Why did Bitcoin and Ethereum’s price drop so quickly?

The cryptocurrency market has been called unpredictable due to its high volatility. So when the market saw the price drop over the past couple of days, traders were quick to pin the blame on the old news of ‘China banning Bitcoin’. This narrative, which was played out in 2017, somehow made its way back again. This time around, China may not be the reason for the current descent of digital assets across the price charts.

Market analysts have had the time to examine the circumstances leading up to the crash and the signs were present all along. With the balances on exchanges rising, there was a significant rise in nervousness too. According to Ryan Allis, whales started to move large chunks of Ethereum and Bitcoin on exchanges to sell on 20 May. In his recent post, Allis noted that at around 12:40 am UTC 500,095 ETH [worth $1.65 billion, at the time] was moved. At this time, ETH was valued at $3.4k but crashed to $3,009 within six hours.

Whales did not stop there and pushed 13,555 Bitcoin [worth ~$39k, at the time] onto exchanges to sell at 6:30 am UTC. Following which the BTC price dropped to $37,976 and impacted the ETH market to slip to $2,651 within five hours.

This was also due to the participation of European and US traders who had woken up to Bitcoin at crucial support at $38k, while ETH was hanging on to $2.5k. As the assets lost support at these levels, the price crumbled, triggering massive liquidations.

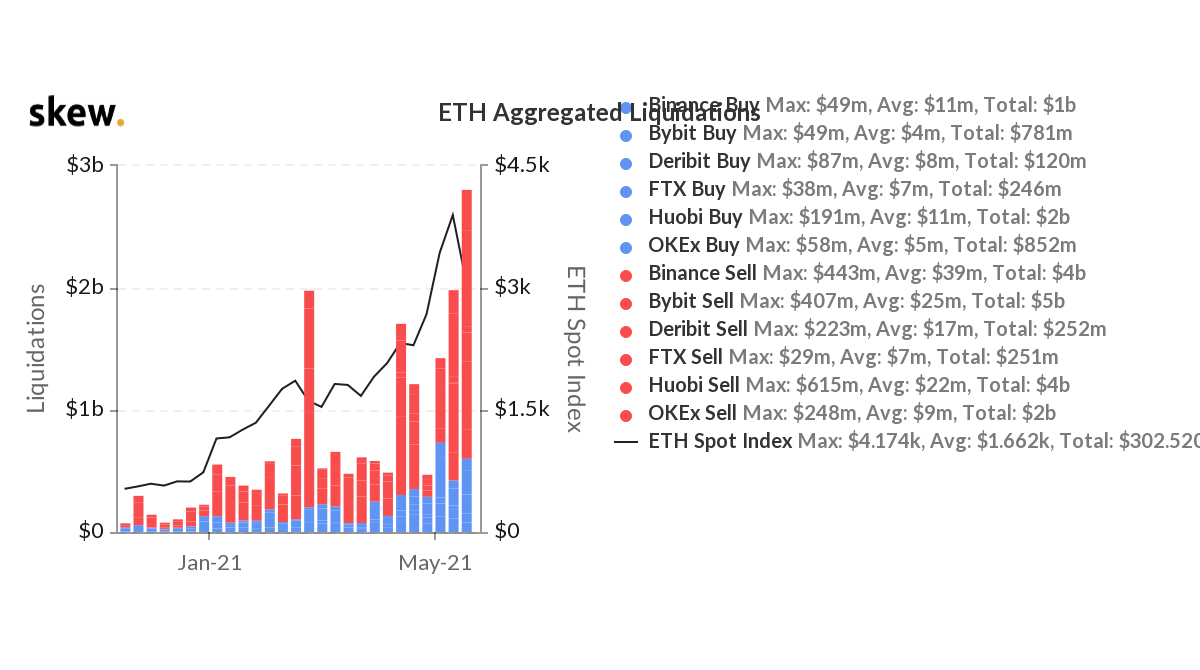

These were among the largest liquidations witnessed by Bitcoin and Ethereum. In fact, this was Ethereum’s worst day of trading. The chart below showed that the longest hourly candle showed liquidation of $2 billion, which was mainly dominated by the ‘sell liquidations.’

Source: Skew

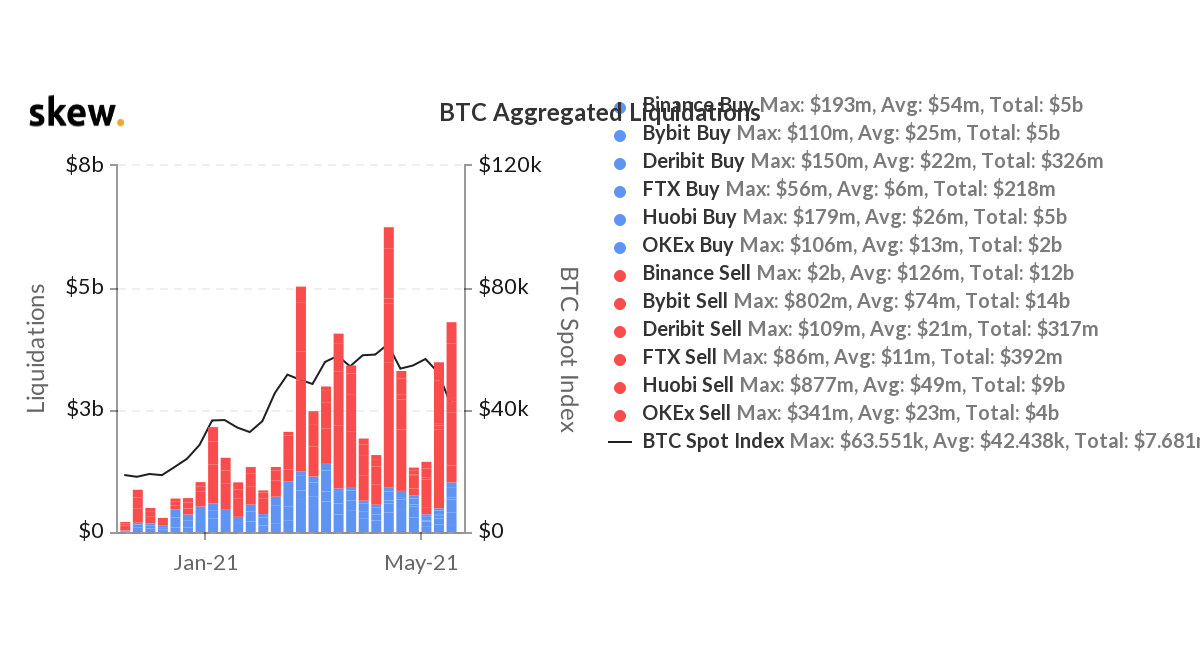

On the day of the recent crash, the Bitcoin market saw liquidations worth $3 billion.

Source: Skew

While the two major cryptocurrencies were losing their foothold at strong supports, decentralized finance was holding strong. DeFi tokens like COMP and AAVE experienced the ripple effect of Bitcoin’s price falling, but they were quick to recover. The entire DeFi market has withstood the strong volatility.

What to expect?

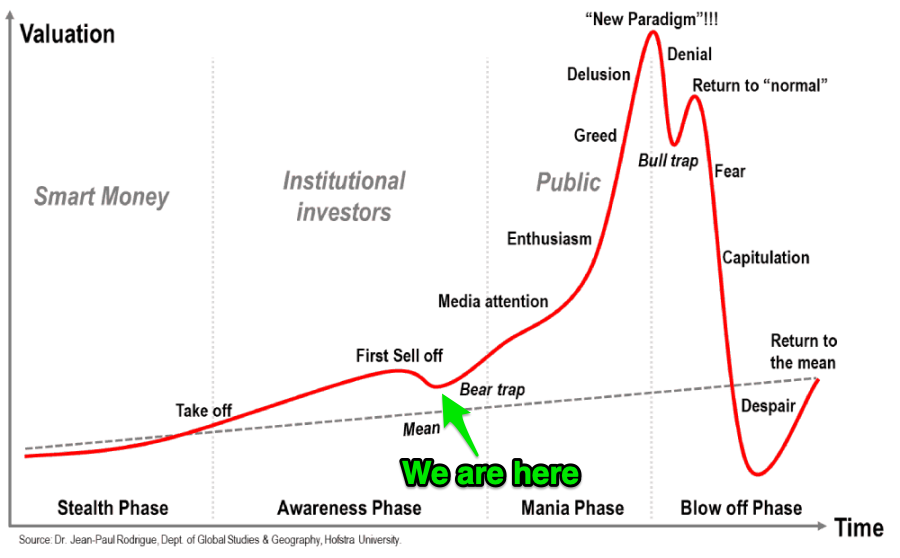

As we move further into the bearish realm, it will be good to consider this trend as a momentary one. Many analysts believed that falls such as these have occurred before and the market has managed to recover from it.

As per Allis’ analysis, Bitcoin could see a new all-time high by July/August, while Ethereum could be seen peaking by late June.

Source: CoinStack