Why Bitcoin’s rally is so crucial for investment flows into Ethereum

The effects of Elon Musk’s tweets and Twitter bio update have been felt throughout the Bitcoin community, with the crypto’s price responding to the same in the last 72 hours. In fact, in a 24-hour period alone, Bitcoin’s price hiked by over 18 percent, a hike fueled by Musk’s tweets and institutional demand.

In response to the same, Bitcoin recorded over 1.25 million active addresses and $95.83 billion worth of Bitcoin transacted on-chain. Now, the critical question is – Was there any spillover into Ethereum?

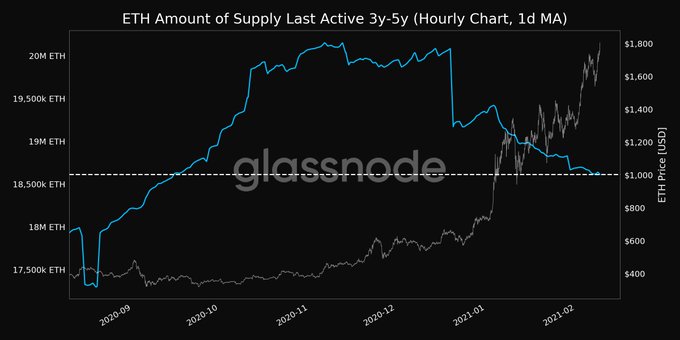

Ethereum’s price rose by over 5 percent over the same timespan. What does this entail? Well, this suggests there was some spillover, with investment flows moving into Ethereum from Bitcoin. Further, in the context of the current Bitcoin rally, it is also worth mentioning that Ethereum’s active supply has continued to drop. In fact, the Amount of Supply Last Active 3y-5y (1d MA) fell to a 4-month low of 18.6 million ETH, based on data from Glassnode.

ETH Active Supply || Source: Glassnode

Though the active supply has been dropping for some time now, why does it signal a change this time around? Well, because investment flows are a critical component for an increase in volatility, trade volume, and the price of Ethereum, with the dropping active supply and shortage of supply narrative critical to Ethereum’s price rally.

The hike in institutional investment flows from Bitcoin traders and from the CME ETH Futures launch has given a boost to the trade volume and demand on exchanges. Additionally, just hours ago, the ETH mean fees paid hit an ATH of $19.95. It is metrics like these that indicate that Ethereum’s price is moving towards its next high after hitting the ATH of $1815.96.

Now, there is also the likelihood that resistance in crossing the ATH may contribute to Ethereum’s price being rangebound like Bitcoin. However, while the correlation between the two assets has dropped since the beginning of 2020, the narratives for both are nearly the same. Ethereum’s ATH came on the heels of Bitcoin recording its own ATH. If Bitcoin’s price continues to rally, investment flows may continue into Ethereum, and with the interest in Ethereum Futures on CME, it is likely that the top altcoin may hit a new ATH all over again.