What effects broader sentiments had on wBTC supply vis-à-vis DeFi & Ethereum

The immense success that the cryptocurrency industry has experienced over the past couple of years was facilitated not just through Bitcoin‘s rising popularity, but also the emergence of sectors such as decentralized finance. While the sector grew many-fold since mid-2020, it also fostered the growth of tokenized assets that aid in DeFi trade. For instance, stablecoin usage grew 370% in 2021, as compared to the previous year.

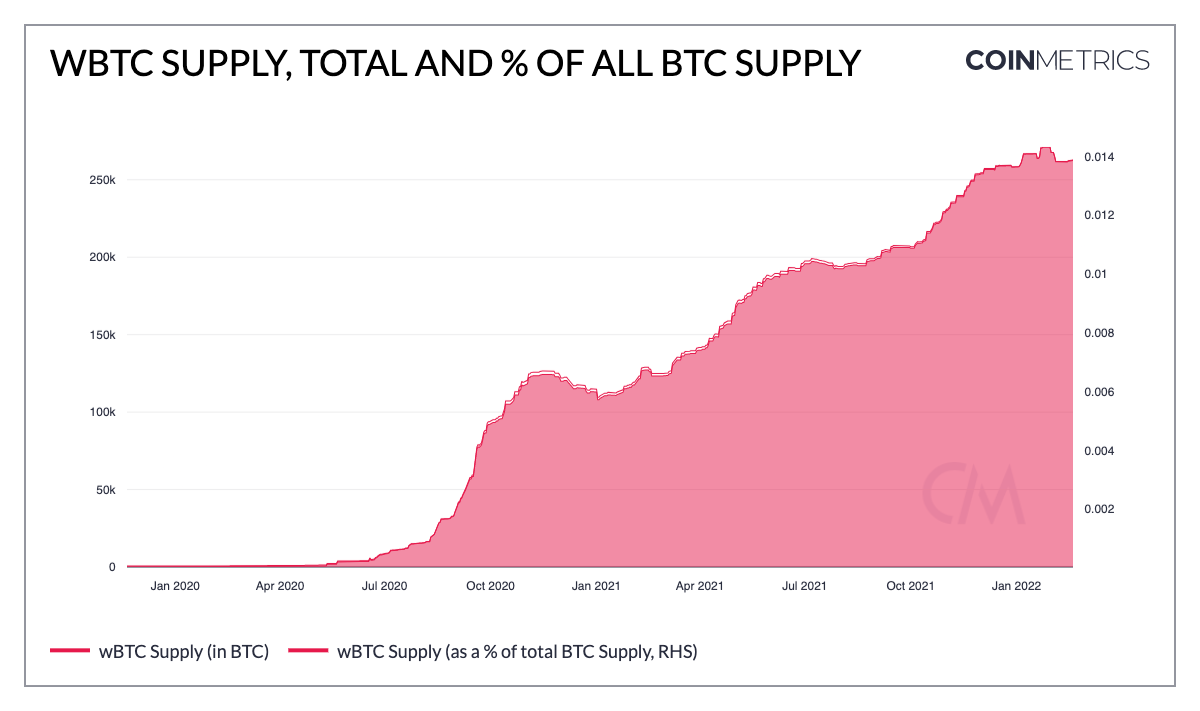

However, what is often overlooked is the growth experienced by wrapped Bitcoin (wBTC), which can often be seen trading on various DeFi protocols. Their usage is in fact so ingrained by now that one in every 72 Bitcoins in circulation is tokenized on Ethereum, representing 1.4% of the total BTC supply, according to a report by Coinmetrics.

wBTCs are essentially ERC-20 tokens that are pegged 1:1 to Bitcoin and are redeemable through the BTC in the custody of the issuer. Since their launch in late 2018, they have proliferated the DeFi market as an efficient way to include the top cryptocurrency in this niche sector.

Out of the total wBTC on Ethereum, 66% are locked up in smart contracts. Thereby, highlighting their importance in facilitating trade on decentralized exchanges and lending protocols.

It should be noted here that even as Ethereum remains the primary platform for DeFi trade, its recent issues with congestion and high gas fee have led to some of the wBTC supply migrating to other protocols such as Avalanche.

Nevertheless, Bitcoin tokenization has brought 250,000 BTC on the Ethereum blockchain, growing 113% in the past 12 months. The growth in new wBTC supply has dwindled since December 2021 after peaking to an all-time high of 271,257 BTC in January. Its current supply stood at 263,162 at the time of writing, a 3% decline from its January peak.

This could be a consequence of the current bear market and its recurrent slowdowns- a similar trend can be noticed across DeFi. The recent changes in the total value locked in DeFi smart contracts are evident of this downturn, which stood at $183 billion at press time. Thus, losing over 6% in just the past day, according to data by DeFi Llama. In contrast, the TVL was measured at $250 billion when it had peaked in November end, around the same time as BTC had reached an all-time high of over $69,000.

Clearly, the overall market has been following a similar southbound movement since then, with the total market capitalization retreating 47% since peaking at $3 trillion.