What you need to know about Bitcoin’s ‘capitulation for the ages’

For the better part of the last two months, Bitcoin held its consolidation range between $32,000 and $40,000, and 15% of the BTC money supply moved in this range during this period. Its hash rate took a fall on 25 June, post which larger block intervals have been noticed, the largest of which was 23 minutes. Issuance of coins too slowed due to this, in the backdrop of more and more bitcoin miners moving out of China.

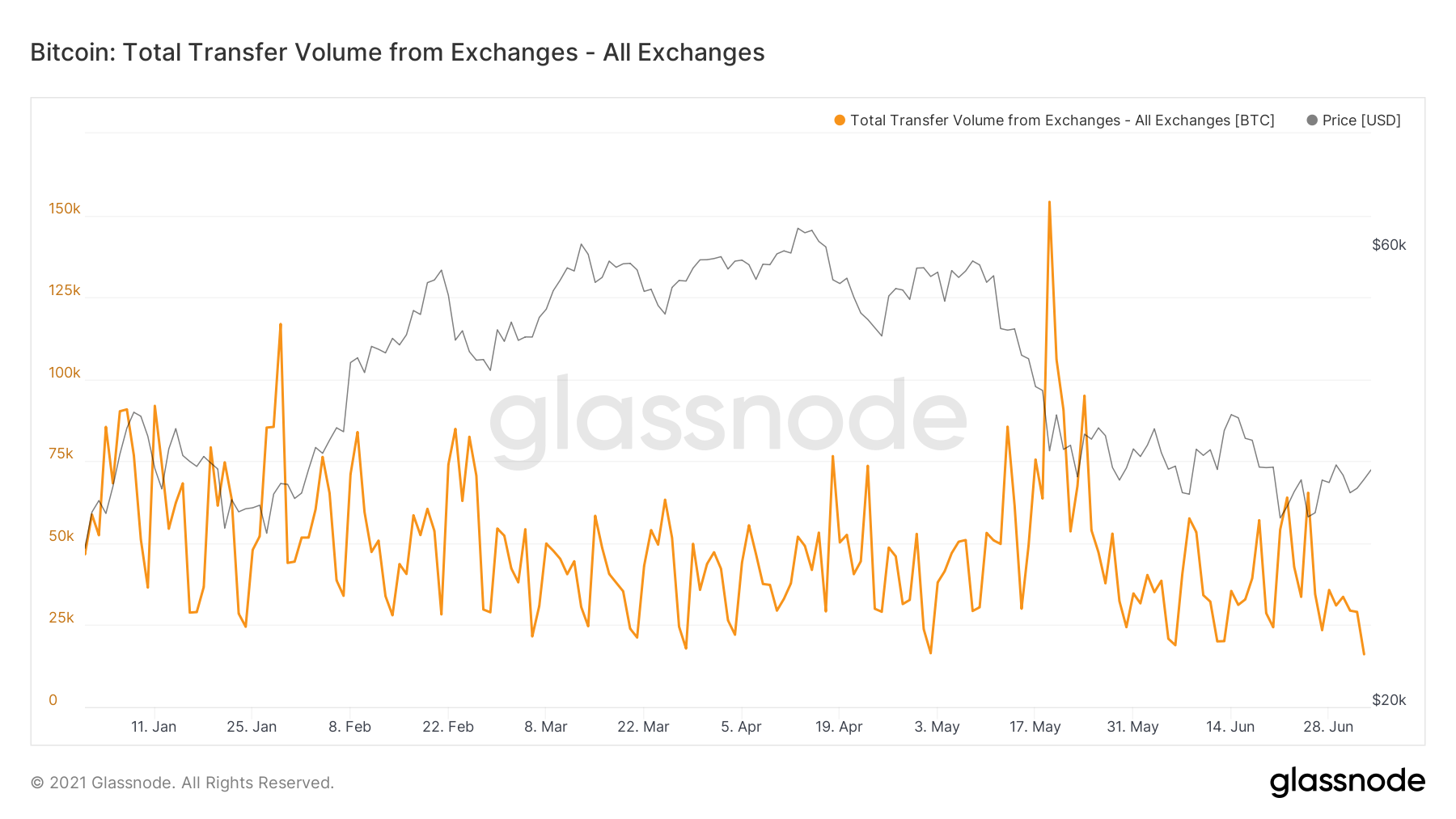

In a recent podcast hosted by Anthony Pompliano, Glassnode Analyst, Checkmate expressed his optimism about BTC’s price action. Bitcoin’s aforementioned range held out even after two large capitulations since May, both of which were over $3 billion in total net volume. Calling it the “capitulation for the ages”, Checkmate noted how these events in mid-May and late June were bigger than earlier capitulations.

Total Transfer Volume from Exchanges in 2021; Source: Glassnode

He further noted that almost no long-term holders spent during the second capitulation, whereas a disproportionate number of short-term holders did, post which the market bounced back up. With the great migration of hash power out of China, miners looked for avenues to liquidate their treasury. These liquidations were absorbed by strong hands, along with the supply spent by retail investors.

The analyst further pointed out that an influx of supply volume could further trigger accumulation by short-term holders as opposed to long-term ones. He said:

“The higher the price goes at a trillion-dollar market cap, you just need more dollars to come in and absorb that supply and we moved very quickly from 20k to 60k. And you just need an enormous amount of volume to come in… And we are now at this middle ground where we are waiting for the volume to step in, maybe they are the ones accumulating, maybe there’s a lot of buyers down below. We need to see that supply kick in, we are seeing a distribution by long-term holders, which is now actually reversing.”

The ramifications of long-term holding by whales were also highlighted by Checkmate, who mentioned that a supply squeeze was in order if the current trend of HODLing was followed. Using on-chain metrics, he pointed out that the total accumulation by HODLers was much higher than earlier years. He elaborated further,

“ What I’m seeing is the hallmarks of what we would otherwise call a bear market, which is long-term holders accumulating and not spending, but ultimately they are doing it for a much higher base. They are not doing it from 58% and then accumulating up to 70%. They are accumulating at 70% and if we get the same supply squeeze which occurs at 80%, it’s not gonna take that long for the supply squeeze to kick in.”

In conclusion, the Glassnode analyst said that while it was a good sign that multiple FUDs and crashes couldn’t result in a breach of the 32k support in almost two months, the ongoing re-accumulation phase will prevent a breakout from the ceiling in the near future.

“We have held the consolidation range despite multiple capitulations, so that tells me that people are accumulating at that range. Otherwise with a 50% drawdown and pretty much every piece of FUD you could come up with in the market… it’s gonna take something fairly dramatic in my view to really take out that flow… I don’t think that we at some point are just going to rally out of this consolidation range, I think time and patience are a big part of this.”

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)