What Polygon’s [MATIC] resilience to the last market turmoil suggests, as per…

![What Polygon's [MATIC] resilience to the last market turmoil suggests, as per...](https://ambcrypto.com/wp-content/uploads/2023/04/po-2023-04-04T081302.858.png.webp)

- MATIC’s strength reflected how the cryptocurrency defied the odds during the 2022 crypto winter.

- More holders have gained than they have lost in the last six months.

In 2022, the cryptocurrency market experienced an insane amount of volatility. But one asset that held its own during the series of capitulations was Polygon [MATIC]. Crypto investor and analyst Dan Lim comprehensively looked at the token’s condition in his CryptoQuant publication.

Read Polygon’s [MATIC] Price Prediction 2023-2024

Tough on the challenges

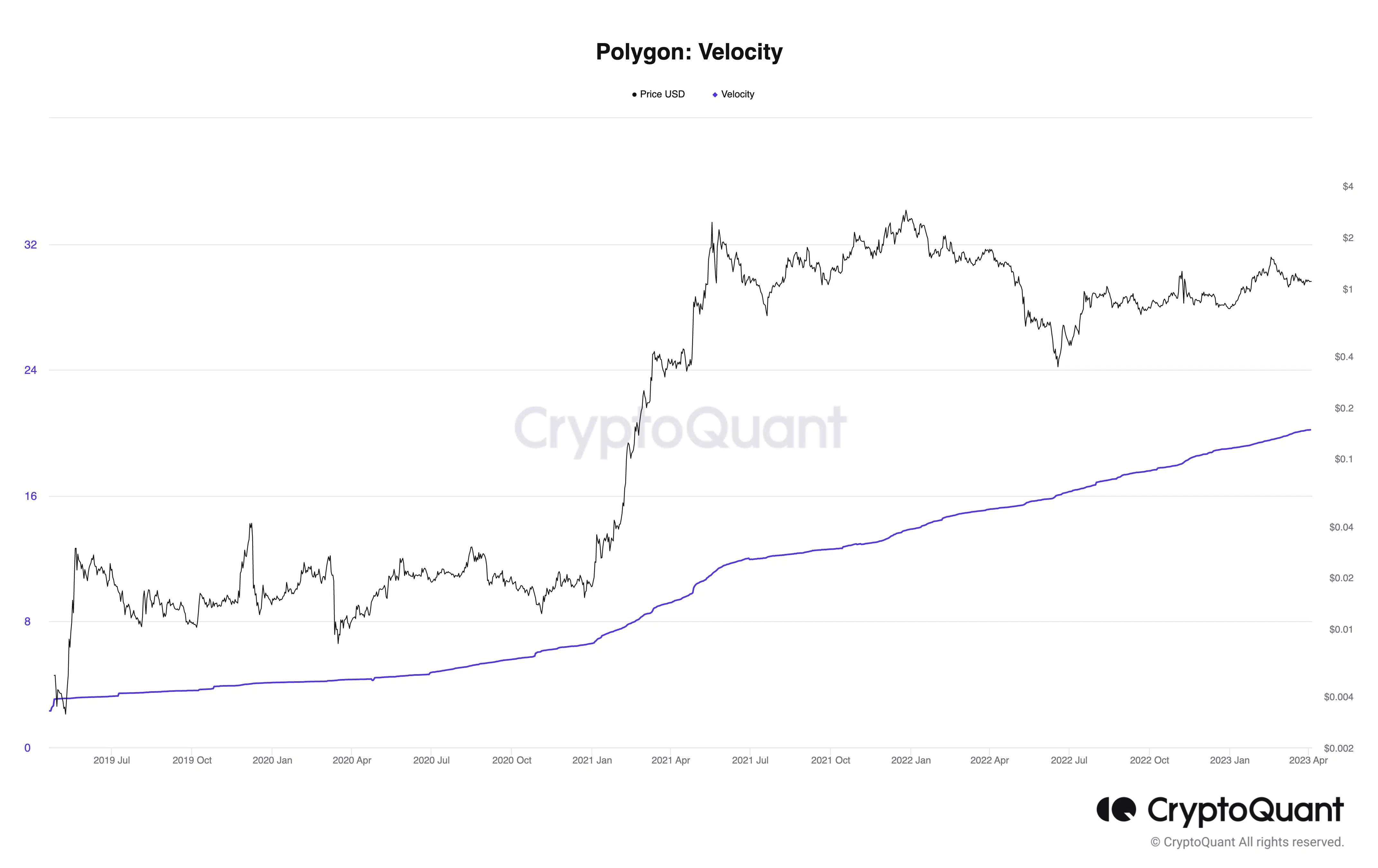

According to him, MATIC’s remarkable resilience was due to its increased velocity. In crypto, the velocity of an asset refers to the total amount of coins moved over the past year divided by the total supply. This metric serves as an indicator of the coins circulating within the crypto economy.

At press time, the metric was still at an increasing rate. This showed that MATIC tokens were circulating fast.

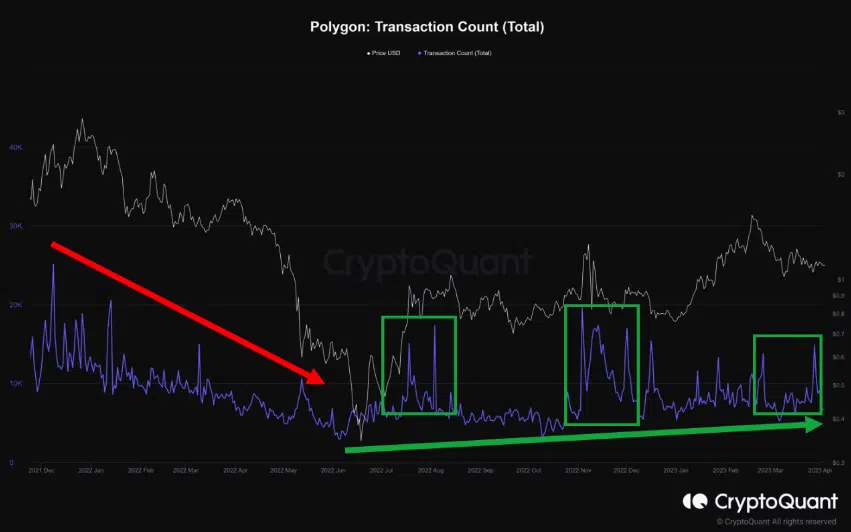

Dan Lim also pointed to the Polygon trading volume as one reason MATIC’s value has remained relatively stable. The analyst noted that before June 2022, the volume hardly increased. However, after the period, it exempted itself from the trend and turned upward.

Interestingly, this was enough to back MATIC’s resistance to close in on a new low even when Bitcoin [BTC] dropped to $18,600.

In ascending and descending order

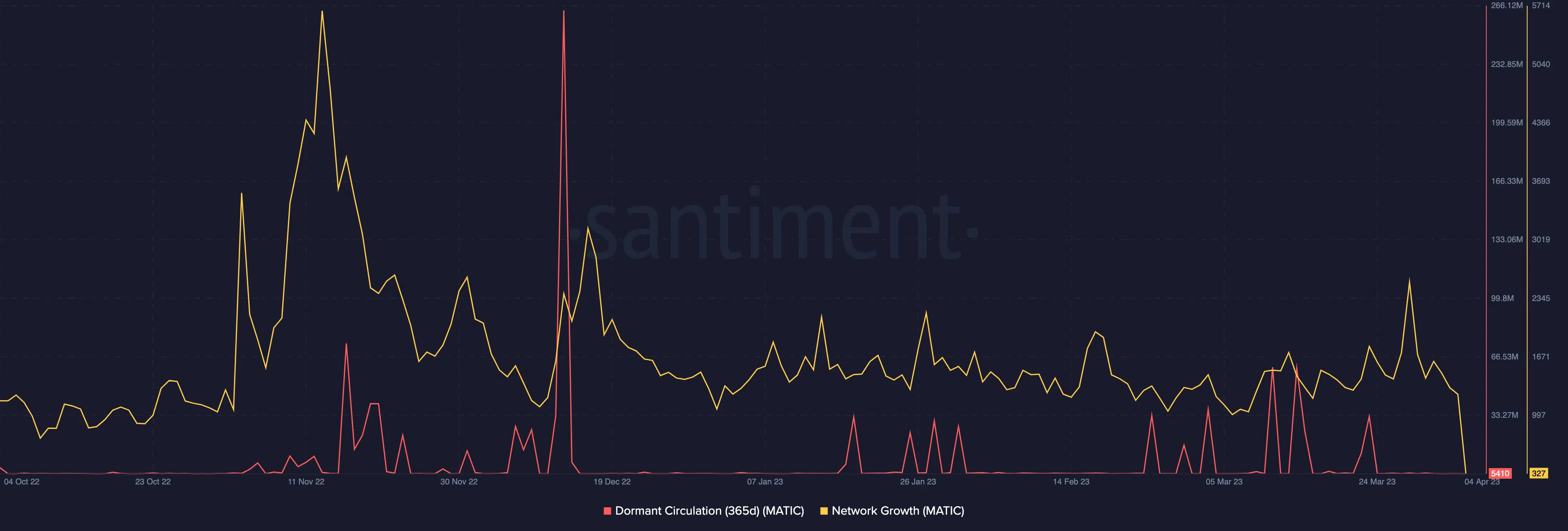

This year, MATIC’s performance has summed up to a 36.59% hike and remained far above the $0.34 low. On looking at the 365-day dormant circulation, Santiment showed that there were a series of spikes.

The metric showed the number of unique tokens that have existed for a long period. Hikes in this regard meant that the token moved or was transacted. The data showed inconsistencies in the metric, as there were times when the circulation increased. Moreover, there were seasons when it was flat.

This implies that some holders dumped some of their holdings in between the velocity sustenance while others stayed put. With respect to the network growth, Polygon’s condition was impressive at a time when most projects struggled with adoption.

Is your portfolio green? Check the Polygon Profit Calculator

The metric describes the rate of traction gained by a project. For Polygon, the series of highs over the past year implies that several new wallets entered the ecosystem. Although, the growth has now decreased significantly.

Over time, the crest and trough displayed by MATIC have ended in more gains than forfeiture. This was because on-chain data showed that the transaction volume in profit, on most occasions since 2022, outpaced those in a loss.

All in all, MATIC’s tenacity during the crypto winter was something most cryptocurrencies struggled to exhibit. As of this writing, the token value was $1.1 — a 1.66% increase in the last 24 hours.

![Polygon [MATIC] on-chain volume in profit and loss](https://ambcrypto.com/wp-content/uploads/2023/04/Bitcoin-BTC-08.08.02-04-Apr-2023.png.webp)