What traders need to know about the evolving Ethereum-Bitcoin relationship

Ethereum’s price action over the last 72 hours or so has been very topsy-turvy. While the aforementioned period saw ETH recover all its losses on the charts and climb to a new ATH of $2,644, at press time, the altcoin was struggling to register an uptrend after BTC corrected below $50,000.

How did Ethereum initially recover its losses in the first place, however? How come ETH hiked to a new ATH, especially when the rest of the market, including Bitcoin, wasn’t exactly bullish? Well, the answer may lie in Ethereum’s growing emergence as an independent crypto-asset. And in doing so, ETH might be the one to reignite the altcoin season once again.

Price down, fundamentals too?

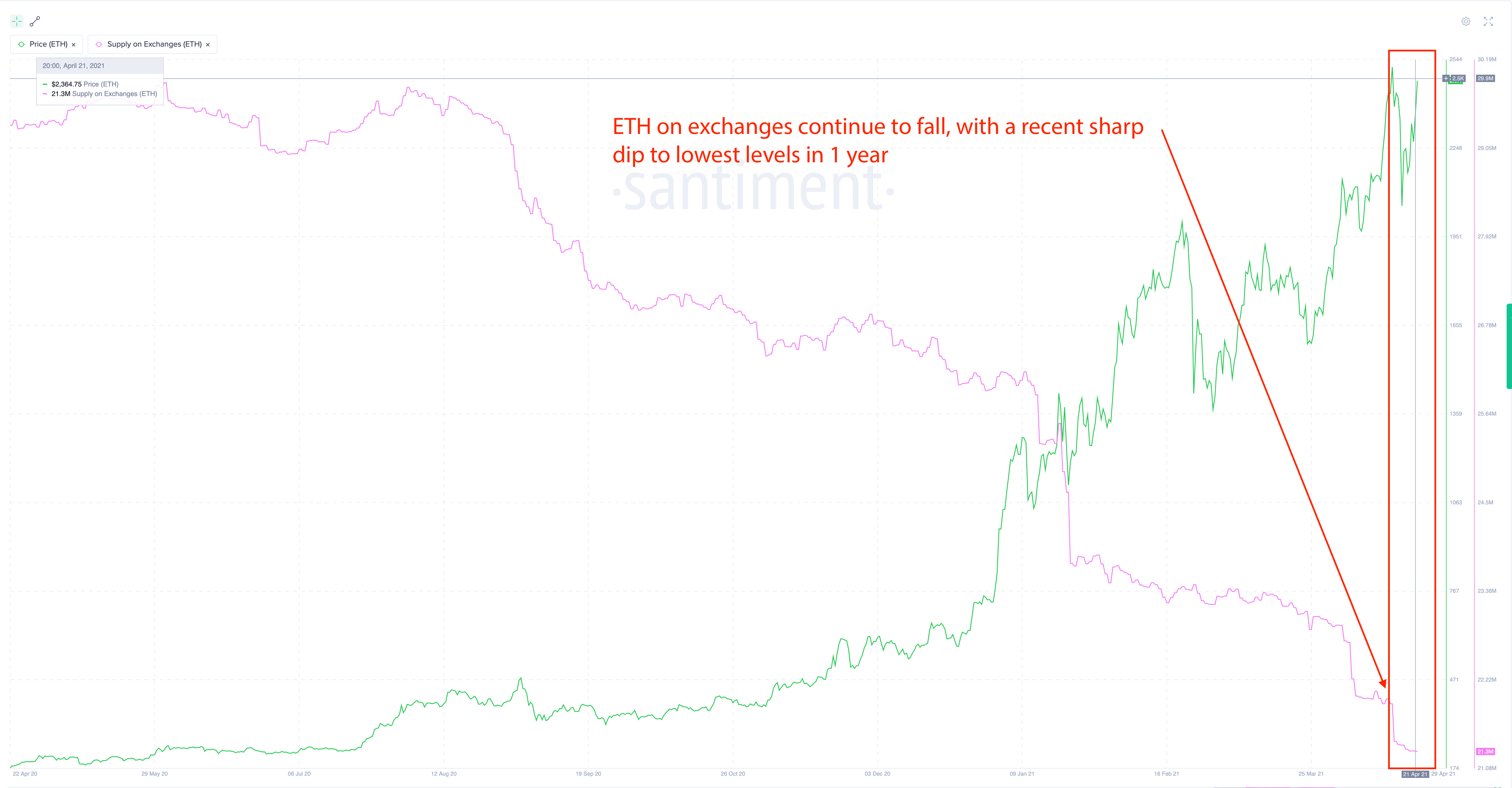

Consider this – Selling pressure has been a highlight of the crypto-market over the past few days, with indicators flashing bearish signals across the board. In the case of Ethereum, however, such pressure has been alleviated somewhat, with the same underlined by the altcoin’s supply on exchanges.

Source: Santiment

According to Santiment, ETH supply of exchanges recently fell to a 1-year low. What this means is that the altcoin is being moved away from exchanges, and is instead being HODLed and accumulated. This finding supports the alt’s price prospects and its long-term credentials.

Similarly, Ethereum’s daily active deposits have continued to fall since the latter half of 2020, with the same underlining how more and more people are now holding on to their ETH rather than pushing them on to exchanges to sell and dump. Here, it’s worth noting that the latest corrections have contributed to the health of the altcoin since a sustained appreciation might actually run the risk of a DAD spike.

Source: Santiment

Finally, before Bitcoin’s fall below $50,000 and by extension, Ethereum’s fall to $2,150, Ethereum’s 30-day MVRV was holding firm right under the overvalued zone. What this meant was that ETH, despite trading at levels around $2,500, had the potential to see more upside on the price charts before local corrections set in.

With Bitcoin and Biden-fueled depreciation making its way before the latter could set in, the MVRV can be expected to have dipped lower. Ergo, ETH, at press time, will have a little more upside and room to climb once the market steadies itself.

Now, when that might be? That’s a question with no certain answer. At the time of writing, both BTC and ETH were still bleeding, with the former below $51,000 on the charts. The next few trading sessions, ergo, would be key to what to expect from the altcoin in the near term, especially since a sustained consolidatory phase would be crucial to Ethereum restarting its rally.

If Bitcoin continues its dumping spree, it is likely that ETH’s run will be pushed back once more.

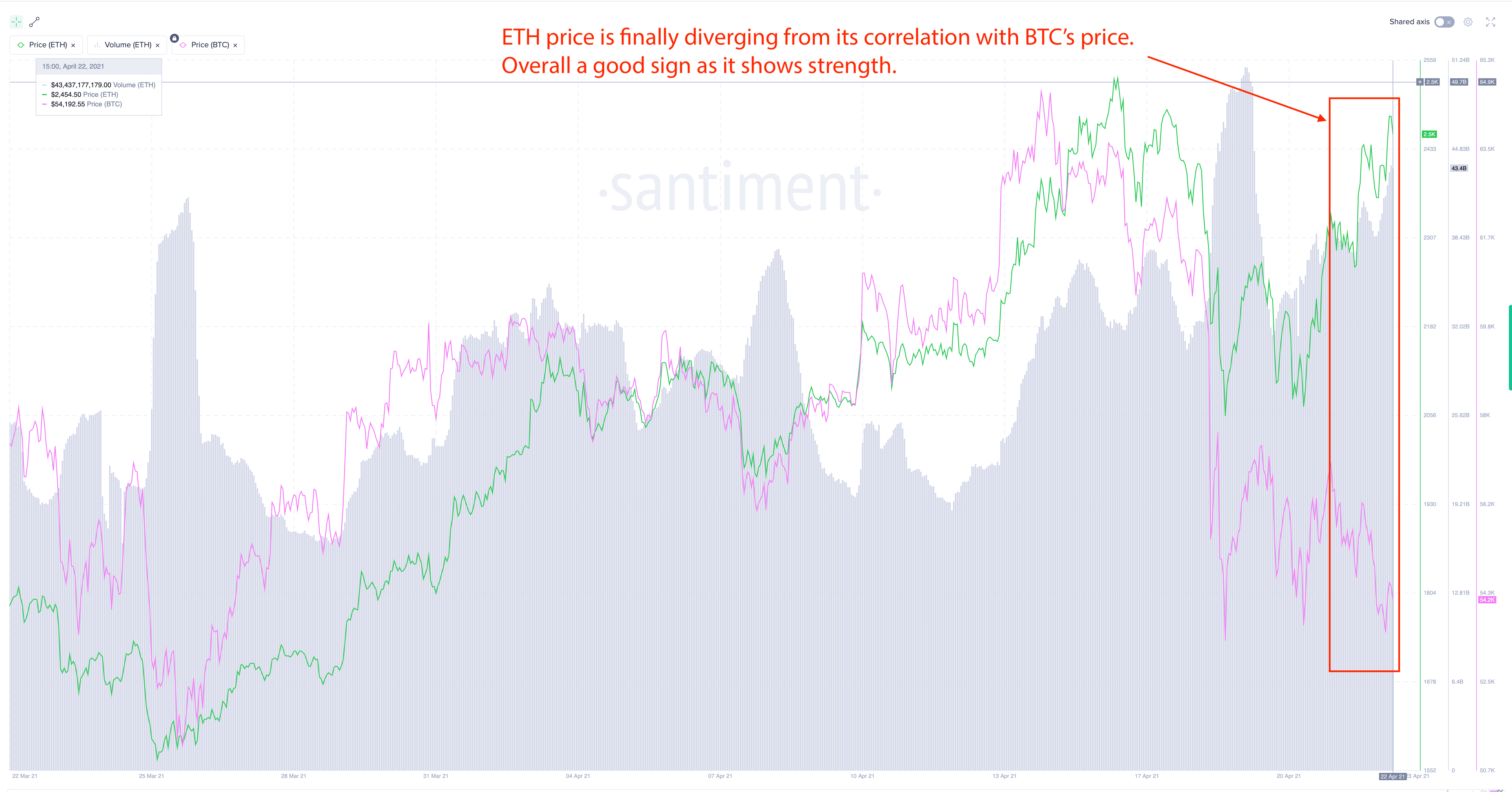

Finally “decoupled?”

Or, will that really be the case? Sure, if the last 72 hours are any evidence, ETH does follow BTC’s lead. But, will this correlation come to an end anytime soon? Well, it may be starting to. According to Santiment, “ETH’s price is finally diverging from its correlation with Bitcoin’s price. “A sign of good strength,” it added.

Source: Santiment

This “decoupling” between Ethereum and Bitcoin’s prices was touched upon by eToro’s Simon Peters too. The popular analyst told AMBCrypto recently,

“While the two have traded in tandem for much of the last three years, as the crypto-asset market starts to mature, investors will be looking across the broader spectrum of assets and assessing which has the best long-term potential.”

He added,

“Bitcoin has captured the attention of millions of investors, but Ethereum offers an alternative. With Ether’s dollar valuation significantly lower than Bitcoin, it also appeals to investors who want to own whole coins, something which is now far more expensive to achieve with Bitcoin.”

Recent price depreciation notwithstanding, backed by strong fundamentals, ecosystem-centric developments, its falling correlation with Bitcoin, and the king coin’s dropping market dominance, Ethereum might finally go on its own on the price charts once some stability ensues. And in doing so, the altcoin may take the rest of the market along with itself too.