Why Bitcoin and DeFi are ‘some way on everyone’s to-do list’

More institutional investors turned to Bitcoin, altcoins, and DeFi as additions to their portfolios over the past year due to the rising inflation concerns regarding the Dollar.

In a recent podcast, Bitwise CEO Hunter Horsley highlighted the reasons why more financial advisors were recommending crypto investments.

The recently obvious uncertainty of traditional pools of liquidity like fixed income, bonds, cash, stock market, real estate, and equities was one of the main reasons highlighted by Horsley. Just last year, the Bank of America Securities came out with a report that stated traditional wisdom of investing 60% of your portfolio in stocks and 40% in bonds is dead. This led to investors looking for other potential sources of liquid investment. Horsley said:

“People thought maybe I should do something I didn’t do before or maybe I should be considering an approach with some adjustments and they look at crypto and say wow, here is something that is uncollated, that’s liquid, that a lot of smart people are doing, and it’s only a 1-2% allocation I have to make.”

This is another point repeatedly highlighted by the CEO. Rather than having to allocate 20-40% of their portfolios to crypto investments, it is only a 1-10% allocation that most investors make.

In early 2021, the global market for stocks was $95 trillion and for bonds it was $105 trillion, as opposed to the $1 trillion value of the global cryptocurrency market, representing just about 0.50% of the global market portfolio. Hence, it doesn’t seem like much of a gamble if it provides comparatively high yields. Bitcoin did increase its yearly ROI by 301.46% in 2020, as opposed to 83.83% in the previous year.

“It is in some way on everyone’s to-do list”

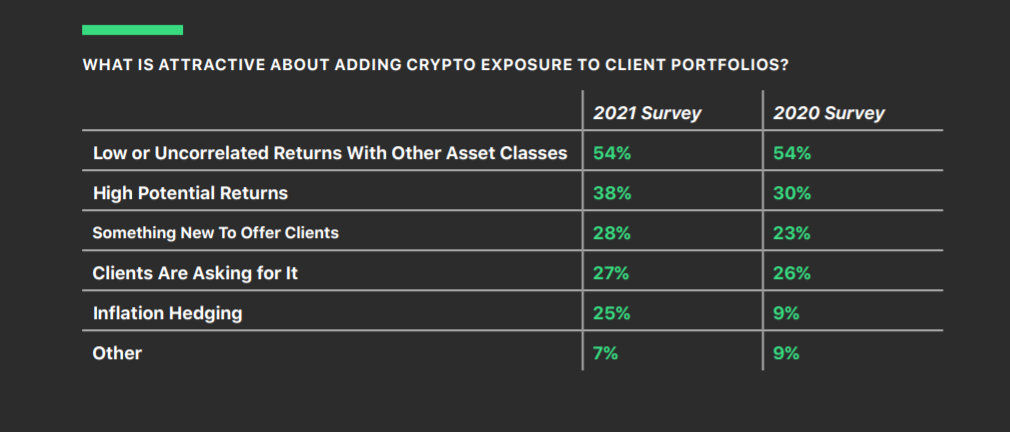

Horsley outlined the various reasons why financial advisors are increasingly looking at crypto as an investment asset class. The above chart shows the yearly survey conducted by bitwise on the emergence of this new asset class. It can be observed that there was an 8% increase over the past year in the belief amongst advisors that crypto has very high potential results. Similarly, a 16% increase can be noticed in the belief that it is a hedge against inflation.

In February, Bitwise launched the first DeFi crypto index fund with other asset managers following suit. Although the fund’s returns have reduced by 44% since its inception, it still was the fastest grower at the time, raising $32.5M in 2 weeks. Horsley added:

“With Bitcoin, you know many of the hangups that many investors have. It doesn’t have cash flows, doesn’t have yield, demonstration of use case is somewhat limited. Gold is not the most popular thing for bitcoin to be, and it’s a digital version of that.”

However, the interest in DeFi is mainly due to the similarities in understanding between DeFi and traditional finance as opposed to the complications of understanding blockchain. Horsley stated:

“Defi is taking the disruptive blockchain technology, it has use cases, and offers financial services like brokerage, loans, trading. It has traction. Some of these exchanges have more volume than the Winklevoss exchange and they have more capital. Investors understand it so it is intuitive to them.”

The total value locked in Ethereum-based DeFi platforms was sitting at $47.65 billion, according to DeFi Pulse. This is a little lower than the numbers noted in March, however, they are still significant when looking at the total 1.5 trillion global crypto market cap. Horsley added:

“If you just showed up and said in 2015 what’s interesting to invest in, the set of things you could invest in are totally different from what it is today and the rate at which new things are emerging is proliferating, and its one of the reasons why space is getting bigger and bigger because it’s just not relying on only bitcoin to solve all of the world’s problems.”