What you should consider when looking at DeFi’s long-term, short-term prospects?

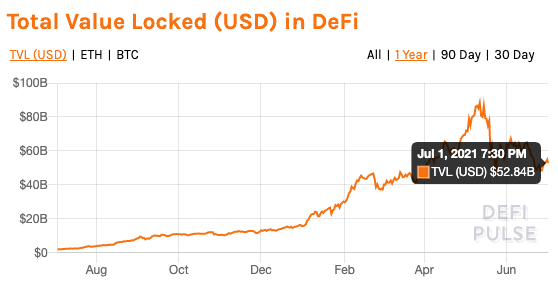

The Total Value Locked for DeFi has risen by over 50 times since last year, going up from $1.97 billion to $52.25 billion. What’s more, DeFi projects’ market capitalization has increased consistently too, hitting a peak of $88.4 Billion on 12 May 2021 before dropping to its present levels, as per data from DeFiPulse.

TVL of DeFi || Source: DeFiPulse

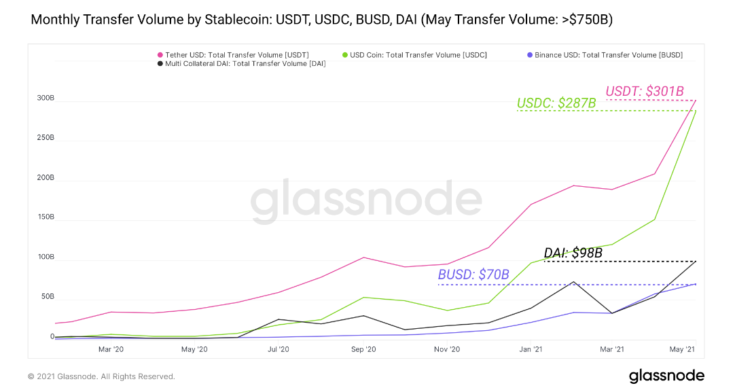

Curiously, rather than moving away from centralization, as is the goal of a decentralized finance ecosystem, DeFi is now relying on stablecoins more than ever. Stablecoins are pegged to the centralized finance economy through fiat currency reserves. In fact, DeFi has pegged over $100 billion in value to the USD. In May 2021, for instance, over $750 billion in value was transferred through USD Tether, USDC, DAI, and BUSD on-chain.

Monthly Transfer Volume by Stable coin || Source: Glassnode

If we take away this centralized element of DeFi, then it would be back to where it started. It would neither have lending markets nor a farming/ liquidity vehicle to begin with due to its higher dependence on stablecoins. Ergo, the removal of stablecoins from the DeFi ecosystem would be an existential threat to its lending, farming, and liquidity projects.

It is very likely that the future of DeFi might be quite different from where it is and how it stands right now. However, unless projects that rely heavily on farming and lending move away from stablecoin reliance and onto a treasury of assets varying from stablecoins to assets that abandon the peg to a fiat currency and codify monetary policy through a smart contract, a long-term drop in value might be inevitable.

This may have a negative impact on the portfolios of traders holding DeFi projects in their portfolios for the long-term. At the same time, it may be profitable for traders to look at DeFi projects that are experimenting with a newer monetary policy. One example of such a project is Olympus DAO’s OHM, which is in its early stages as of now.

So, would it be profitable to hold tokens of DeFi projects for the long term, or to invest in DeFi projects that offer incentives in exchange for liquidity mining, farming, and others? It may be profitable in the short term, but that narrative might change entirely over the next quarter of 2021.