Why Chainlink investors need to know this before rage-selling

Over the past few months, the hype around several altcoins has taken a new direction. Polygon and Solana, for instance, have retained high levels of traffic while Cardano has emerged as a major altcoin in recent months. Chainlink had a similar story in 2020, but over the course of 2021, the asset has become more like a journeyman.

There have been fewer individual spikes and at press time, LINK was still consolidating under $20 – Its 2020 high. However, there is more to Chainlink than its price structure. And, this may have a greater impact on the alt’s market performance going forward.

Oracles and Smart Contracts?

The main objective of Oracles stems down to generating strong security measures for a blockchain. In light of the emergence of smart contracts, it is a major issue because the vast external data required to maintain connectivity is extremely rigid. Therefore, the addition of an oracle fetches data from off-chain sources. It then delivers it onto a blockchain so that the information can be consumed by smart contract applications.

Now, a centralized oracle is another presumable point of failure since it can be corrupted or go offline. Hence, the oracle mechanism has to be decentralized to ensure network security. What’s more, Chainlink offers the best oracle solution in the ecosystem.

The industry currently facilitates over 450+ Chainlink Price Feeds operating across a number of blockchain networks including Ethereum, Polygon, BSC, Avalanche, xDai, and Heco, with plans to expand access to many more blockchains and layer 2 solutions such as Arbitrum, Optimism, Solana, and beyond.

Hence, going forward, Chainlink’s oracle services will have a huge impact since the entire DeFi space is based on hybrid smart contracts. The interest in DeFi will indirectly improve the necessary need for oracles across different networks. This will eventually allow LINK’s price to scale from a point of functionality as well.

How is network development holding up?

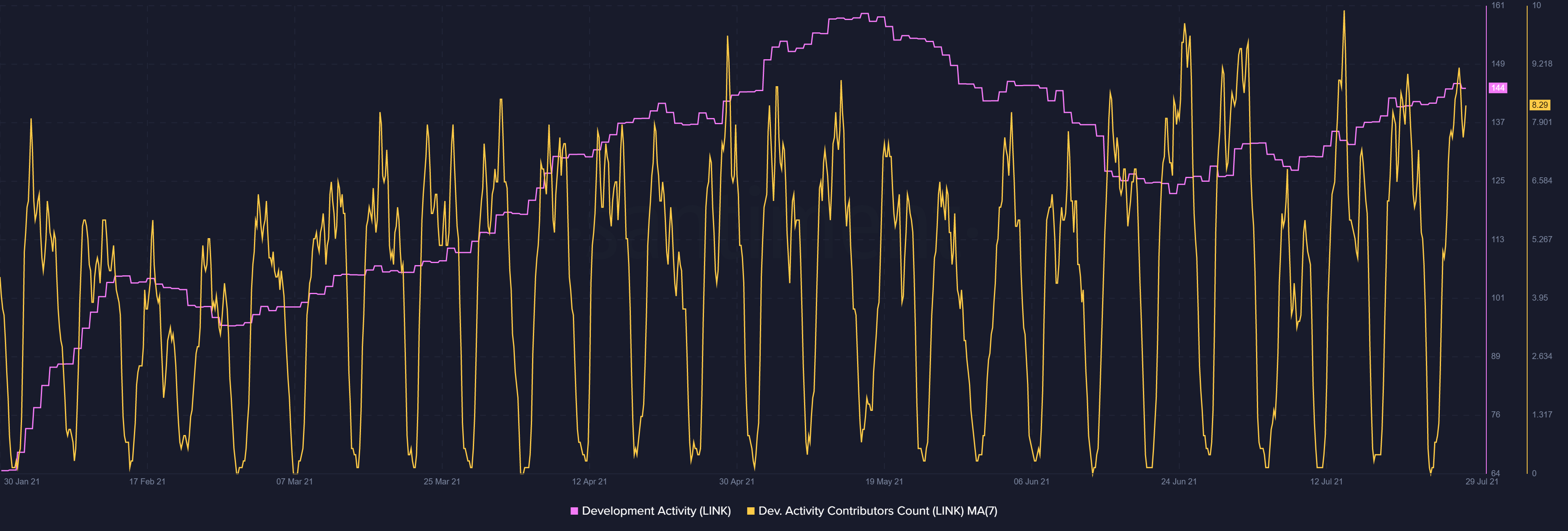

With respect to development activity, Chainlink has consistently facilitated a higher activity rate. Github repositories have been significantly higher than 1000 for the ecosystem and development contributors’ count has maintained a strong level as well.

Now, here it is important to note that dev. activity does not always correlate with active price performance. However, it does allow necessary clarity on whether a project is obsolete or not.

But, what about Chainlink right now?

It is a difficult narrative to draw out in the short term since the trend is still under a bearish cloak. If the trend turns to lean bullish again, more DeFi projects might register greater traffic and the requirement for Oracles might escalate even further.