What does the dramatic rise in this metric mean for Bitcoin

Bitcoin (BTC) hiked considerably during last week, advancing close to a new all-time high. Various new HODLers have incorporated the flagship token in their portfolio. That said, strong hands continue to HODL. At least that’s what the metrics projected.

Consider this, Bitcoin’s on-chain activity has been consistently high through Aug-Oct. Many activity metrics are up since the $29k low, in late July. However, a few of these metrics did showcase otherwise.

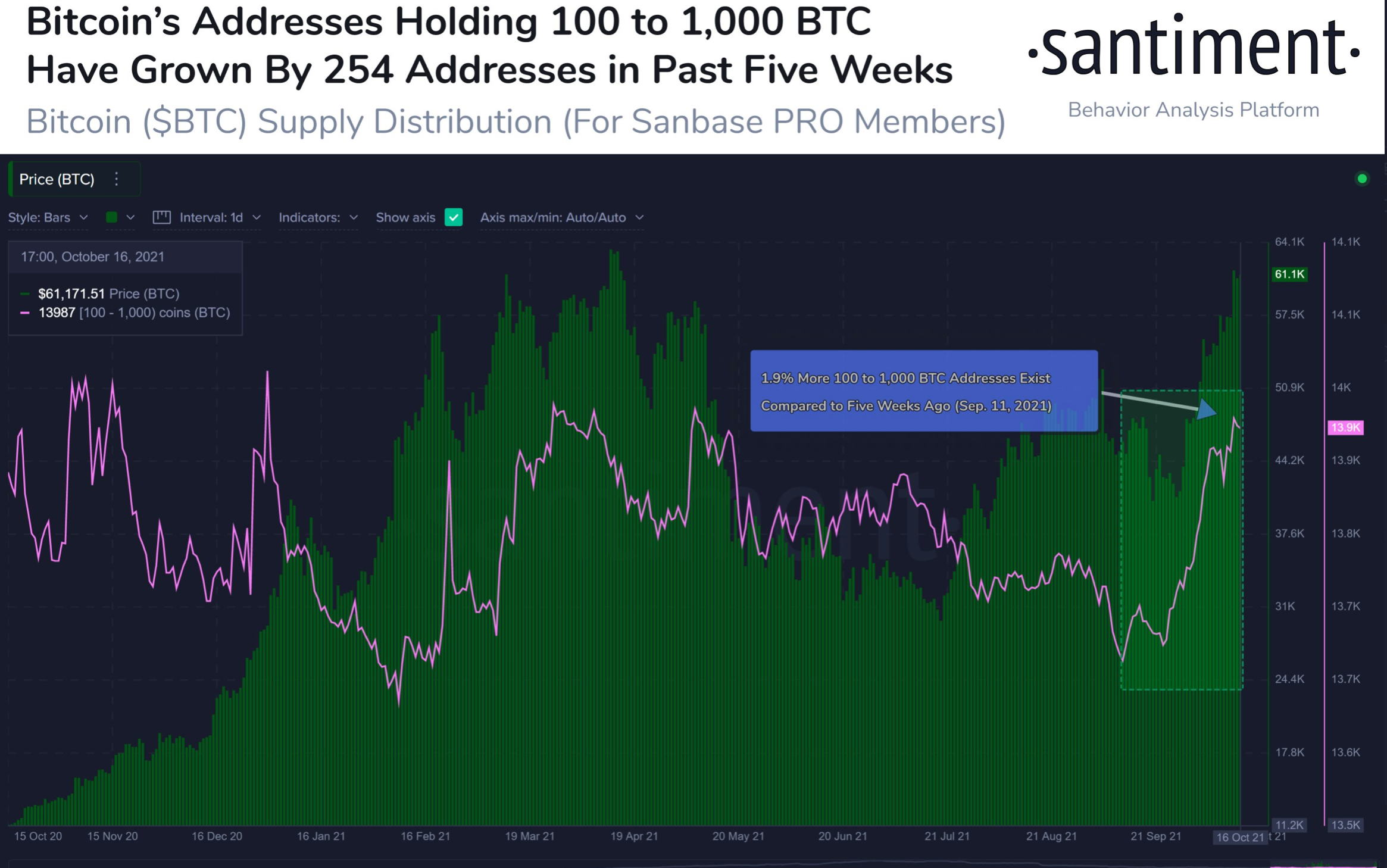

Large Bitcoin (BTC) addresses have jumped significantly since the start of September 2021. As per the latest data published by Santiment, BTC addresses holding between 100 and 1,000 coins increased by approximately 2% in the last five weeks.

“The number of Bitcoin addresses holding between 100 to 1,000 BTC has grown substantially over the past five weeks. 254 more of these whale addresses now exist compared to five weeks ago, which is a notable 1.9% increase in this short time period.”

The chart below supports the same.

Source: Santiment

Colin Wu, Chinese journalist, reiterated the same update, “…the number of addresses holding 100 to 1,000 BTC has increased significantly in the past five weeks.”

One of the major reasons behind that has been the rising institutional interest. Large institutional investors have started accumulating Bitcoin in substantial amounts during its recent bull run.

However, as per metrics from bitinfocharts.com’s top 100 richest Bitcoin addresses portrayed a slightly different scenario. At the time of writing, the addresses list stood as below.

Source: BitInfoCharts

Statistics from Glassnode show that whale-sized addresses with over 1,000 BTC have dipped to the smallest amount in eight years. The number of addresses with current holdings of ≥ 10,000 Bitcoins has dropped to historically low levels.

At press time, only 78 Bitcoin addresses were holding ≥ 10,000 Bitcoins. Nevertheless, all the BTC addresses with less than 1,000 holdings have increased. Well, the reason behind it could be Bitcoin’s surge of more than 9% in a week.

However, the most obvious reason could hint at several Bitcoin whales selling to make some gains off the top. For instance, one of the explanations read as below.

February – May $BTC whales (>1k BTC) were gradually selling to retail investors (>.1 BTC). This is why the distribution phase displayed on the HT chart. They kept the price stable via manipulation until they were finished selling – then collapse. The whales won, again. #Bitcoin pic.twitter.com/ia8C8ze99h

— Illusive ⛓ (@IllusiveTrades) October 10, 2021