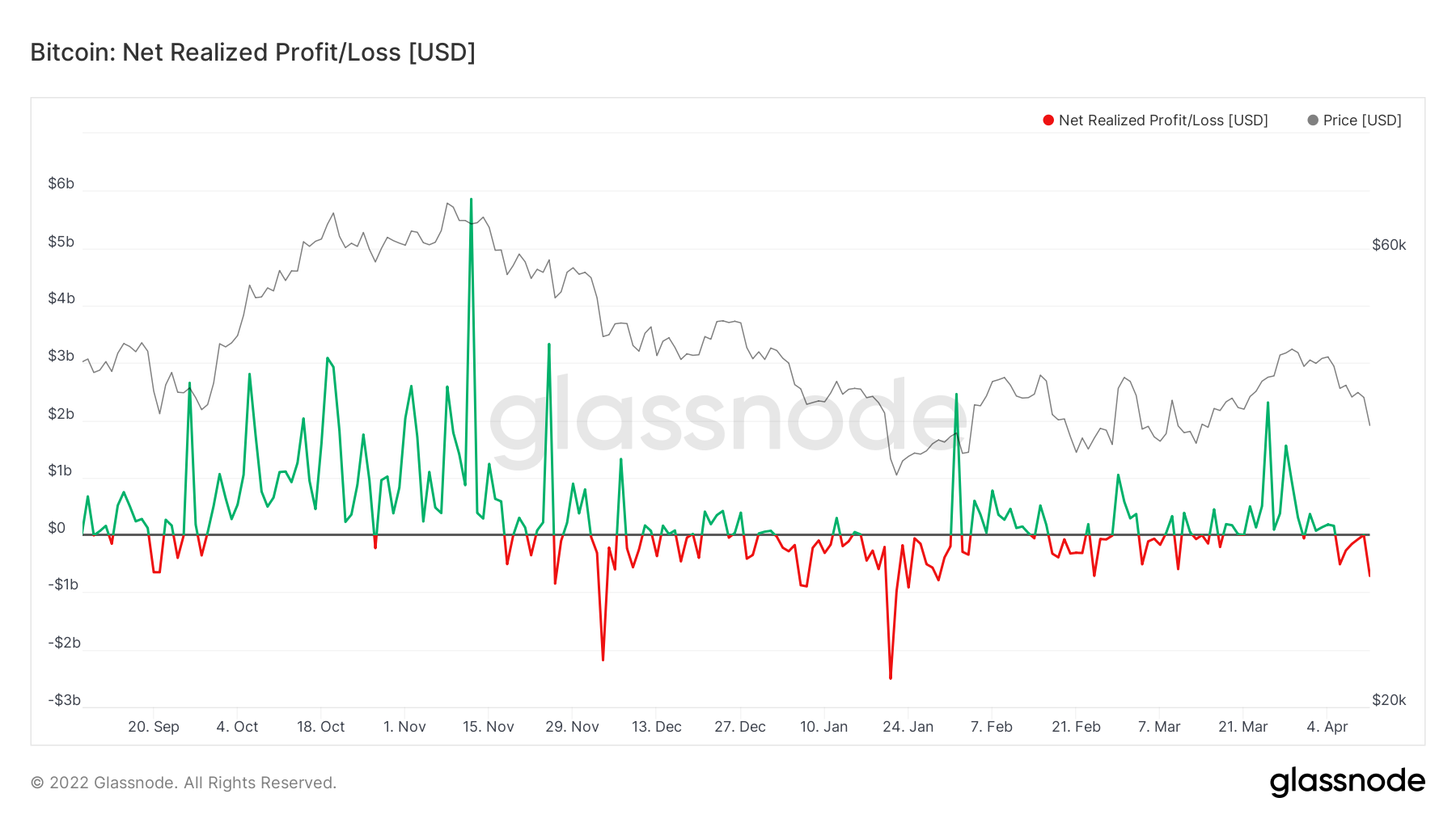

Furthermore, for the last seven days, the king coin has realized losses worth over $713 million. It is bound to affect the confidence of retail investors.

Bitcoin net realized losses | Source: Glassnode – AMBCrypto

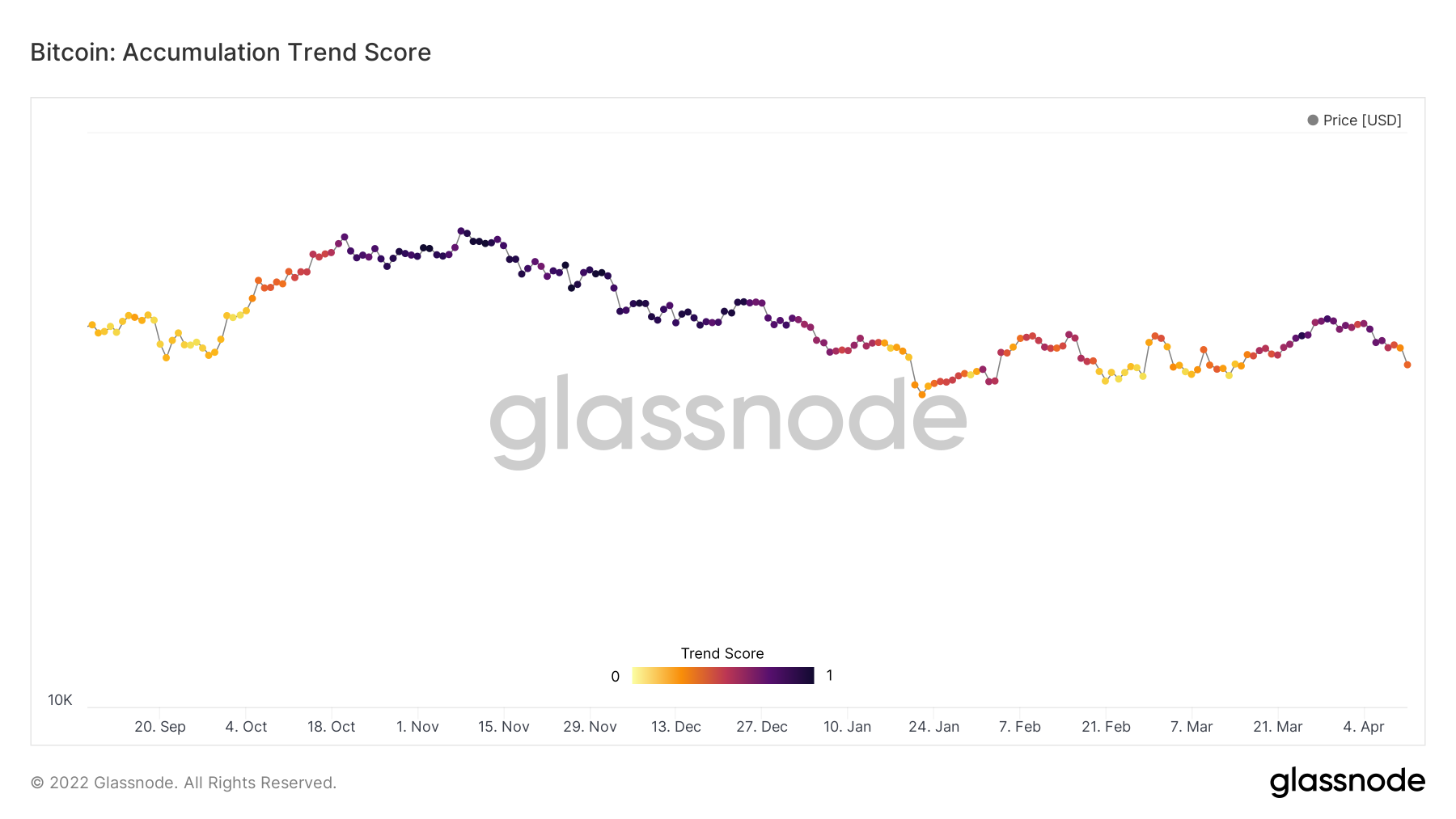

Moreover, as per the Accumulation Trend Score, their conviction is wavering since most of the network has moved from accumulating to distributing/sitting idly until better opportunities present themselves.

And, as long as the indicator remains close to zero, investors will continue to maintain their current position.

Bitcoin accumulation score | Source: Glassnode – AMBCrypto

Thus, the outflow trend is needed to slow down, and that will only happen when the market observes some recovery.