What do recent market corrections say about ‘Ethereum killers?’

2021 has seen Ethereum go on a parabolic run, with the world’s largest altcoin climbing one ATH after the other over the past few months. While significant corrections over the past few days had pulled ETH’s value down to $2,615 at press time, its YTD returns were still as high as 260% on the charts.

Now, in the past, we have already touched upon the scale of Ethereum’s bullishness and the factors that have contributed to the altcoin’s rally. These factors include growing institutional interest in Ethereum and optimism around impending network upgrades such as EIP-1559, among others.

However, what often gets lost in the discussion about ETH’s performance is the impact it has had on DeFi. The same was recently brought to the fore by how the space reacted to the corrections in the broader crypto-market, especially when compared to the likes of Binance Smart Chain.

Before going there, however, it’s worth touching upon how much Ethereum, the platform that is the foundation of a majority of DeFi protocols in the space, has grown over the year.

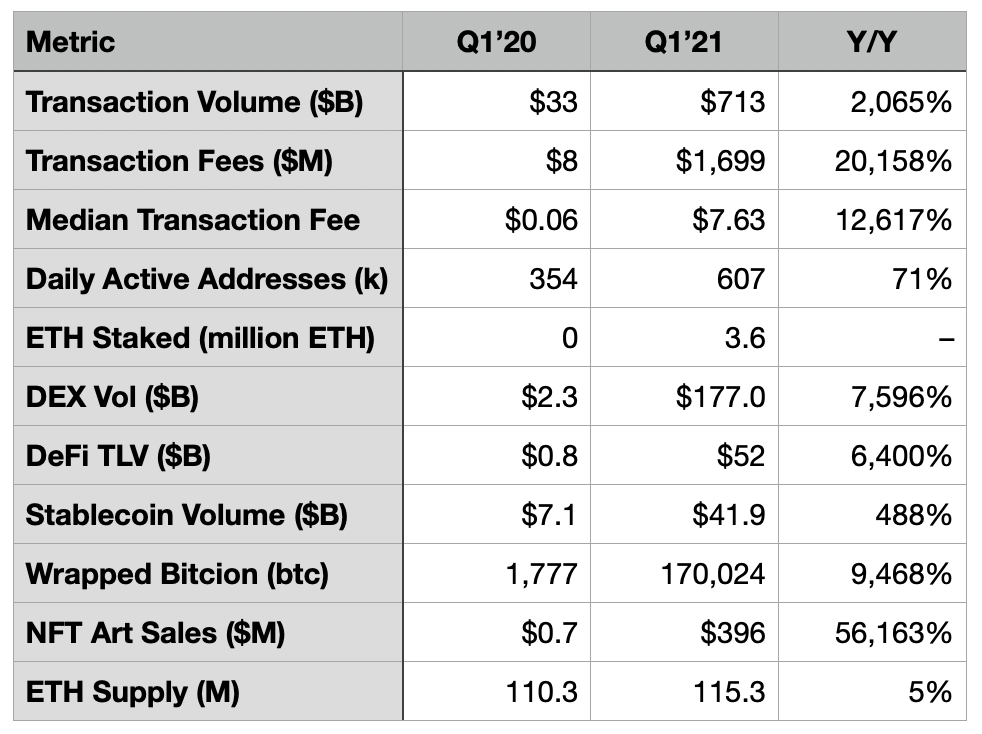

Consider this – According to findings made by James Wang, Ethereum’s network revenue rose by 200x over a year, with the same climbing from $8 million in Q1 2020 to $1.7 billion in Q1 2021. In fact,

“In April, Ethereum generated annualized revenue run rate of $8.6 billion—comparable to AWS in 2015.”

What’s more, total transaction volume rose from $33 billion to $713 billion over the said period too. Finally, daily active addresses seemed to have risen from 364k to 607k as well.

Outside of the altcoin’s price, Ethereum’s performance has had an impact on DeFi too. Total Value Locked, for instance, rose from $0.8 billion in Q1 of 2020 to $52 billion in Q1 of 2021. Further, DEX volume also hiked from $2.3 billion to $177 billion over the said time period.

Source: James Wang

Here, it’s worth noting that DeFi’s popularity reared its head once again, like it did last year, despite the fact that the issue of high gas prices arose once again.

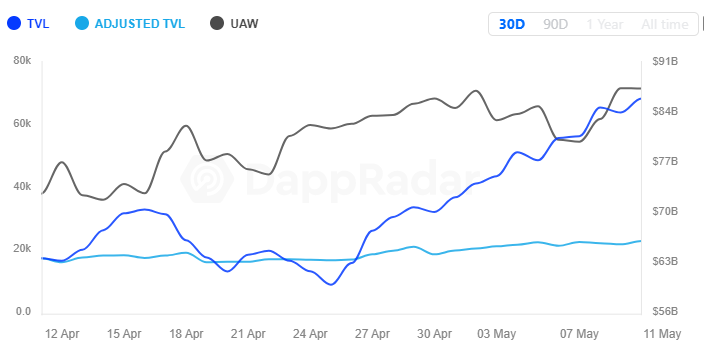

However, there are other metrics that can be used to underline the scale of growth in the DeFi space. According to OKEx Insights, for instance, unique active wallets in the DeFi ecosystem have grown by more than 60% since mid-April.

Source: DappRadar

The volume of ETH locked in smart contracts has risen too, with the same dwarfing the ETH held by centralized exchanges. The same was evidenced by a recent Glassnode finding, with the same revealing that until a few days ago, the former held almost 23% of Ethereum’s circulating supply while the latter held just 12% of the same.

What this implied is that since the start of the year, “ETH holders have been transferring their holdings from cryptocurrency exchanges to DeFi protocols,” with the same being the case when the most recent corrections set in as well.

The aforementioned corrections share quite a window into the persistence and performance of the ETH-led DeFi space. According to DeFi Llama, for instance, on the back of recent corrections, its TVL fell from a high of $115.9 billion to $82 billion at press time.

Source: DeFiLlama

Now, that’s a significant fall, but it pales in comparison to the losses noted by the world’s largest altcoin over the same period, losses worth over 40%.

An even starker examination of Ethereum-led DeFi’s performance over the last week would be a comparison with the so-called “Ethereum killer,” Binance Smart Chain. As was pointed out by Messari’s Mira Christanto recently, on the back of the first bout of corrections this week, the drawdowns noted by ETH-built DeFi projects weren’t as sharp as the ones registered by “BNB-DeFi names.”

In fact, the latter’s TVL had fallen dramatically from $20.6 billion on 10 May to $7.92 billion on the 20th.

$ETH-DeFi has been much more resilient than $BNB-DeFi names in this selldown pic.twitter.com/lkqTLoBliU

— Mira Christanto (@asiahodl) May 17, 2021

What does this tell us? Well, it tells us that while Ethereum might have its own set of issues, its supposed “killers” still have a long way to go when it comes to aping the former’s market resilience.

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)