What Ethereum investors need to watch out for in the coming days

Ethereum is down by 13.06% this month. However, this week, the alt saw the first sign of consolidation as the it barely noted any change in price. However, the netflows observed until three days ago, paint a more concerning picture for Ethereum investors.

Ethereum flows out

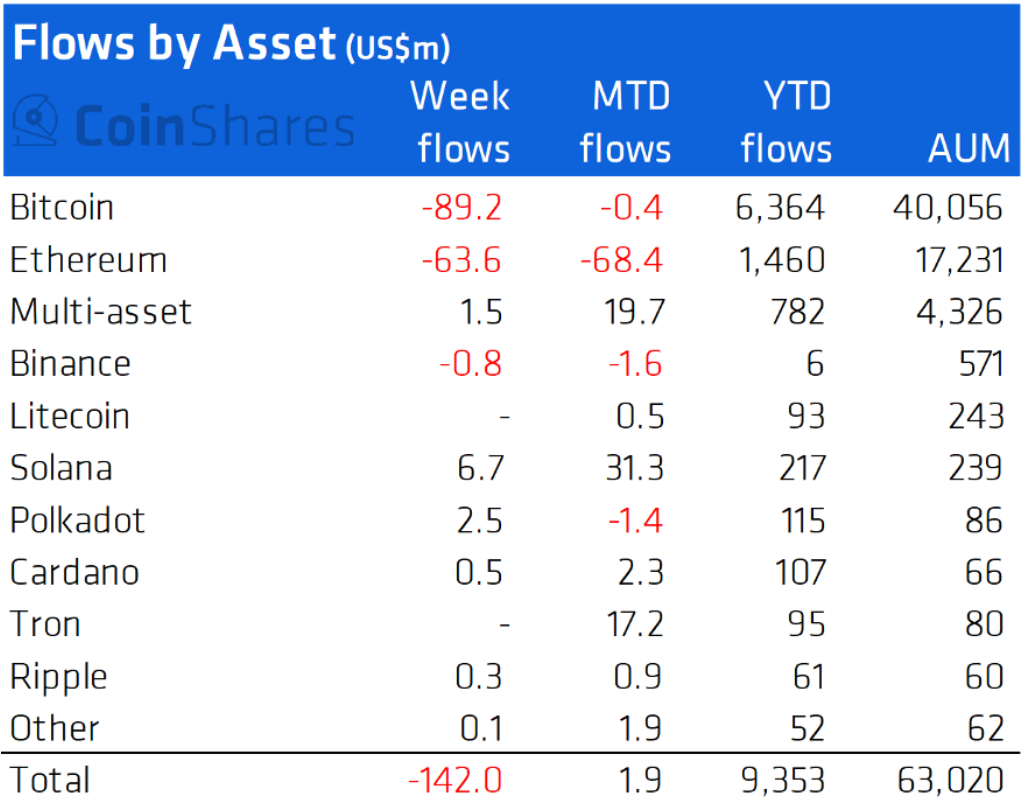

The week ending 17 December saw the biggest outflows in digital assets in a while, totaling $142 million. In fact, this was the first time in over 17 weeks that the overall netflows leaned toward negative.

However, Ethereum, in particular, stood out this week thanks to its outflows of $63 million which is making the situation worse for ETH holders.

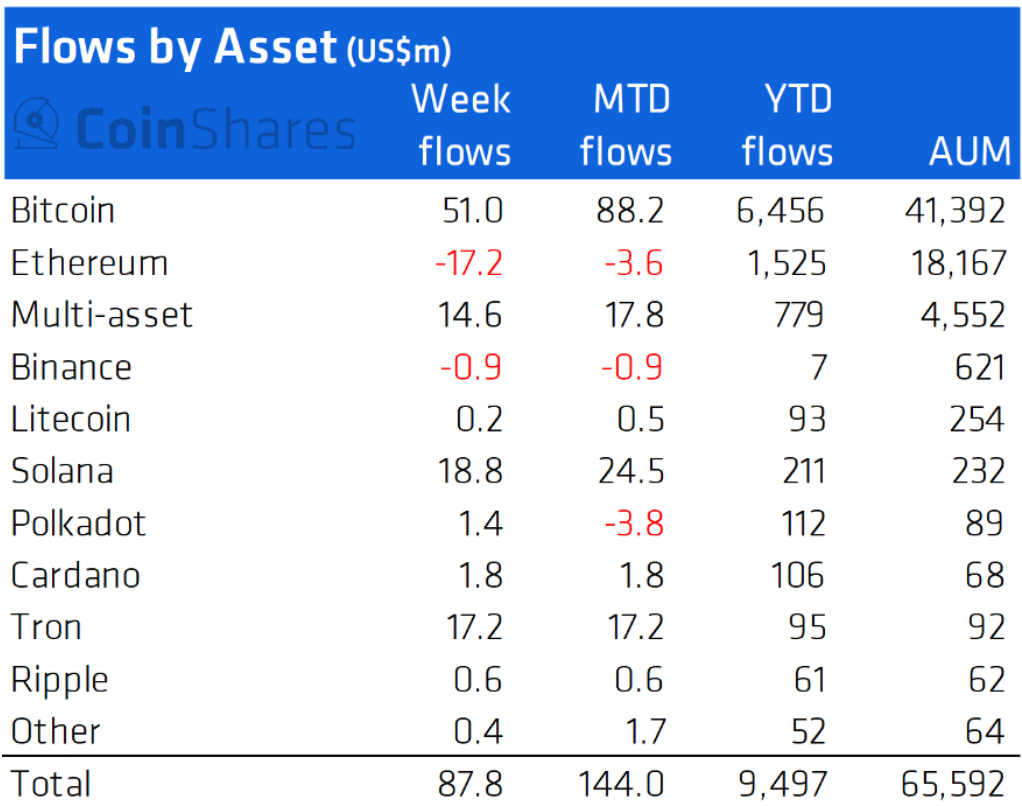

Throughout the month and until last week netflows maintained a balance between inflows and outflows, keeping Ethereum outflows at a low of $3.6 million. In fact, Month to Date (MTD), Polkdaot’s outflows were higher than Ethereum’s.

Digital asset netflows for the week ending December 10 | Source: CoinShares

But this week’s development led to Ethereum taking the crown from Polkadot by registering total MTD outflows of $68.4 million.

Even though Bitcoin lost $26 million more in inflows compared to Ethereum, its performance during the previous weeks helped the king coin keep its losses at a minimum.

Digital asset netflows for the week ending December 17 | Source: CoinShares

The same cannot be said for Ethereum though, as over six million addresses are now observing losses for the first time since July.

Furthermore, owing to the possibility of further losses, investors have become more cautious now, whales included. Their volumes on 14 December crossed $10 billion, the highest recorded volume since January 2018, after ETH fell by 8.5% the day before.

Ethereum whale movement | Source: Santiment – AMBCrypto

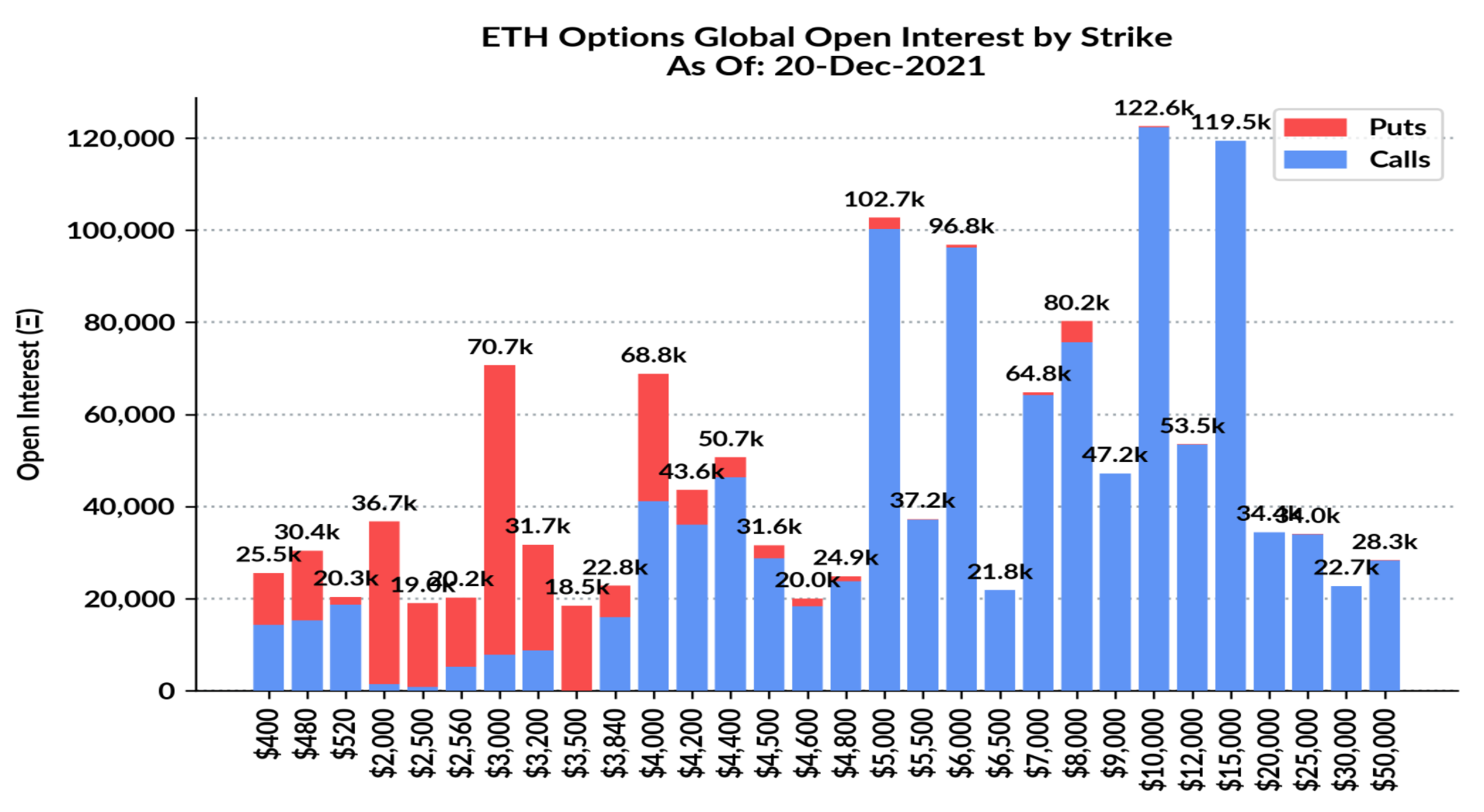

However, as the biggest expiry of the year gets closer, we can hope to see somewhat of a recovery soon.

While 102k contracts are demanding Ethereum to close above $5k, another 122.6k and 119.5k investors are looking for a $10k and $15k close respectively.

Ethereum options contracts | Source: Skew- AMBCrypto

However, even $5k is doesn’t look likely at the moment. If ETH was to ever rally, $5k is the closest level, as reaching $10k and $15k is out of the question. Well, even then ETH will need to rise by 23.69% in the next 10 days to achieve $5k.

Ethereum price action | Source: TradingView – AMBCrypto

So it would be safe to say that going forward even if ETH recovers, a lot of investors are still going to suffer losses.