Where is Crypto.com Coin headed and what it needs to reclaim its now past glory

Crypto.com Coin (CRO), currently the 16th largest coin by market cap rose to fame in November as its price noted an over 350% spike within a month. The coin’s price rose alongside its popularity as an unconventionally hyped-up marketing campaign aided the coin’s run uphill.

In the last quarter of 2021, Crypto.com had announced back-to-back deals with a host of football clubs and also secured the naming rights to LA Lakers’ Staples Centre in a $700 million deal. This aggressive marketing strategy alongside decent retail euphoria and Coinbase’s announcement to list CRO on its exchange due to the rising demand all fueled the massive rally.

After the notable rally and a new ATH of $0.96 in the last week of November, general interest, and confidence around the coin started waning and the same could be seen in CRO’s declining trade volumes. In fact, the coin lost around 44% price from its ATH, after the early December flash crash.

At the time of writing, for the last 40 days, CRO’s price was in a larger downtrend so what’s the way forward?

The way ahead

The altcoin’s market cap dominance even though lower than the ATH levels, still held better compared to the over 35% price losses. Further, the circulating market cap held at $14.32 billion almost 35% down from the ATH levels of $22 billion.

However, with new developments taking place in the space such as Crypto.com becoming a Gold Member of the Singapore Blockchain Innovation Program the possibility of higher social attention and a subsequent recovery can’t be discarded.

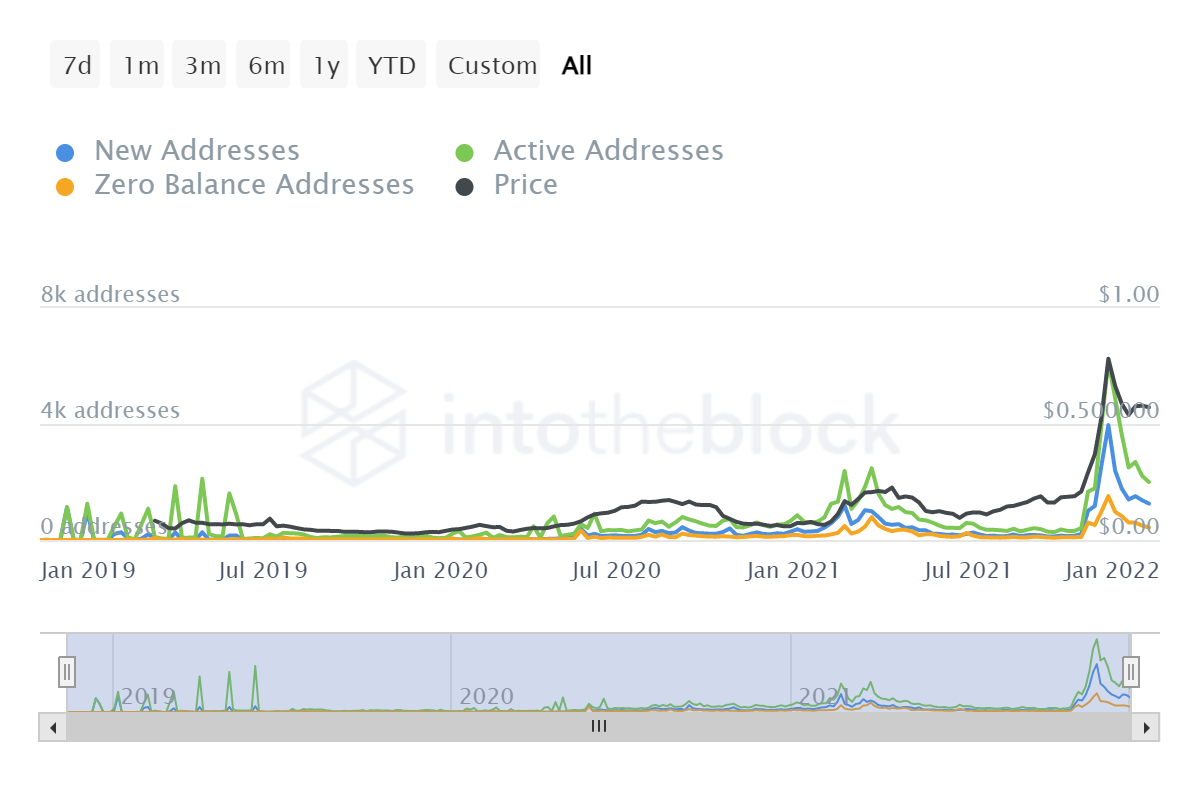

Further, the Cronos testnet had recently completed 15 million transactions in its incentivized testnet event, Cassini. In terms of vibrancy, however, the once active network now had much lower users as the 7-day active address count had fallen by 26.85%. The new addresses count had dropped by 23.72% presenting a much less active network.

What’s needed?

Looking at the In and Out of Money for CRO it could be noted that achieving the average price level of $0.658 would be crucial to ease sell-side pressure if the coin’s price starts to recover to the aforementioned price level. Over 15K addresses with a total volume of 3.18 billion CRO would be in profit after price breaks this level.

Notably, the institutional and retail interest in the altcoin has gone down. The same can be said looking at the larger transaction volumes and large transaction numbers which have gone down over the last weeks.

The coin would need a push from the retail and institutional crowd for a rally in the near term. However, with the coin’s Sharpe ratio recovering, a flipping of the same in the positive territory could mark a recovery for the coin making it a good investment in the mid-term.

For now, with the network looking dull the coin would need some support from the retail side to trigger a price action in the right direction.