What you should know about the impact of Ethereum’s scalability

On the back of a brief market crash on 18 June, Ethereum’s price was attempting to recover somewhat after trading around the $2200-level. This is the second time Ethereum has recovered from a significant drop in this range and it is important for the altcoin to remain steady above the psychologically important price level of $2000. Ethereum’s price chart and on-chain metrics signal that the altcoin is scaling. In fact, its market dominance was 17% at the said price level.

Now, many traders and analysts may argue that Ethereum hasn’t yet effectively scaled. This is set to change soon, however, when Arbitrum opens to users in a few weeks the scaling begins. StarkNet’s next big upgrade is currently in the testnet stage. Optimism launches in July 2021 and zkSync’s EVM-compatible zk roll-up will launch later in 2021. These updates are likely to change the current perception of analysts and the sentiment of traders about Ethereum.

Layer-2 scaling solutions like MATIC have increased in popularity and become mainstream. In addition to that, it is now likely that Ethereum’s scalability may drive the price rally for scaling solutions. For instance, after gaining institutional spotlight, Solana is likely to register an increase in trade volume. Though Solana creators claim ETH won’t scale to a billion users daily, L2 is likely to scale to billions of users, unlike L1. What’s more, roll-ups with off-chain data may be able to scale to 1 billion daily users in a single app.

MATIC’s on-chain activity can be a sign of the upcoming rally. The social dominance for MATIC, for instance, has risen by nearly 30%. This can be seen in response to the volatility and the increasing demand across exchanges. Since MATIC has lined up partnerships in several DeFi protocols, with projects that have relatively high investment inflows, the path to a price rally is clear.

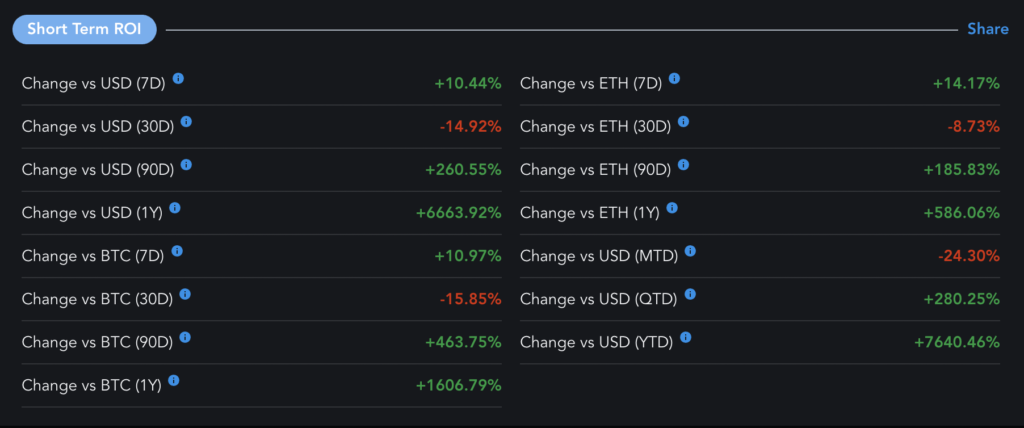

MATIC Short-term ROI | Source: Messari

Based on the attached chart, the ROI over the past year and the past 90 days has remained consistently high for L2 scaling solutions, Polygon [MATIC] in particular. In fact, the transaction volume and the market capitalization of MATIC are slowly falling out of correlation with ETH.

However, until the decoupling happens for real and for long, scaling of ETH is likely to drive a price rally in L2. With the launch of zk roll-ups, it is only expected that transactions will get faster, cheaper, and a higher volume of traders are likely to turn to L2 scaling solutions in an effort to save further costs.