What’s in store for Ethereum, XRP in 2021?

Bitcoin’s latest price rally has pushed the cryptocurrency’s value higher on the price charts, with BTC briefly climbing to $25,000 as well. However, while for a time the said rally was driven primarily by institutions, with Christmas over and the rest of the festive season coming up, one might expect institutions to leave the reins to retail traders.

This has happened in the past as well, on weekends, and despite a degree of institutionalization, the price has dropped when institutions haven’t traded as much.

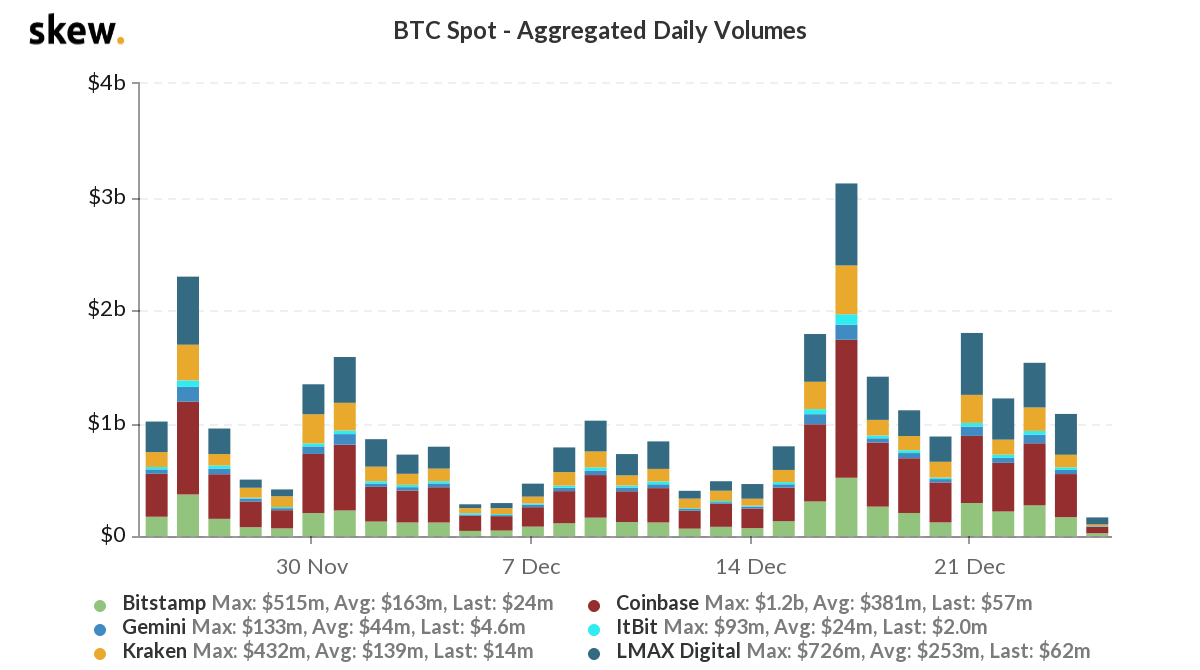

BTC Spot Daily Volumes || Source: Skew

At the time of writing, the spot exchange volume had already dropped below $2 billion on top exchanges, with there being a low likelihood of retail traders being able to sustain the price at the current level. However, based on exchange volume and OI in Bitcoin, most traders seemed to be looking at the current 2020 price rally with the 2017 outlook, and in that sense, an imminent correction could be due.

Simply put, while the crypto-asset is already in the price discovery range, the volatility and network momentum required for it isn’t on the charts currently.

However, accounting for the same sentiment and logic, XRP and Ethereum are trading at much lower levels. This poses a buying opportunity as the volatility in these markets is higher than Bitcoin‘s. Ergo, there is a bigger opportunity for Ethereum and XRP in 2021. Despite Bitcoin’s dominance and its price touching ATH levels in 2020, its volatility has not neared the 2017-level yet.

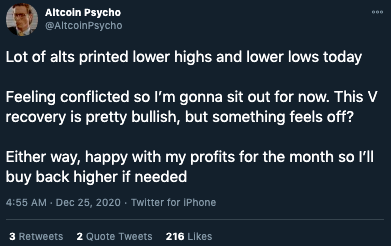

Source: Twitter

Popular on-chain analyst Joseph Young recently tweeted about the potential of DeFi projects versus the lackluster ICOs from 3 years ago. DeFi projects have hundreds of millions of dollars in weekly volume and their high real user activity has given a boost to the Ethereum ecosystem. Though Ethereum is already trading above the $600-level, increasing trade activity from the DeFi network increases the probability of price discovery beyond $600.

Source: Twitter

Though most altcoins have made a V recovery, the sentiment in most traders is neutral, according to crypto-Twitter. With XRP’s price down by 45% in 7 days, there is more ground to cover. The crypto-asset has recovered from slumps before and with heightened demand, it may be easier to recover the market capitalization it lost to Tether.

XRP was replaced by Tether as the cryptocurrency with the third-highest market capitalization, however, going into 2021, increased demand is likely to pump XRP’s market capitalization.

![Story [IP] price prediction - Traders, look out for this key divergence!](https://ambcrypto.com/wp-content/uploads/2025/06/Story-IP-Featured-400x240.webp)