What Chainlink’s drop in popularity means for its price

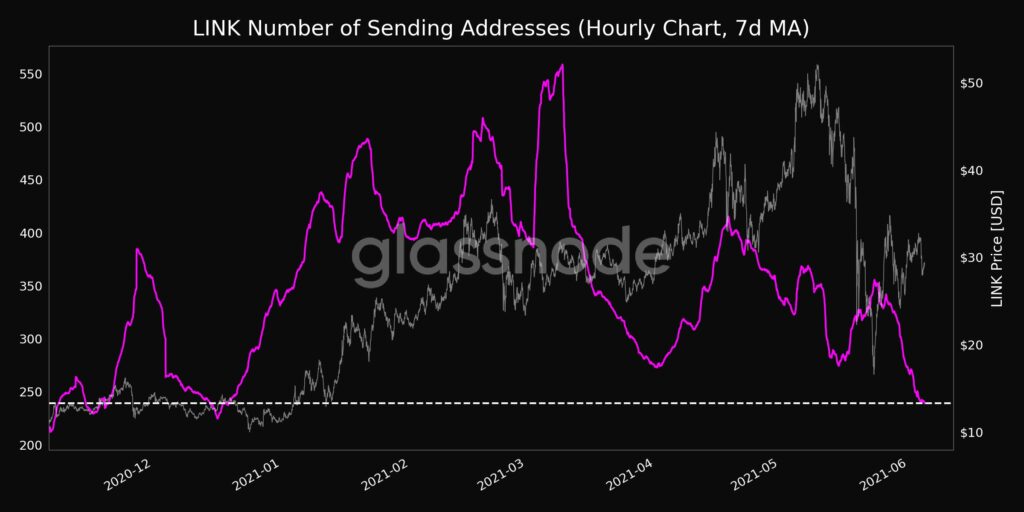

LINK price has increased consistently in the past, when Bitcoin price has dropped or remained rangebound. LINK was trading at the $27.22 level and the number of sending addresses has dropped in the case of LINK based on data from Glassnode.

Source: Twitter

Based on the above chart, the number of sending addresses has dropped. Additionally, despite a price rally, LINK has observed a drop in social volume and popularity. However this is not the end for LINK and with increasing momentum, volatility and users, LINK is likely to rally soon.

LINK’s concentration by large HODLers was at 78% based on data from IntoTheBlock, this is likely to change, as an increase in concentration is likely to be bullish for LINK. If there is a drop in the concentration it may negatively impact the price with a drop in liquidity.

The drop in popularity in the case of LINK may be temporary, given that the market capitalization, users and demand have increased consistently since the beginning of 2021. This time around, besides responding to Bitcoin’s activity, LINK’s on-chain activity and social volume have had an impact on price.

LINK’s active addresses, transactions and transfers on the network have increased, signaling a rally to the $50 level. The price is nearly 50% away from its ATH, however that hasn’t deterred HODLers and traders. The accumulation continues, even as the altcoin remains undervalued.

There is an increase in the 24 hour trade volume across several markets on spot exchanges. The rally is likely to continue over the following two weeks.

LINK’s community has backed the demand owing to consistent updates in the network. The partnerships and new updates on the LINK network include the new DeFi projects that cannot be live/ supported without Chainlink’s oracles, the creation of dynamic NFTs using LINK. This offers a multilayered project in NFT and an excellent use case for LINK, through the Strata-Chainlink partnership. In May 2021 alone, LINK had 55 integrations, thus the drop in popularity cannot be equated with a drop in price or market cap for LINK.