What you need to know about XRP’s path to $2

When compared to the likes of Polkadot, Cardano and Ethereum, XRP’s utility has always been undermined. The token has, however, gained traction of late, thanks to its 56.4% weekly surge.

XRP’s several use cases

As of now, XRP is being used by a host of companies for various purposes. Ripple uses it for cross-border remittances, Coil for micro-payments, Blockchain Capital for capital calls, SB Projects for entertainment monetization and XRP Tip Boot for tips on platforms like Twitter and Reddit.

Additionally, banks and other financial institutions use XRP via RippleNet’s ODLs. The San-Francisco based blockchain company has, in fact, been tying up with new partners of late. Furthermore, when the on-going lawsuit against the SEC winds up, with more regulatory clarity, the number of partnerships will eventually rise. In retrospect, the same has the potential to warrant XRP’s valuation.

Interestingly, the Ripple network also supports the launch and sustenance of stablecoins and CBDCs. XRP’s aforementioned use-cases are somewhat lesser known.

By and large, the price of any given asset is the resultant of two key factors – its utility value and speculative value. As far as the utility aspect is concerned, XRP has considerably fared well, but what about its speculative value?

What do metrics say

The mean coin age of XRP stood at its ATH level (1001 days) at the time of writing. As such, this metric depicts the average number of days that all the XRP tokens have stayed in their current addresses. It witnessed a slight deviation during the beginning of August, but has been able to negate the same with its current uptrend. The rise in the average age points out the fact that most of the HODLers are accumulating XRP at this stage.

The coin’s dormancy also exhibited a similar trend. The Dormant Circulation, as a matter of fact, shows the number of unique tokens transacted on a given day that have not been moved for a fairly long duration of time. Now, as per the chart attached below, the 180-day dormant circulation did witness a massive spike during the end of July and the token’s price parallelly felt the pinch. The same, however, remained on the lower side since the beginning of August. This, by and large, supports the accumulation narrative again.

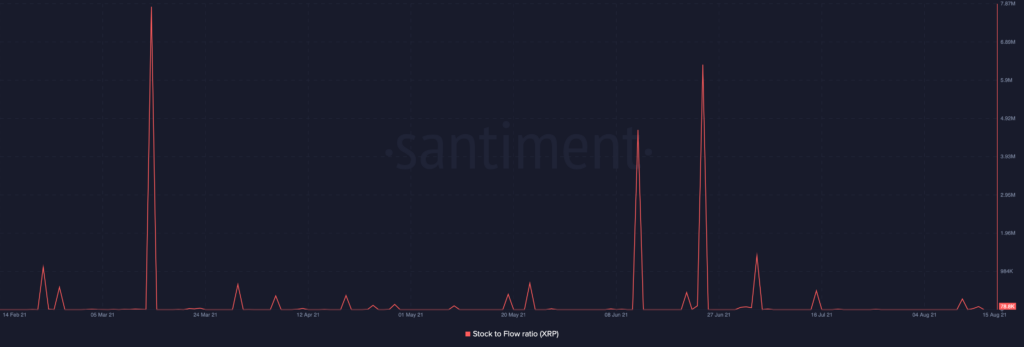

XRP’s stock-to-flow ratio, has however remained on the downside since June. The S2F model helps in deciphering how much supply enters the market every year, relative to its total supply. Ergo, higher the ratio, lesser is the supply that enters the market. However, looking at the current state of this indicator, it can be said that it would be quite challenging for XRP to retain its value over the long term.

Amidst the brouhaha over the recent price hike, it should be noted that XRP’s path from here to the $2 benchmark is not going to be that easy. The token has a host of resistance levels ($1.4, $1.65, $1.82) to break above, before its valuation actually inflates. XRP was notably trading at $1.25 at the time of writing.