What is compressing Bitcoin’s price under the psychological $40,000 mark

On different bearish occasions, Bitcoin long-term holders remained unfazed with the market trends. While many investors preferred exiting their Bitcoin positions, LTHs continued to HODL.

Doom and Gloom

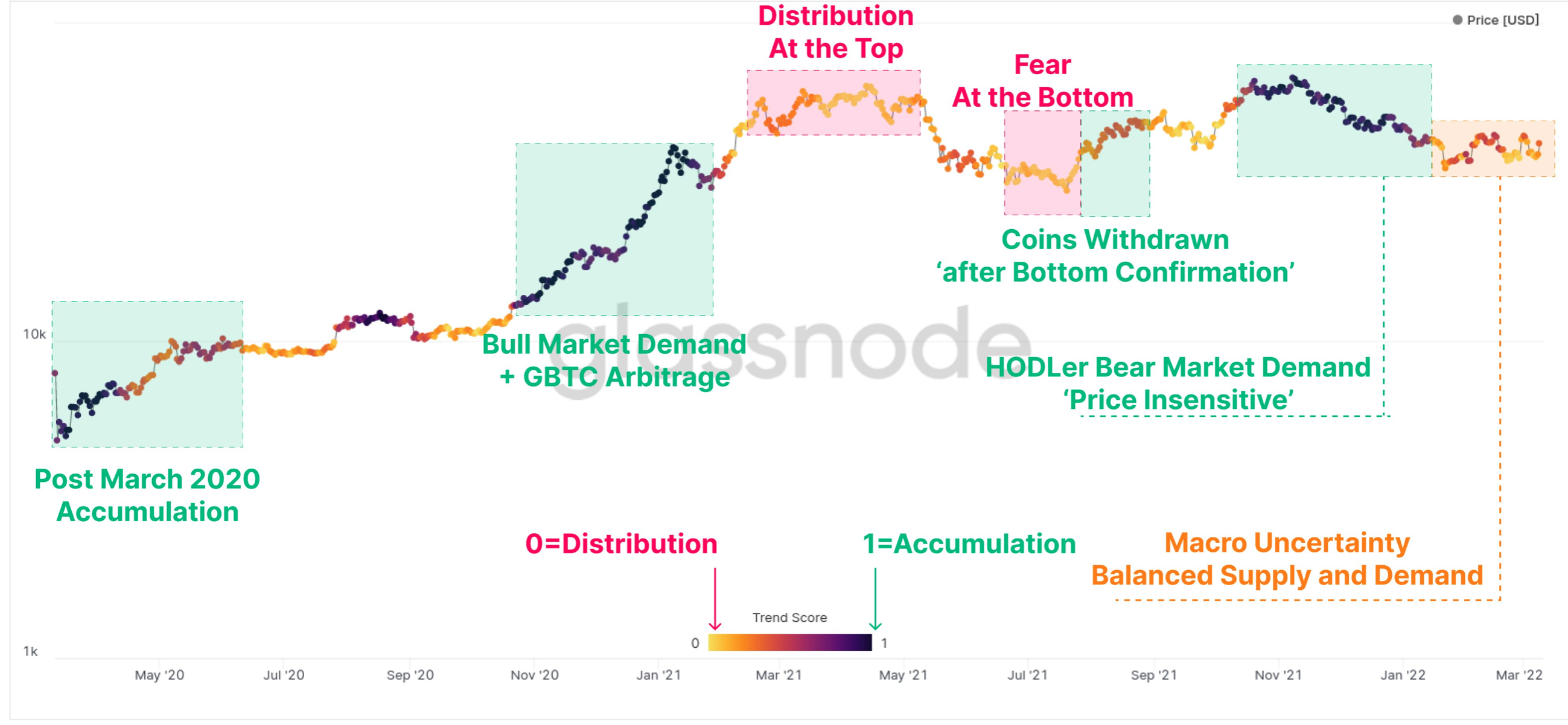

Bitcoin, the largest cryptocurrency witnessed significant fluctuations in its price in 2022. Even at press time, BTC dipped below the $39,000 mark with an increase of 1.54% in the last 24 hours. Despite the interest, macro uncertainty was felt across the board. Consider this graph that showcases Bitcoin’s Accumulation Trend Score.

Source: Glassnode

As per this graph, price-insensitive HODLers of all wallet sizes accumulated in the current market. A Glassnode’s tweet added,

“we see balanced supply and demand, as macro uncertainty tests $BTC HODLer conviction throughout 2022. This differs from the clear distribution seen in mid-2021.”

Now, the accumulation score, at the time of writing stood at 0.3. Here, a score of one indicates that the whales or large part of the market are accumulating. And, a score below zero means that there is a macro distribution by the market.

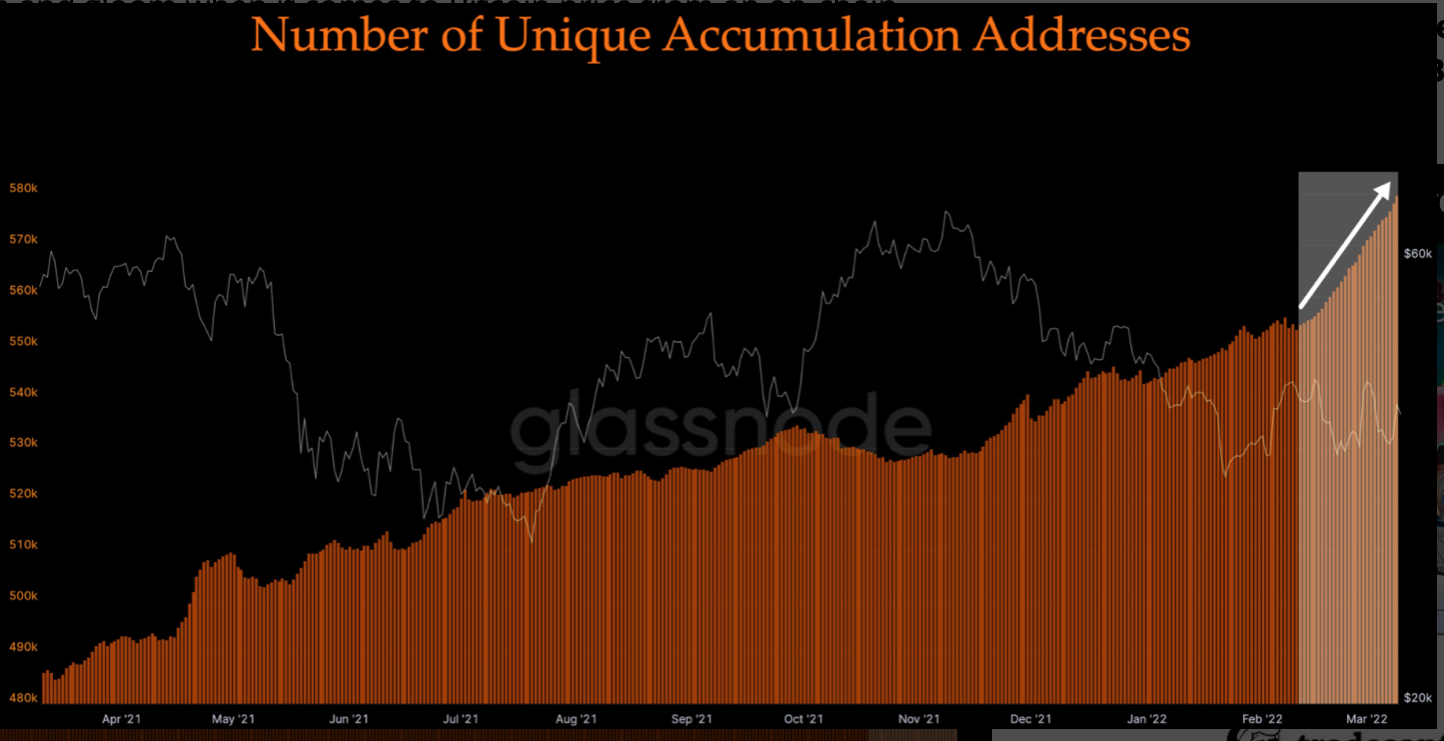

But, it’s not all doom and gloom when one looks at the metrics. Notably, crypto analyst and pseudonymous Twitter user ‘Plan C,’ explained that “the number of Bitcoin accumulation addresses has gone parabolic over the last month.”

Source: PlanC| Twitter

Plan C defined accumulation addresses as “addresses that have at least two incoming non-dust transfers and have NEVER spent funds BTC.”

Not bullish below THIS

To shed some light on BTC’s price action amidst the volatility, crypto trader and pseudonymous Twitter user ‘Rekt Capital’ posted the following chart. Here, the higher lows and lower highs compressed the price.

#BTC is still consolidating between the green Higher Low support and the blue 50-week EMA resistance

The Higher Lows and Lower Highs are compressing price

Price compression precedes volatility$BTC #Crypto #Bitcoin pic.twitter.com/h9aTOqS03Y

— Rekt Capital (@rektcapital) March 10, 2022

Rekt Capital pointed to the green and blue exponential moving average (EMA) lines which have proved to be strong points of resistance over the past two weeks.

To move higher inside its macro range, #BTC needs to reclaim the two key Bull Market EMAs to confirm bullish momentum

Over the past two weeks, $BTC has rallied towards these EMAs but failed to reclaim them as support#Crypto #Bitcoin pic.twitter.com/fpOHCIaQdl

— Rekt Capital (@rektcapital) March 10, 2022

The probability of a further dip was high. Dutch market analyst Michaël van de Poppe noted that things didn’t look bullish below $46,000.

Source: Twitter

BTC has been stuck in the $33,000-$45,000 range for a long time now. The bulls will have to exert more pressure to take it past its psychological level of $40,000.