What part are Ethereum-only portfolios playing?

With Bitcoin’s price dropping below $19,000, the focus has shifted from the world’s largest cryptocurrency to Ethereum and the rest of the market’s altcoins. Institutions that dabbled in Bitcoin since June 2020 are now discovering Ethereum following the launch of ETH 2.0. In fact, scalability issues faced by Ethereum might have well become a thing of the past now.

However, the current state of Ethereum suggests that a “supply shortage” may be underway. Though Ethereum does not have a supply as limited as Bitcoin, the recent staking for ETH 2.0 has encouraged HODLing of Ethereum. Nearly 100% of the fees spent on Ethereum, on ETH deposits, is made to centralized exchanges. It has fallen from 25% in 2017 to less than 1% today. Based on the chart, almost all fees spent on transactions involving centralized exchanges in the past few months were used for ETH withdrawals based on data from Santiment.

Now, does this signal a drop in ETH deposits and eventually, ETH reserves on exchanges?

ETH Exchange Reserves || Source: Cryptoquant

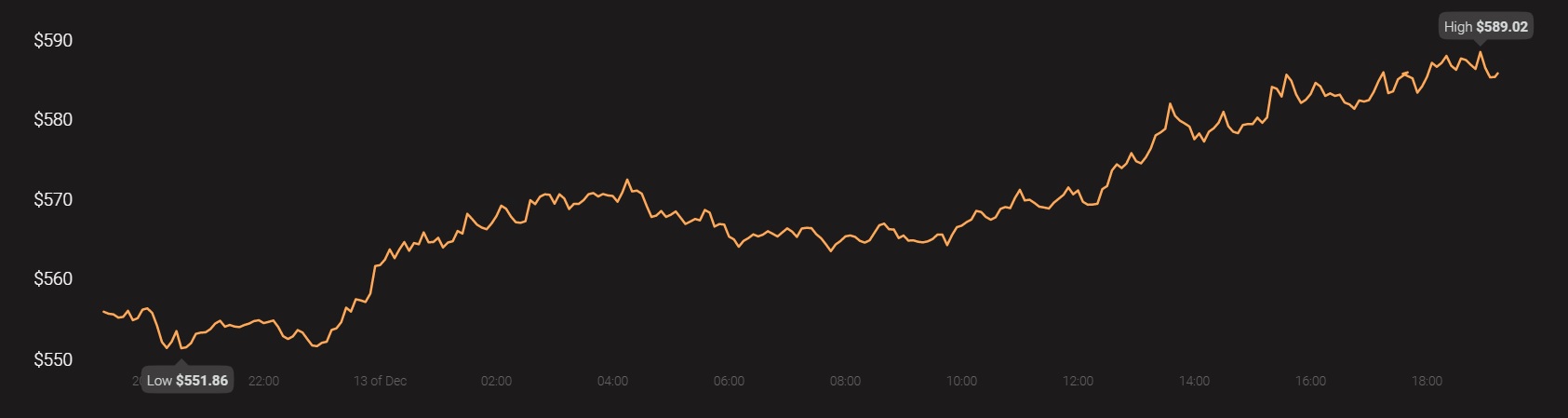

Based on ETH Exchange reserves data from Cryptoquant, net reserves on all exchanges have dropped by nearly 200,000 ETH between the end of November to the 12th of December, 2020. Such a drop in reserves could be a direct result of high ETH staking, however, this is bullish for the crypto-asset’s price both in the long and short-run. Retail traders have been hopeful of a price rally since institutions like Grayscale added Ethereum along with Bitcoin in their portfolios. This, including the recent addition of $74 million worth of Ethereum.

New institutional buyers building Ethereum-only portfolios have led the way, and with an increasing net outflow from exchanges, Ethereum’s supply on exchanges is dwindling. Here, as discussed previously, the classic “supply shortage” scenario may emerge. When Bitcoin’s supply shortage emerged in mid-2020, the bull run followed in the next two months. There was increased volatility and sustained momentum throughout Bitcoin’s price rally after August 2020.

Though the momentum was not of the same level as the previous bull runs, it was enough to get institutional investors interested in buying and HODLing the asset at average prices above $19,000. GrayScale’s Ethereum trust may be leading the way for a similar price rally in Ethereum, as the class of Ethereum-only investors emerges from among retail traders and top institutions.

Source: Coinstats