When it comes to crypto products, Solana, Litecoin outshine Bitcoin, with better returns

Bitcoin has been toughing it out this month and the question now shifts to how its investment products are performing. Looking at the stats, it has become apparent, that where the king coin is lacking, Litecoin and Solana are gaining.

Solana takes over Bitcoin

While the month of November, in general, has been sending out mixed indicators, at present the market’s numbers are lower than they were at the beginning of this month. However, as the spot market was not quite fruitful, the digital asset-based investment products had a rather similar experience as well.

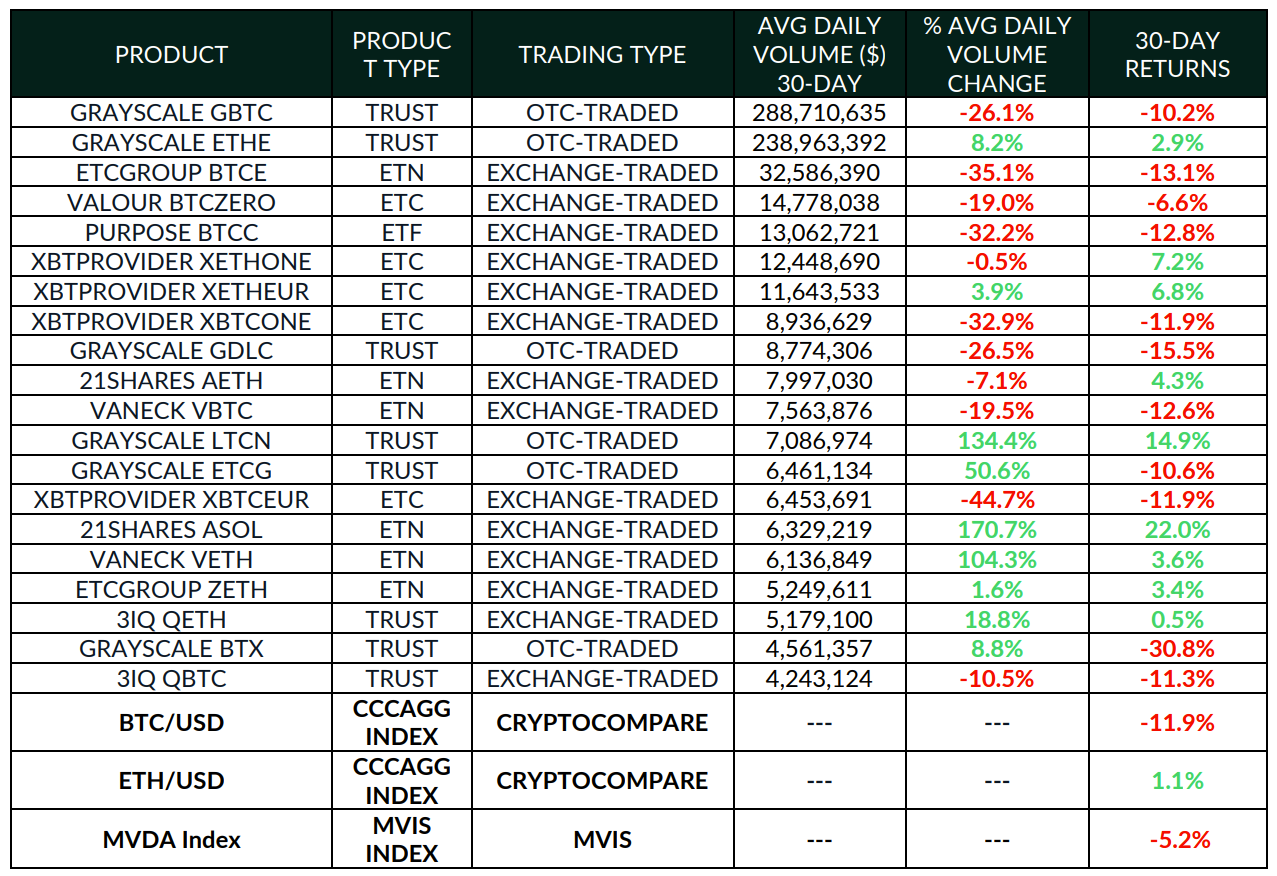

Bitcoin AUM (Assets Under Management) decreased by 9.5% this month which turned out to be the largest pullback since July. However, Litecoin based products (LTCN) came to be the better performer returning 14.9% even when GBTC suffered at -10.2% losing 12% market share in addition to it.

Litecoin was not the only one to rise. Even 21Share’s ASOL (Solana based product) managed to chart strong returns of 22%

Average returns | Source: CryptoCompare

LTCN and ASOL alone could not make up for the overall losses though. Even though this was the third month in a row when average weekly netflows were positive, inflows still registered a 56.2% decrease.

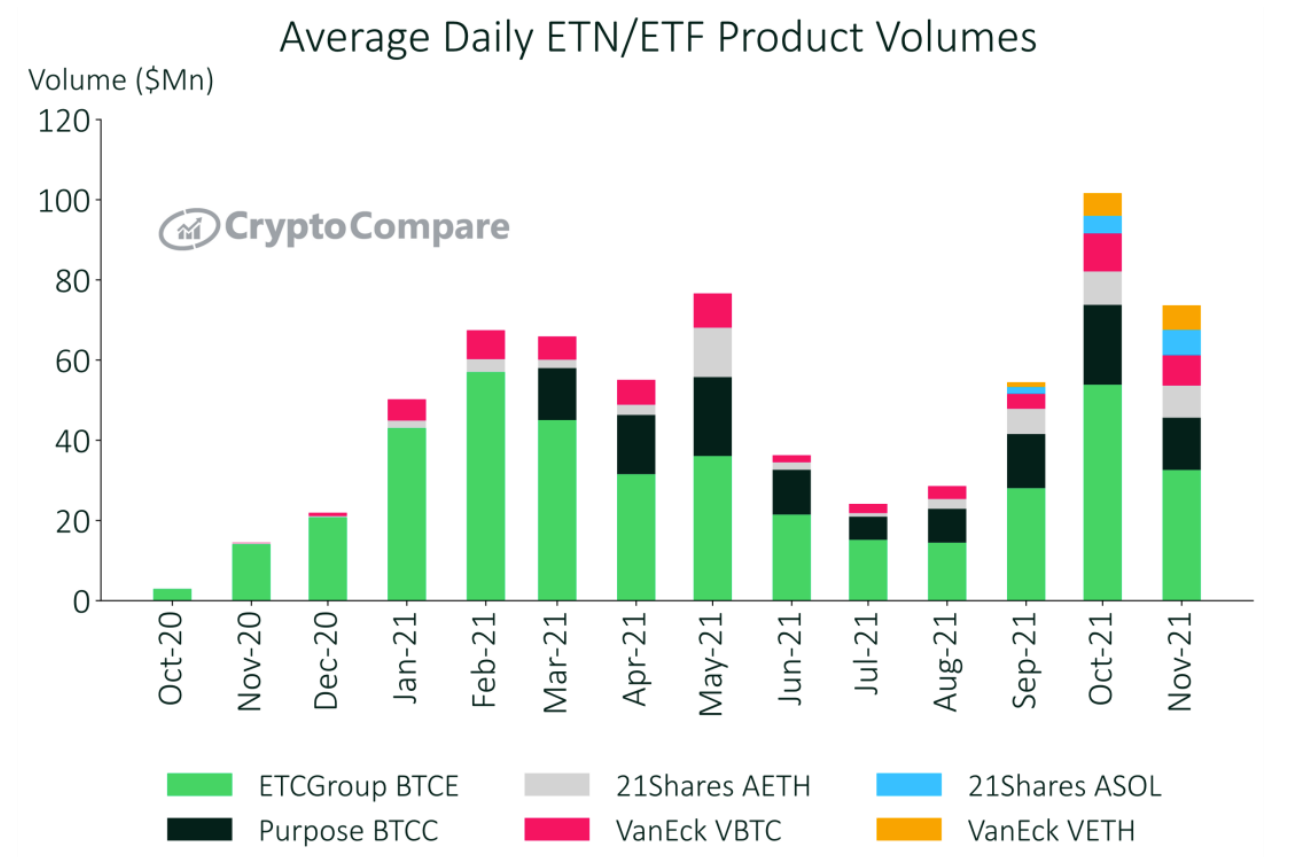

Further, daily volumes across ETFs and ETNs too fell sharply led by BTCE tumbling by 35.1% followed by the Purpose ETF (BTCC) falling by 32.2%.

ASOL turned out to be the only product that managed to make any gains as the Solana product’s volume exploded by 171% reaching $6.3 million.

Average daily volumes | Source: CryptoCompare

As November comes to an end, even the highest gainers of the month are dropping, in terms of price, led by LTCN which is down by 20.44% in just the last 3 days. It currently stands only 9.92% away from invalidating the 45.9% growth of the month.

The case is similar for BTCC which has dropped by 14.44%, GBTC took a hit of 14.02% as well, and ASOL which is also down by 12.45%

In the past, for many assets, the end-of-year performance has proved to be a head start going into the next year. The performance of these products in the month of December will play a crucial role in setting the tone for ETFs, ETPs and ETNs in 2022.