Why ApeCoin, BAYC, MAYC fell behind Bitcoin NFTs in Q4 2023

- ApeCoin reported a positive Q4, but the price of APE declined.

- Interest in Yuga Labs NFTs fell as Bitcoin-based NFTs gained popularity.

The NFT sector grew increasingly competitive over the last few months. With new entrants entering the market, interest in blue chip collections from Yuga Labs slowly waned.

ApeCoin reports a positive Q4

However, ApeCoin [APE] DAO’s recent quarterly report showed that things were going relatively well. As of the 31st of December 2023, the treasury held 348 million APE.

Meanwhile, the DAO spent 1.3 million $APE on operations and distributed 20.5 million $APE in grants.

The report emphasized the DAO’s commitment to transparency by detailing grant allocations, including continued funding for 20 previously approved initiatives and the community’s acceptance of five new grants.

Not as good as Bitcoin

Even though ApeCoin’s Q4 report paints a positive picture, things could be impacted by the overall sentiment around Yuga Labs.

Because APE is a Yuga Labs token, it is highly correlated to the NFTs in the Yuga Labs cohort. The progress of NFT collections such as BAYC and MAYC contributed significantly to the overall growth of the APE token.

Even though sales volumes for both BAYC and MAYC were high, they weren’t comparable to other NFT collections.

AMBCryptos’s analysis of CryptoSlam’s data revealed that BAYC had lost the top spot to Bitcoin [BTC]-based NFT collections.

Collections such as Crypto Punks and Mad Lads were also seen entering the top NFT collection category, however, MAYC was nowhere to be found.

How is APE doing?

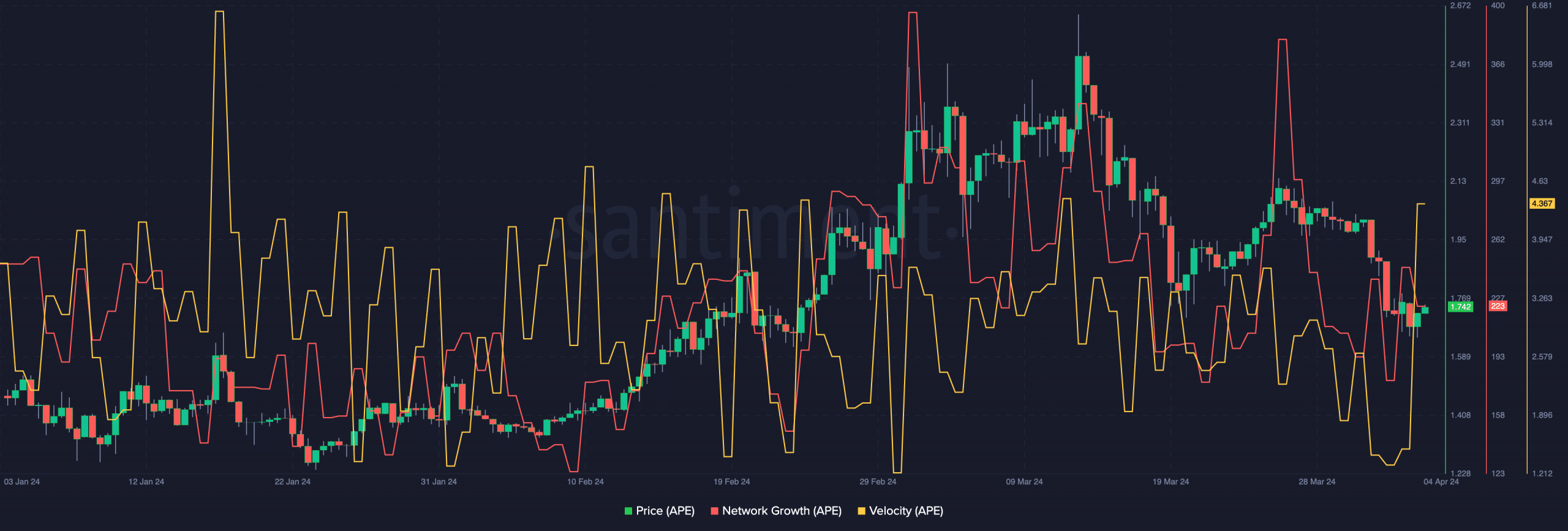

Coming to the state of APE, it was seen that the price had declined materially over the last few days. At press time, APE was trading at $1.742 after testing the $2.49 level in the last few days.

The network growth for APE also fell over the last few days. The falling Network Growth indicated that new addresses were slowly losing interest in APE.

However, the velocity of APE surged, implying the frequency at which APE was trading at had grown.

Read ApeCoin’s [APE] Price Prediction 2023-2024

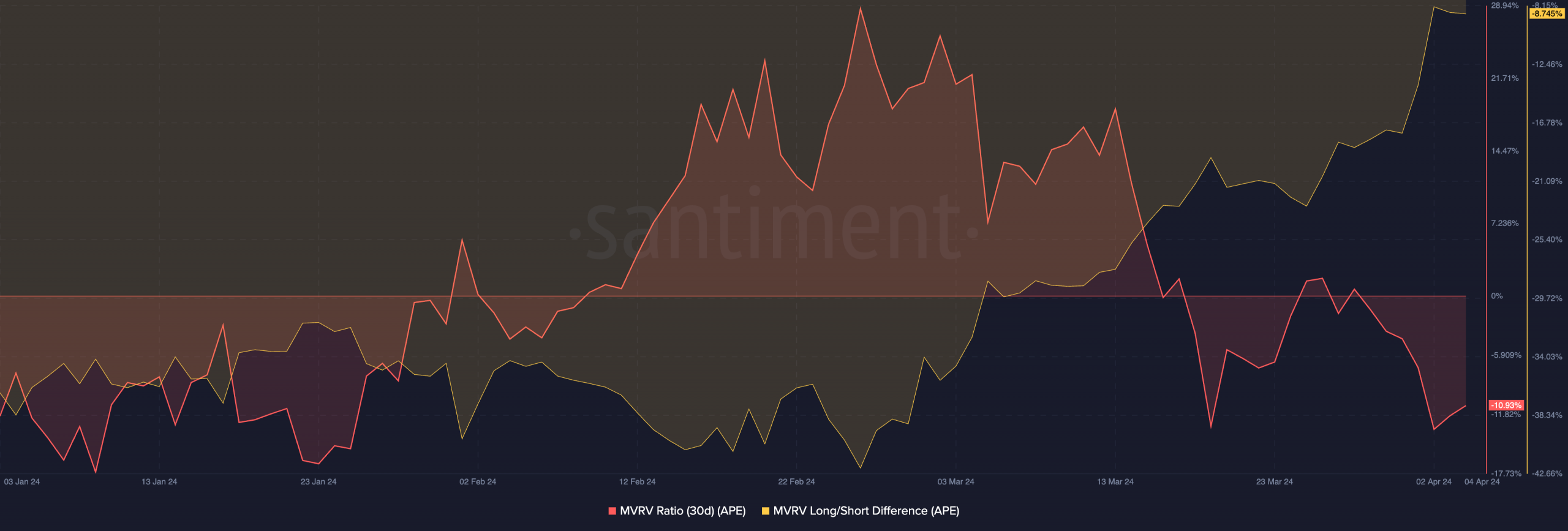

In terms of MVRV ratio, there was a large decline observed, indicating that most holders were not profitable. Additionally, the Long/Short difference grew, indicating that long-term holders exceeded short-term holders.

This meant that due to the price correction, all short-term holders had sold their holdings. Long term HODLers are less likely to sell their holdings and react to market fluctuations.