What Ethereum [ETH] holders should expect in the near-term

- ETH was in a bullish market structure but in a price correction phase

- The price decline could settle at the 78.6% ($1260.23) Fibonacci retracement level

Ethereum (ETH) was trading at $1283.82 at press time. This level was a drop after ETH lost the psychological $1300 mark it reached after a recent rally last week.

At the time of publication, ETH was still healing from the recent rally.

ETH price pullback targets 78.6% Fib level: can it hold?

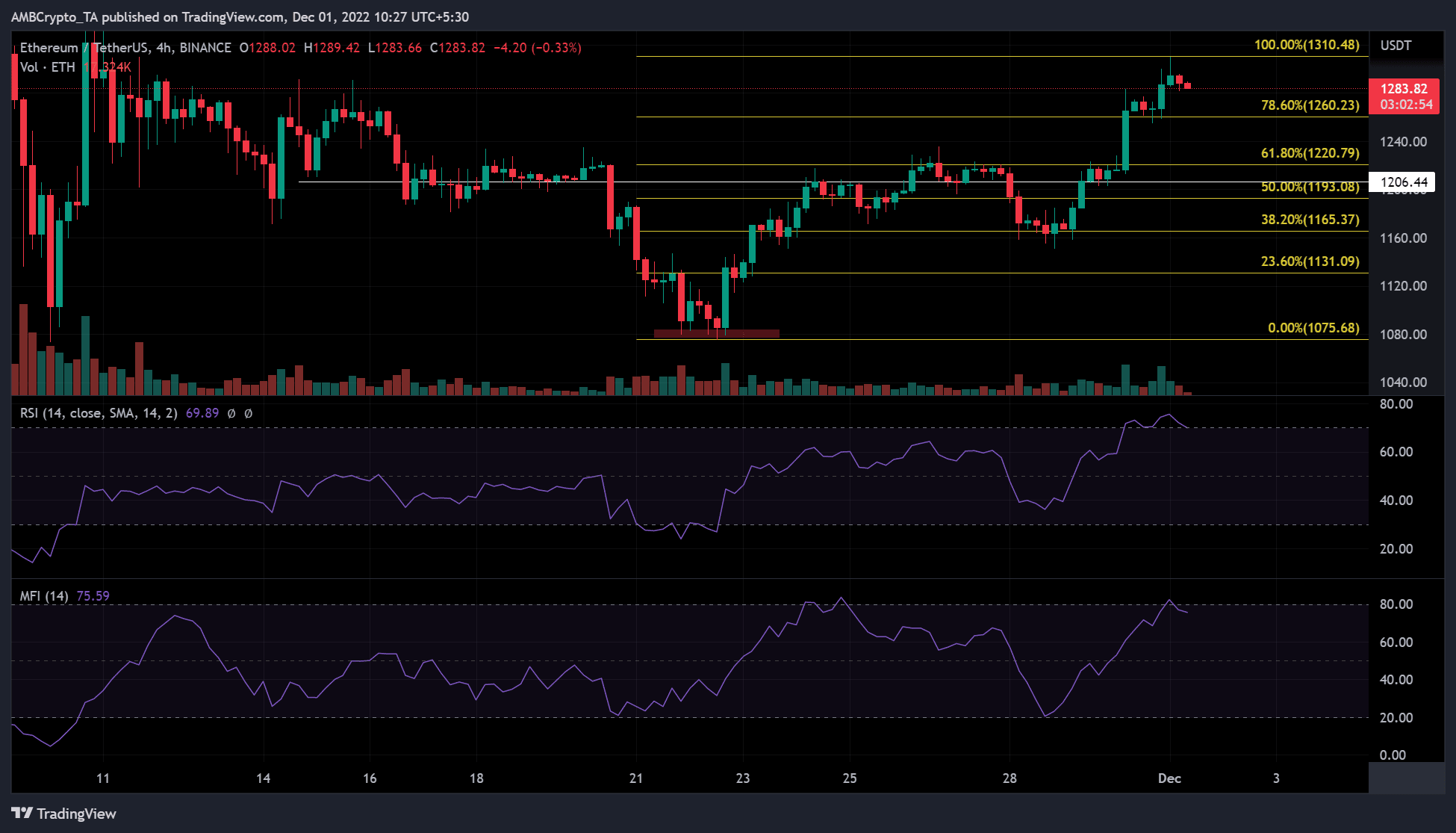

ETH reached $1310 after BTC reclaimed $17K on Thursday (1 December). The 4-hour chart showed ETH had risen since Tuesday (29 November) with negligible price corrections. There was one price correction at press time, but it was not negligible.

Technical indicators on the short-term time frame charts suggested an extended price correction where ETH could settle at the 78.6% Fib level ($1260.23).

The Relative Strength Index (RSI), which is used to gauge buying and selling pressure, was tilted against buying pressure. Specifically, the RSI retreated from the overbought territory and sloped downward. Thus, buying pressure was decreasing, and sellers may gain an advantage in the near future.

The Money Flow Index (MFI) also pulled back from overbought territory. This reinforced the suggestion that the accumulation phase is coming to an end, and a downward move (selling) is likely. Thus, selling pressure could force ETH to move lower and find new support at $1260.23.

If BTC loses the psychological $17K level, the price correction of ETH could extend to $1220.8 or $1193.08.

However, a close above the current resistance target at $1310.5 would negate this bearish bias.

Short-term ETH booking profits but…

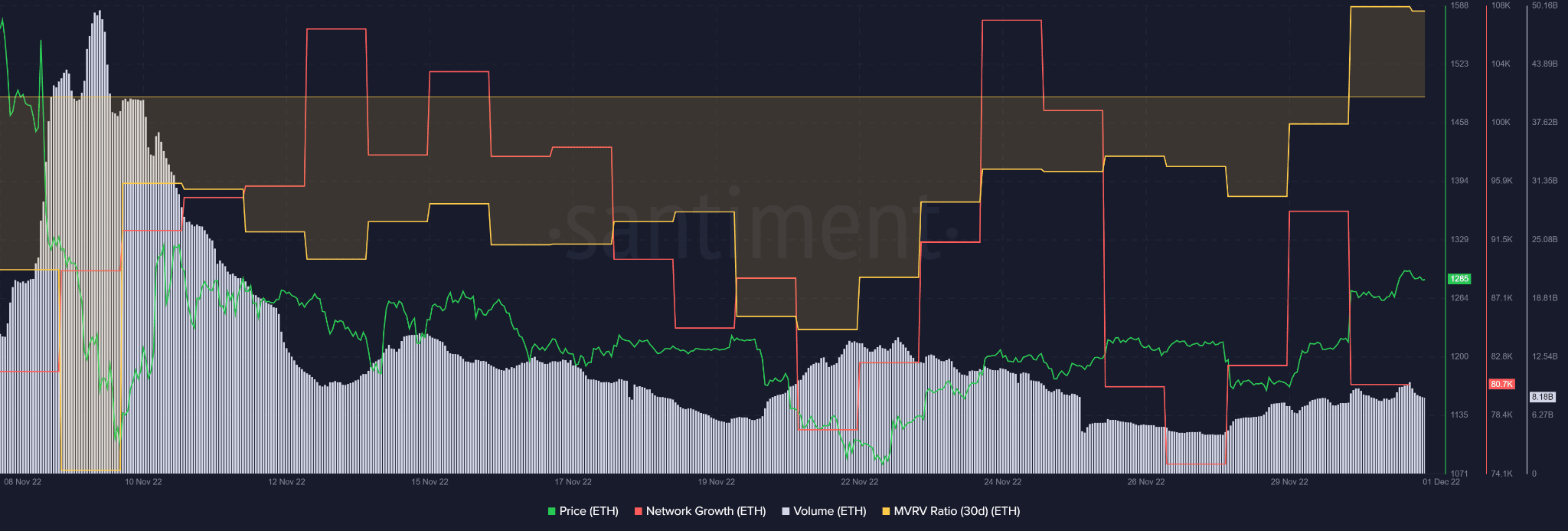

Santiment data showed that the 30-day MVRV has climbed to the positive side, suggesting that short-term ETH holders have booked profits following the recent price rally. Furthermore, the price rally may have been fueled by a steady increase in the growth of the Ethereum network.

Unfortunately, network growth, trading volume, and 30-day MVRV were all down slightly at press time. Given the positive correlation between ETH’s price and these metrics, a further price decline can’t be ruled out.