Why BNB’s bearish stance could last longer than anticipated

- BNB topped the list of cryptos in terms of LunarCrush’s Galaxy Score

- Positive sentiments around the coin spiked, but other metrics remained bearish

While bearish sentiment dominated the crypto market, BNB Chain [BNB] suffered more than the others. Santiment’s recent tweet pointed out that BNB was down -15% since 4 June, and social dominance surged as the asset has become quite polarizing. When BNB’s price declined, its trading volume reached a five-week high.

? #BinanceCoin has been hammered compared to the rest of the markets these past couple days. Now -15% since Sunday, social dominance has surged as the asset has become quite polarizing. $BNB trading volume is at 5-week high levels as well. https://t.co/E7sU59lkRe pic.twitter.com/FL0Er5vmQa

— Santiment (@santimentfeed) June 7, 2023

Is your portfolio green? Check the BNB Profit Calculator

BNB refrains to turn green

The declining trend continued at press time. According to CoinMarketCap, BNB’s price had declined by nearly 4% in the last 24 hours. It was accompanied by a 27% increase in trading volume.

At the time of writing, it was trading at $262.64 with a market capitalization of over $40 billion. A possible reason behind this negative price action could be the Securities and Exchange Commission (SEC) episode. The SEC accused Binance and its founder, Changpeng Zhao, of misusing user funds worth billions of dollars.

Wait! There come the bulls..!

LunarCrush’s latest data pointed out a metric that typically suggests a price uptrend. CryptoDiffer’s tweet mentioned that BNB topped the list of cryptos in terms of Galaxy Score. Therefore, there were possibilities for BNB to register price gains in the coming days.

TOP 15 coins by @LunarCRUSH Galaxy Score

Galaxy Score is a proprietary score that is constantly measuring crypto against itself with respect to the community metrics pulled in from across the web#BNB $BNB $CRO $RNDR $SHIB $SIDUS $ORN #BABYDOGE $ATOM $FLOW #BTC $BTC $OCEAN… pic.twitter.com/Mft3LTB67W

— ?? CryptoDiffer – StandWithUkraine ?? (@CryptoDiffer) June 7, 2023

BNB’s Relative Strength Index (RSI) went up slightly from the oversold zone, which could be considered as a positive signal. Additionally, its Chaikin Money Flow (CMF) also followed the same trend and increased slightly. However, the Moving Average Convergence Divergence (MACD) indicator favored the bears. BNB’s Exponential Moving Average (EMA) Ribbon also displayed a clear bearish advantage in the market.

It’s all in the air…

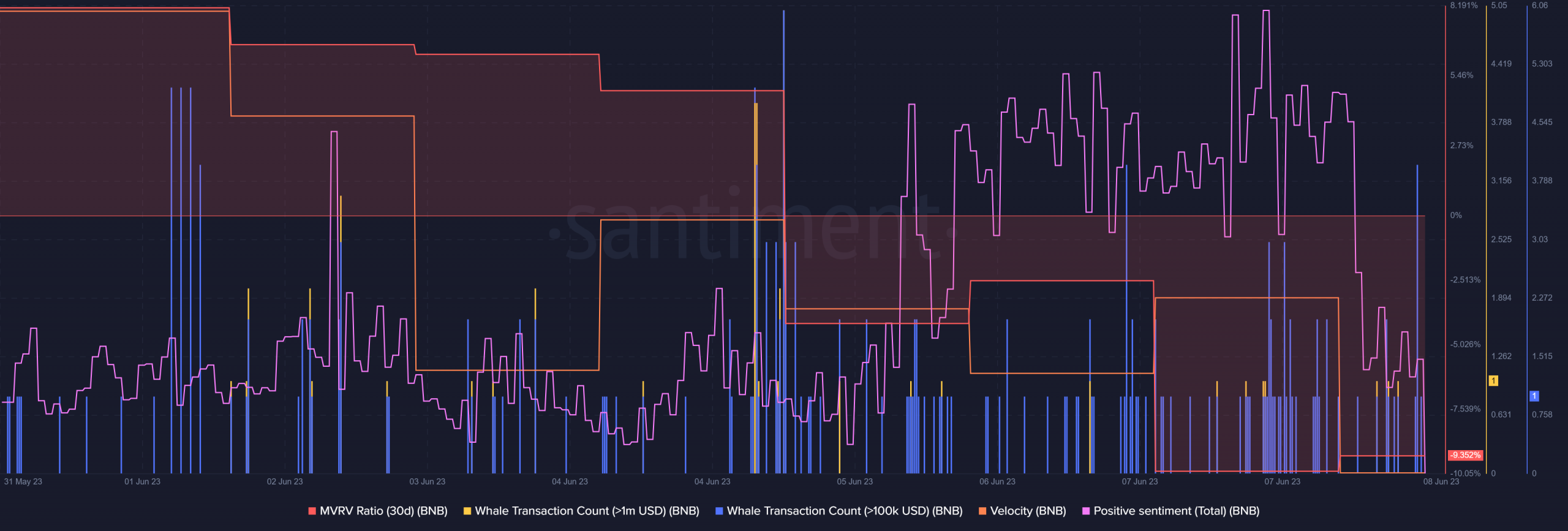

It was interesting to note that despite the massive price drop, positive sentiment around BNB surged over the last few days. However, its Market Value Realized Value (MVRV) Ratio was considerably down, which was bearish.

Whale interest in BNB also declined, as evident from the number of whale transactions. The coin’s velocity registered a decline, meaning BNB was used in transactions less often within a set time frame.

Read BNB’s Price Prediction 2023-24

To add to the bearish sentiment, CoinGlass’ chart gave more reasons to be concerned. As per the data, BNB’s open interest gained upward momentum.

Increasing open interest represents new or additional money coming into the market. Therefore, an increase in open interest implies that the current market trend might not change anytime soon.