What explains Bitcoin’s unexplainable movements in recent days?

With cryptocurrencies gaining more recognition and mainstream attention with every passing day, the instinct to view this still nascent sector through the lens of a traditional financial market is quite understandable. Ergo, it’s not a surprise if some expect the latter’s institutionalization, volatility, and yes, predictability, from an emerging industry such as the crypto-market.

However, are such expectations justified? Just because an emerging sector is going mainstream, can it be expected to act like it as well? Well, when it comes to Bitcoin and the larger crypto-market, the answer is trickier than expected.

Consider this – Bitcoin, the world’s largest cryptocurrency, was rangebound on the price charts until it wasn’t. Its price charts over the last 2 weeks registered quite a few sharp hikes, sudden falls, and long, long periods of sideways movement.

How did this come to pass? Well, the traditional answer would be something along the lines of “developments in the ecosystem pushed the price of XYZ.” However, while that would be the simpler explanation, it would also imply that the market adheres to a financial model, that it is expected to react in a certain way when something happens.

Bitcoin’s recent hikes and falls, therefore, are worth exploring to get some clarity on the subject. It should be noted here that the said instances were also the subject of Arca’s latest market recap.

Janet Yellen – Not quite Janet Jackson?

Consider this – Janet Yellen’s remarks about the use of cryptocurrencies for the purpose of terrorism and money laundering spooked a lot of people, and rightly so. But, what the headlines didn’t highlight was the context and the entire text of Yellen’s answer before the Senate Finance Committee.

Yes, Yellen highlighted the use of crypto for illicit activities, but she also said that they have the potential to improve the financial system’s efficiency, while encouraging crypto’s use for “legitimate activities.”

Yellen says cryptocurrencies could improve the US financial system: pic.twitter.com/L36J6Bn4vx

— Saleha Mohsin (@SalehaMohsin) January 21, 2021

Headlines don’t have room for nuance and because they don’t, the damage was done before it could be corrected. What followed? Well, Bitcoin followed the bear down the price charts.

Not quite a double spend

This wasn’t the only case either, with the instance repeating itself a few days later when news of Bitcoin’s “double spend” broke out. Now, for a blockchain like Bitcoin, news of a double spend would be a HUGE deal, right? Well, yes. Absolutely. Except, in this case, there was no double spend.

In actuality, what happened here was a simple, but unusual, Bitcoin block reorganization, a fairly common occurrence that happens every few weeks. However, before that could be clarified, a combination of poor language and reporting by some in the media allowed the development to be misconstrued. What next? Well, the cryptocurrency fell by over 10% on the charts within hours.

Oddly enough, it works the other way too. Even for the most unusual of reasons.

Elon to the rescue

Just take the example of Bitcoin’s hike on the 29th of January. It was a hike precipitated and triggered by a bio update. All Elon Musk did was add the word “Bitcoin” to his Twitter bio. What happened after? Well, the cryptocurrency pumped by over 10% in minutes, pushing BTC out of its trading range and well beyond $37,500.

Source: BTC/USD on TradingView

News & Bitcoin

Many argue that thanks to the age of the crypto-market, more than the rest, it’s way more susceptible to news stories and headlines. Now, even if we assume that this assertion is true, another question arises – Do cryptocurrencies like Bitcoin react equally to every type of news? Well, that’s a question up for debate.

According to a recent research paper,

“Volatility of Bitcoin reacts most strongly to news on Bitcoin regulation, positive investor sentiment regarding Bitcoin regulation extracted using Google searches, and most notably, hacking attacks on cryptocurrency exchanges.”

The paper also observed,

“We also find that the volatility of Bitcoin is not influenced by most scheduled U.S macroeconomic news announcements, such as government budget deficits, inflation, or even monetary policy announcements.”

When the aforementioned news headlines are viewed side by side with the findings of the report, one can clearly see that the latter does not and cannot fully explain why Bitcoin moved the way it did over the past few weeks.

Even if one stretches the report’s interpretations to conclude something like Yellen’s statements could have been a precursor to Bitcoin regulations, its findings do not explain how a mere Twitter update by Elon Musk could have pumped the price so much.

What does this mean? Well, it means that all its growth and maturity notwithstanding, the Bitcoin market’s movements continue to be an anomaly, for researchers and financial experts alike. While cryptocurrencies may have become more mainstream lately, they continue to behave in a way that defies normal conventions.

A defiant hike

Think about it – There were many reasons why nobody expected Bitcoin to pump like it did on the 29th. After all, as a recent article pointed out, most of its technical indicators were leaning towards the bearish side.

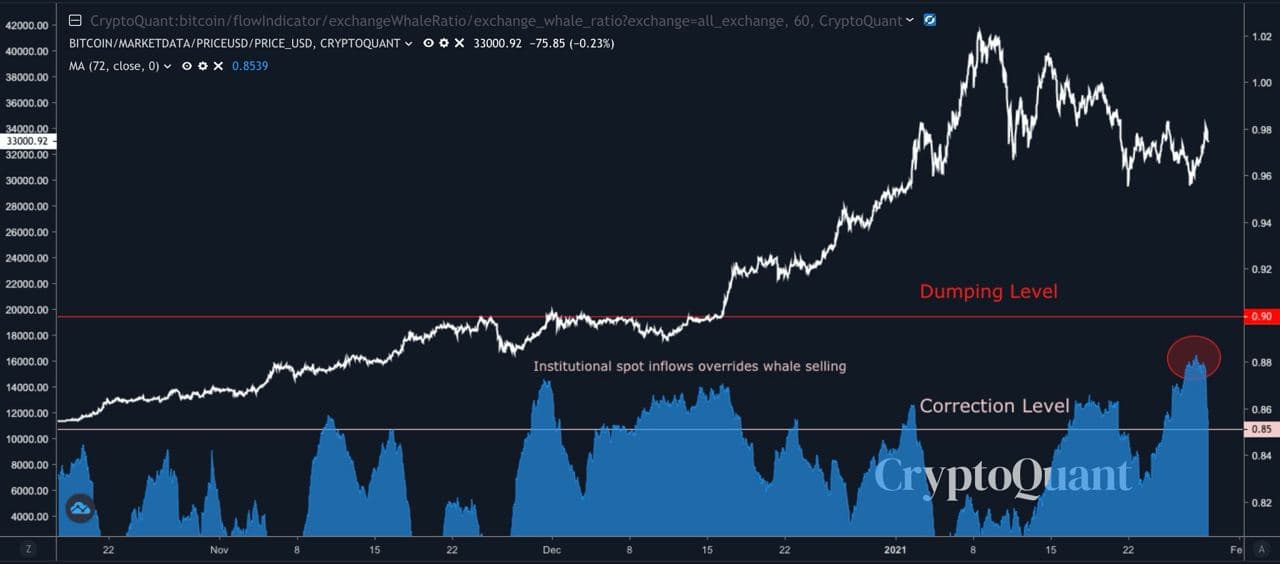

CryptoQuant’s Exchange Whale Ratio for Bitcoin, for instance, had risen to the 0.9-level right before the pump. A 0.9-level is a bearish indication that usually suggests that whales are waiting to sell their holdings and that a drop is incoming. However, the same was invalidated by the Musk-triggered hike on the charts.

Source: CryptoQuant

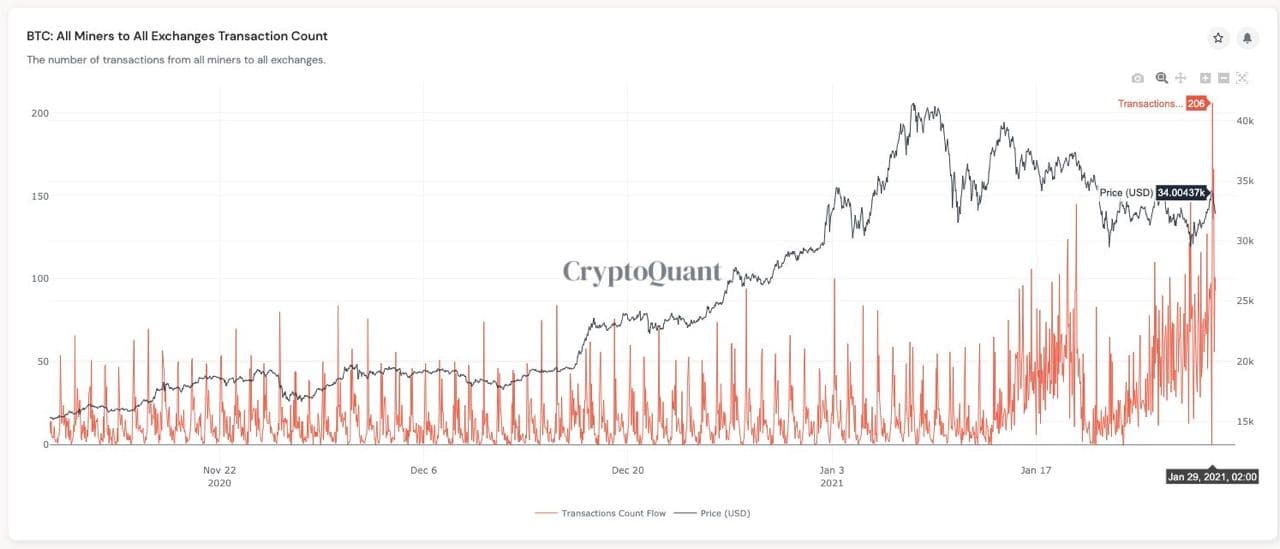

In fact, Miner to Exchange transactions was at a high too, with the same contributing to a lot of selling pressure in the market at the time. However, again, the hike shrugged off all these indicators and pushed the crypto up the charts.

Source: CryptoQuant

At press time, Bitcoin had reverted to type, back to trading within the $32,000-$33,500 price range after its Elon Musk-inspired hike exhausted all its momentum. What does this suggest? Well, it means that the hike was an anomaly, an assertion that can be backed by the fact that the aforementioned indicators, among many others, were all divergent.

However, it also proved the notion that the cryptocurrency market remains as unpredictable as ever. Maybe, the crypto-market isn’t as mainstream after all. Now, if only someone would present a peer-reviewed theory that would explain how and why a market pumped after a Twitter update, that would be great.

Disclaimer: It should be noted that this article was written before Elon Musk’s appearance on Clubhouse during which he praised Bitcoin and termed it a ‘good thing,’ along with a few positive comments on Bitcoin. It will be interesting to see what impact this has on BTC’s price. One can assume a clear statement such as this would have a substantially bigger impact when compared to a Twitter bio update.