What you might be missing about the institutional approach to Bitcoin

Over the past few weeks, the increasing price of Bitcoin has slowly fueled a hike in institutional interest. Now, it isn’t surprising per se to witness growing engagement right now. Especially since BTC’s value hitting $50k before correcting was bound to create some ripples.

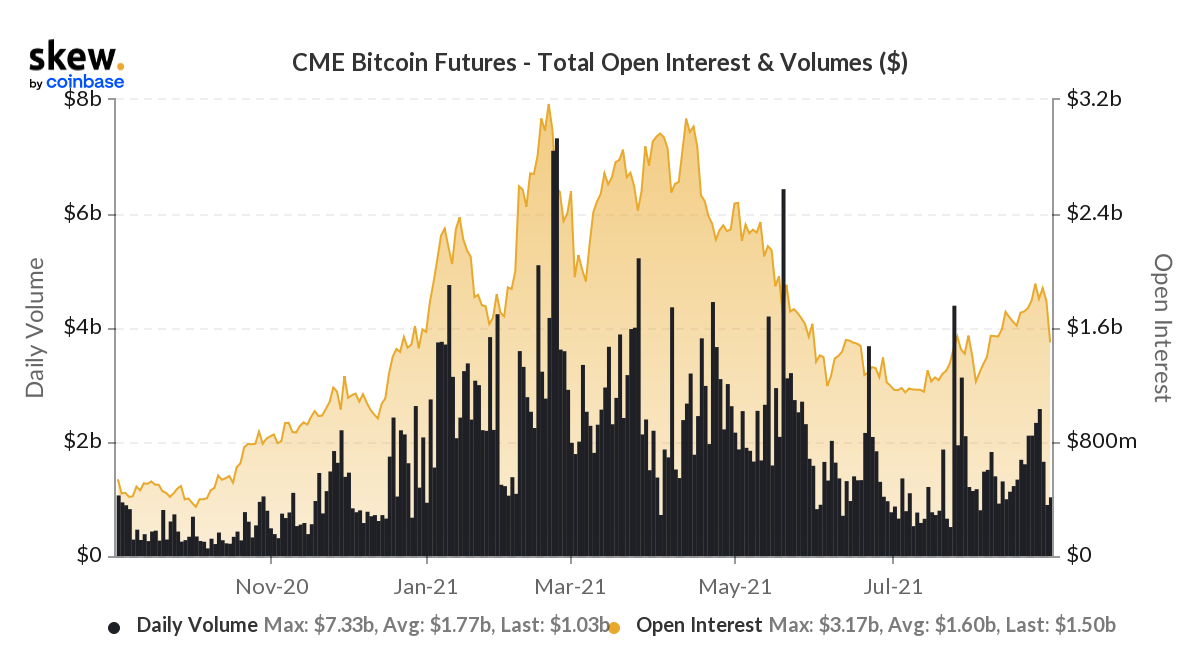

According to data, the Open Interest on CME Bitcoin Futures has been hitting the $2 billion mark again. This is interesting, especially since the market is continuing to maintain its sideways consolidation.

$2 billion v. $3 billion – How much of a difference does it make?

Yesterday, the market OI did drop down to $1.5 billion as possible monthly expiry of contracts led to the reshuffling of OI’s value. At the moment, however, there isn’t exactly the kind of interest Bitcoin saw back during Q1 of 2021. Why? Well, because institutions are still cautious. This narrative can be better understood when the categories are evaluated.

According to the CFTC COT report, since the short-squeeze on 26 July (When Bitcoin jumped from $35200 to $40550 in 24 hours), leveraged or hedge funds have continued to accumulate new short positions.

Now, this is something most hedge funds facilitate as they are trying to remain risk-averse in the market. The entire point of hedge funds accumulating short positions is that a market breakout is still being considered by these accredited investors.

In fairness, these might not be direct short bets against Bitcoin, but exposure through CME or any other market to hedge out risks.

Can we consider the Bitcoin dilemma to be a part of institutions?

Dilemma might be a strong word but right now, institutions might just be positioning themselves to cater and remain net-profitable irrespective of a bullish or bearish breakout. Smart Money hasn’t underlined a change, and this means involvement has been minimal. On the other hand, asset managers eyeing long-term returns are net-long on BTC Futures.

According to Arcane Research, one possible explanation for short exposure amidst hedge funds is the negative premium of GBTC products. Irrespective of the price, GBTC premiums have remained negative across the market. What this suggests is that Grayscale isn’t making any drastic moves in the market either.

Therefore, while institutions are turning towards Bitcoin again, they are taking baby steps as far as market positioning is concerned.