What recent stats say about the ‘Binance Smart Chain over Ethereum’ debate

The cryptocurrency industry is innovative and diverse, yet it is natural that some of the major projects are competing in the same sector. In a recent article, we discussed the recent classification of assets based on their functionality, where Ethereum and Binance, fell under the same column.

Specifically, Ethereum and Binance were in the same pool due to their recent competitive nature against each other’s smart contracts platform. Binance Smart Chain (BSC) has opened doors to various projects in the industry that were incapable of dealing with the ETH transaction fees ordeal. Over the past few weeks, BSC recorded strong network activity, and in July, it was able to send a legitimate statement to Ethereum.

Binance Smart Chain over Ethereum? July stats say so

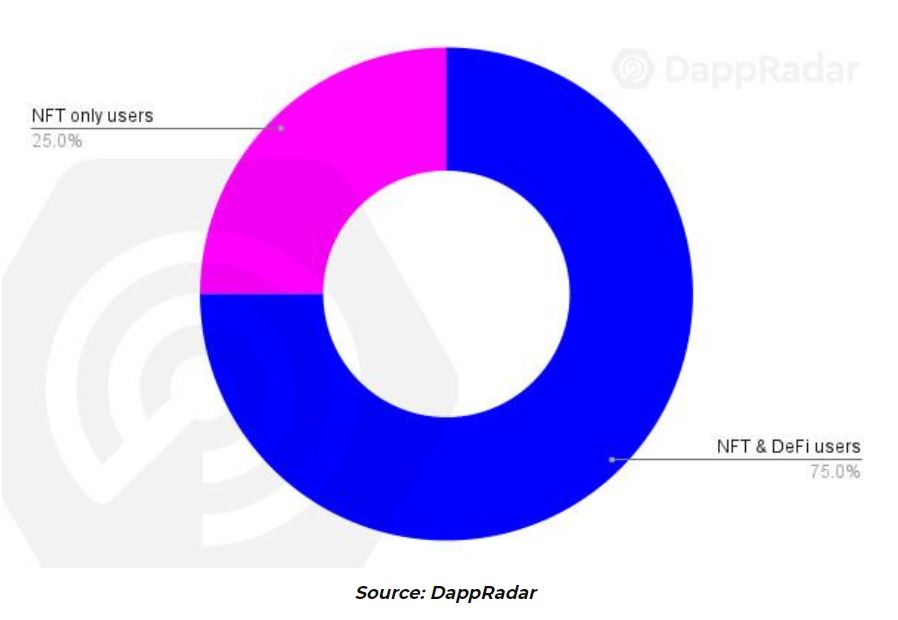

As per data, DeFi had a strong month in July, in terms of activity and engagement, as 85% of the DeFi users were interacting with NFTs. However, in terms of facilitating traffic and new users, BSC was the most used protocol with more than 750,000 daily unique users. Ethereum had 105,000 unique users in comparison.

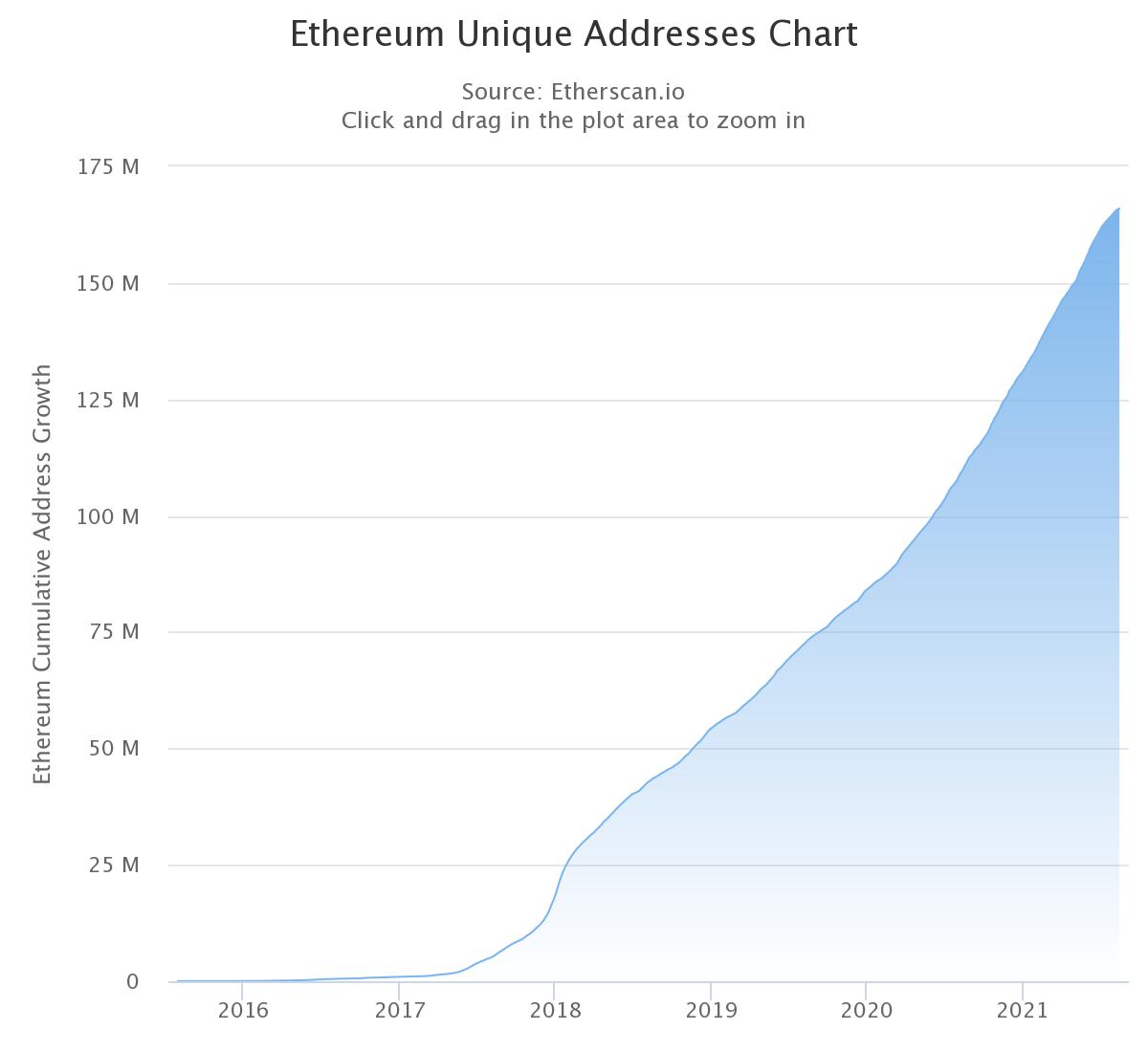

Ethereum still holds the highest overall unique addresses. But there is a condition.

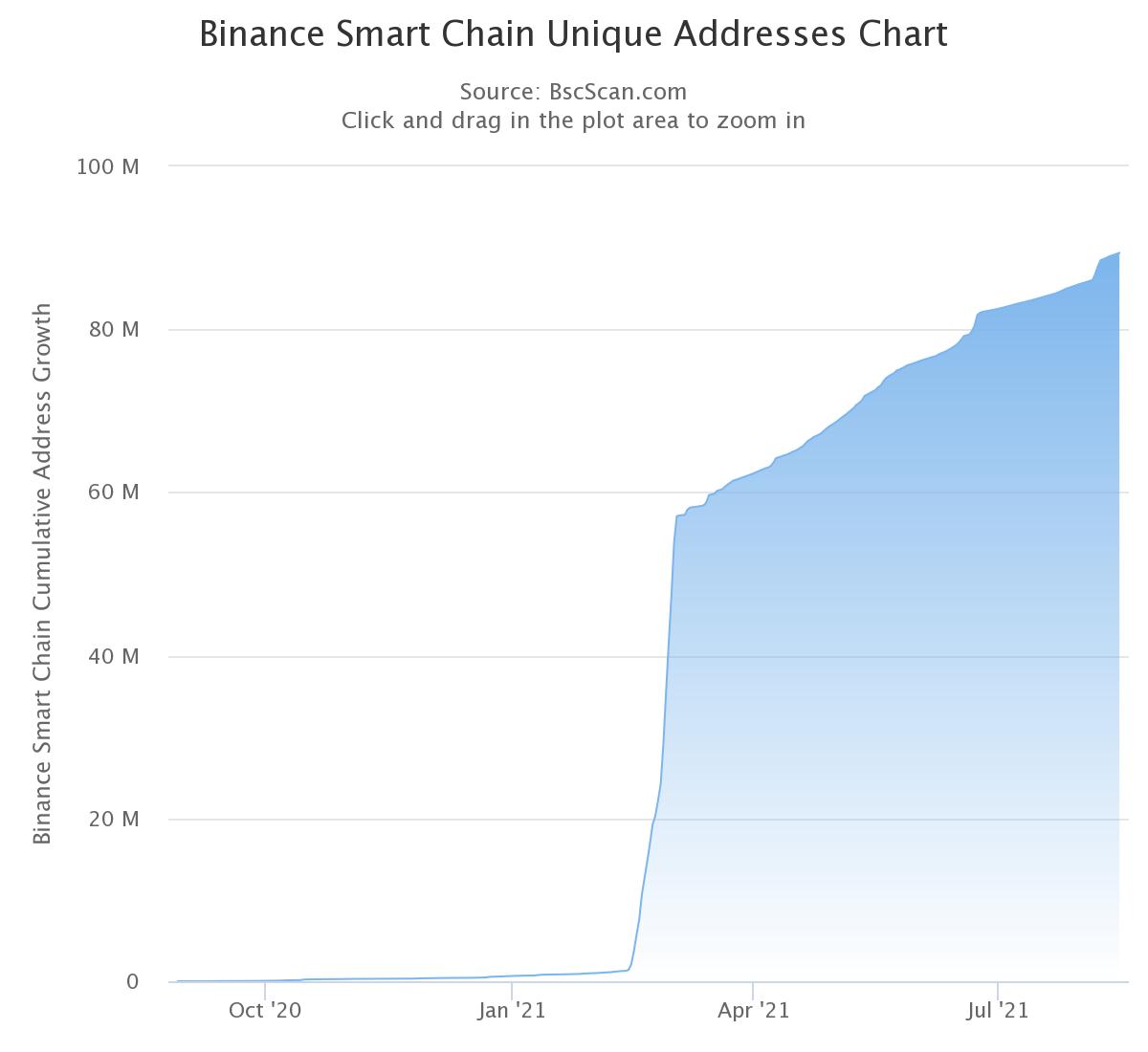

The pace is on BSC’s side

The above charts highlight the pace at which unique addresses were created on each Ethereum and Binance Smart Chain. Ethereum held the highest volume with ~165 million addresses. However, from January 1st, 2021 to the present day, it has added ~35 million unique ones.

For Binance Smart Chain, it registered ~650,000k addresses on January 1st and currently facilitates over ~89 million users. That is more than 80% in less than a year. As impressive as it may be, BSC had the advantage of reaching practical development during the NFT era.

The DeFi space exploded and BSC was one of the platforms available. Ethereum was the most popular one but over the past few months, BSC has created its own marketplace.

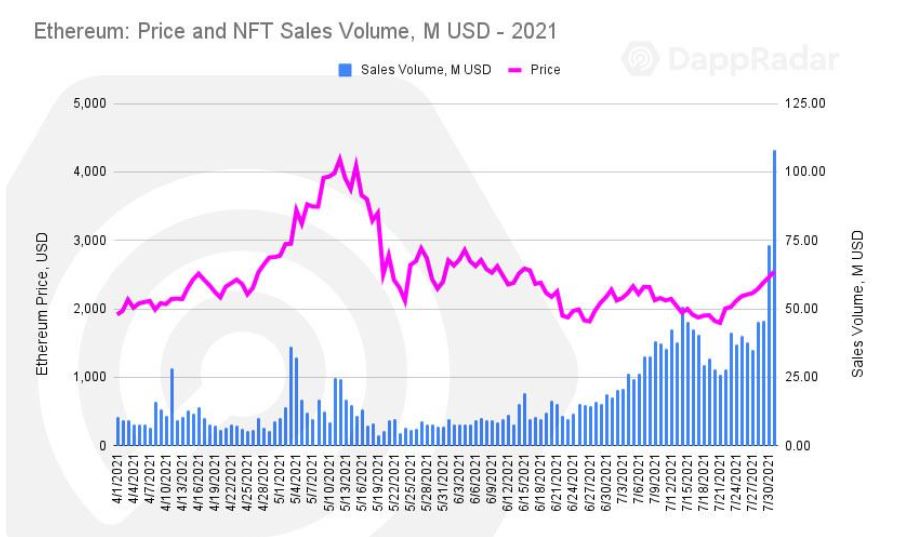

What do the numbers favor?

Ethereum would take a lead on this right now. BSC recorded an impressive start but Ethereum remains in a better position in terms of sales volume. In July, the NFT space amassed over $1.2 billion in sales volume, 80% of which came from Ethereum’s primary and secondary market.

Therefore, while BSC has managed to build its market, Ethereum’s marketplace was generating more capital from its operations. Binance Smart Chain is catching up, but it hasn’t caught up yet.