What Litecoin’s post-halving hash rate suggests

Editors’ note – The article was edited on 07 August to better clarify the long-term trend in Litecoin’s hash rate.

- Slashing block subsidies impacted miners’ profitability.

- Contrary to the hype, LTC has exhibited bearish price action over the last few days.

Litecoin’s [LTC] ecosystem recently witnessed its biggest event of 2023 when the block subsidy given to miners was slashed from 12.5 LTC to 6.25 LTC. Since then, experts have been busy examining the after-effects of the pivotal halving process, which took Litecoin one step closer to scarcity.

Is your portfolio green? Check out the Litecoin Profit Calculator

One major source of discussion is the noticeable drop in the network’s hash rate immediately after the halving.

Did miners abandon Litecoin?

According to CoinWarz, after a temporary uptick on the day of the halving, the hash rate trended downwards. At the time of writing, the network’s computational power was 746 TeraHashes per second (TH/s), down 11% on a week-to-date (WTD) basis.

The decline could be explained from the perspective of miners’ profitability. People participate in mining activity owing to the incentives they get after creating a particular block. Now that these incentives, i.e. mined Litecoins, have been cut in half, miners’ revenue has taken a hit.

Moreover, contrary to the hype, LTC has exhibited bearish price action over the last few days. At the time of publication, the “Digital Silver” exchanged hands at $82.51, marking a significant dip of 11% since the halving event, per CoinMarketCap.

Miners require cash and frequently liquidate their crypto holdings to meet their mining and infrastructure expenses. In the absence of strong returns, less inefficient miners are forced to exit the market, causing the hash rate to fall.

Here, a caveat must be attached to the aforementioned findings. The fall in hash rate is likely just a short-term anomaly, especially since over the long-term Litecoin’s hash rate has trended upwards. In fact, despite the recent decline, the same is still hovering around its ATH on the charts. Similarly, its difficulty is close to an ATH as well. Ergo, the post-halving decline in hash rate is likely to amount to nothing.

Tepid network activity since halving

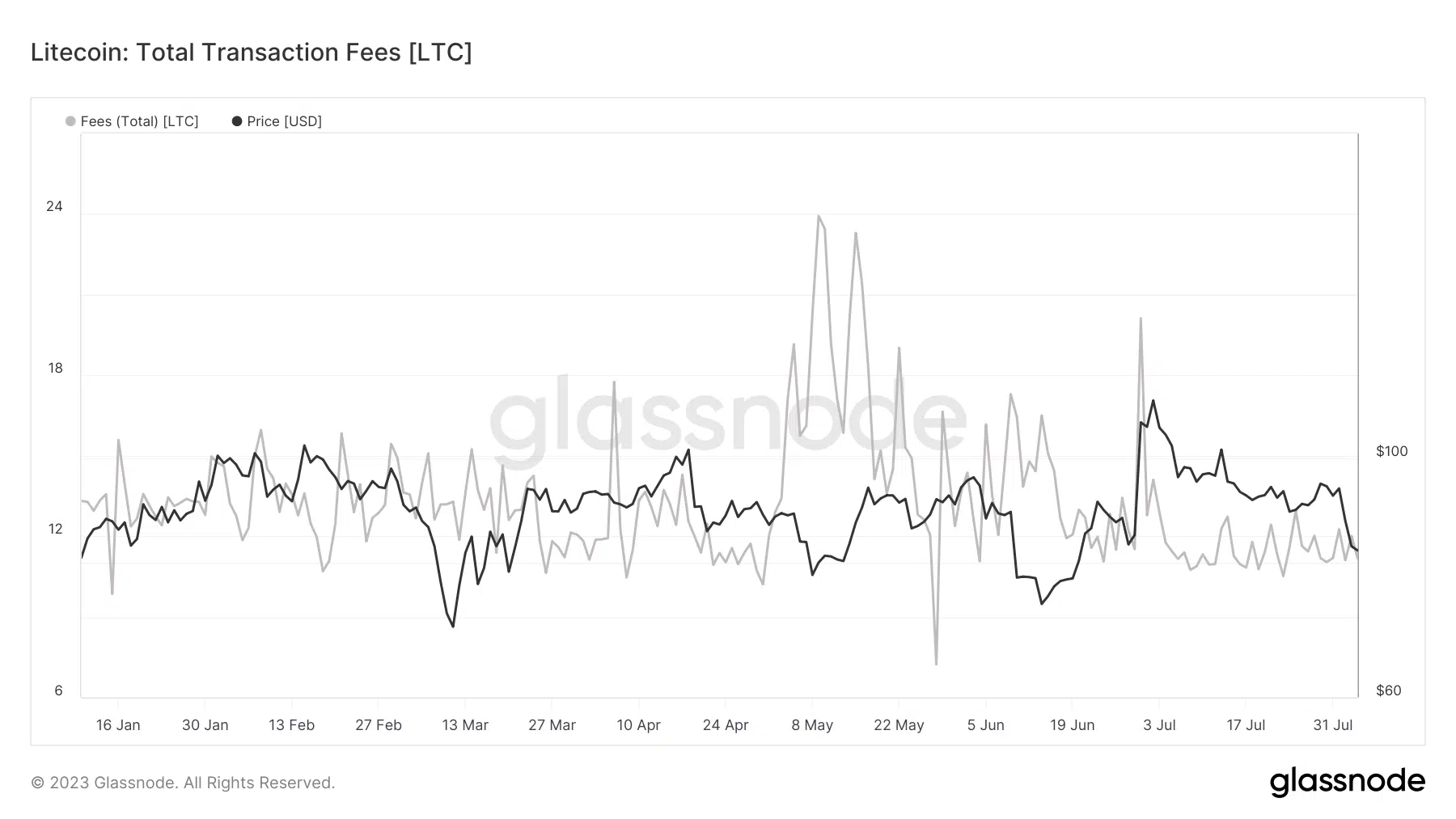

Even so, the decline in hash rate could also be interpreted as weak network activity on the network. As LTC plunged, users shied away from using it in transactions. This was evidenced by the fall in transaction fees collected by miners.

How much are 1,10,100 LTCs worth today?

Mining machines didn’t operate at full capacity due to reduced network traffic, resulting in a drop in hash rate.

Downturn to continue?

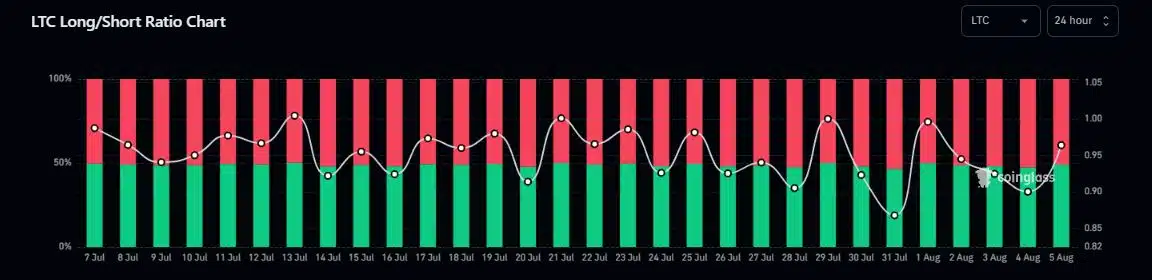

LTC’s bearish price action changed its dynamic in the derivatives market. The number of short positions taken trumped the longs, reflecting that investors expected prices to be bearish in the near term. According to Coinglass, the Longs/Shorts Ratio was below 1 at the time of writing.