Why Ethereum miners are making more than Bitcoin miners

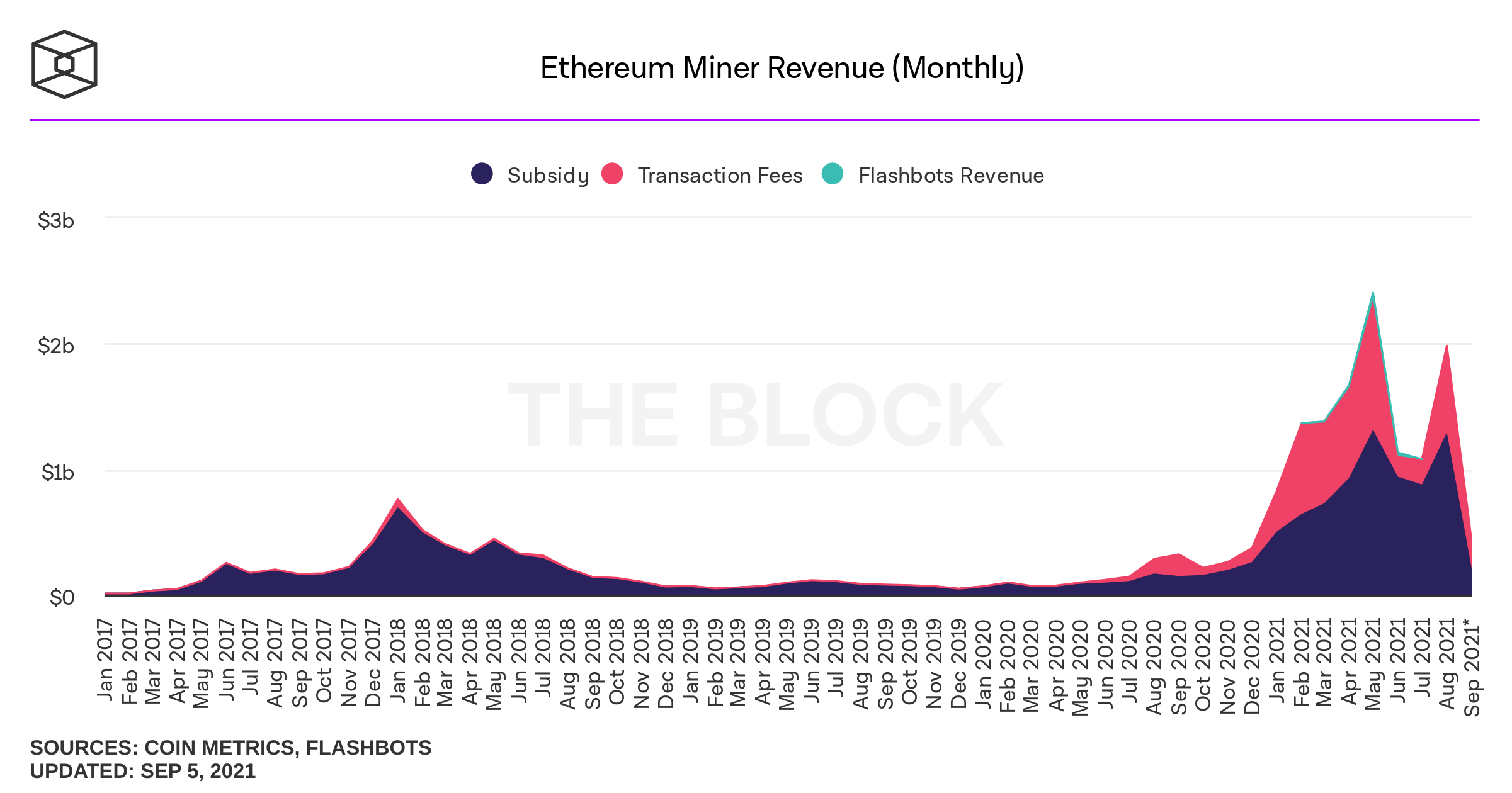

After the China’s ban on mining, other countries around the world opened up avenues for mining activities which are now picking up again. Now, in terms of mining revenue, BTC miners generally dominate the front. However, as per CoinShares Research, the trend has seemingly reversed in the last three months. As a result, ETH miners maintained a lead over BTC miners in gross revenue, of late.

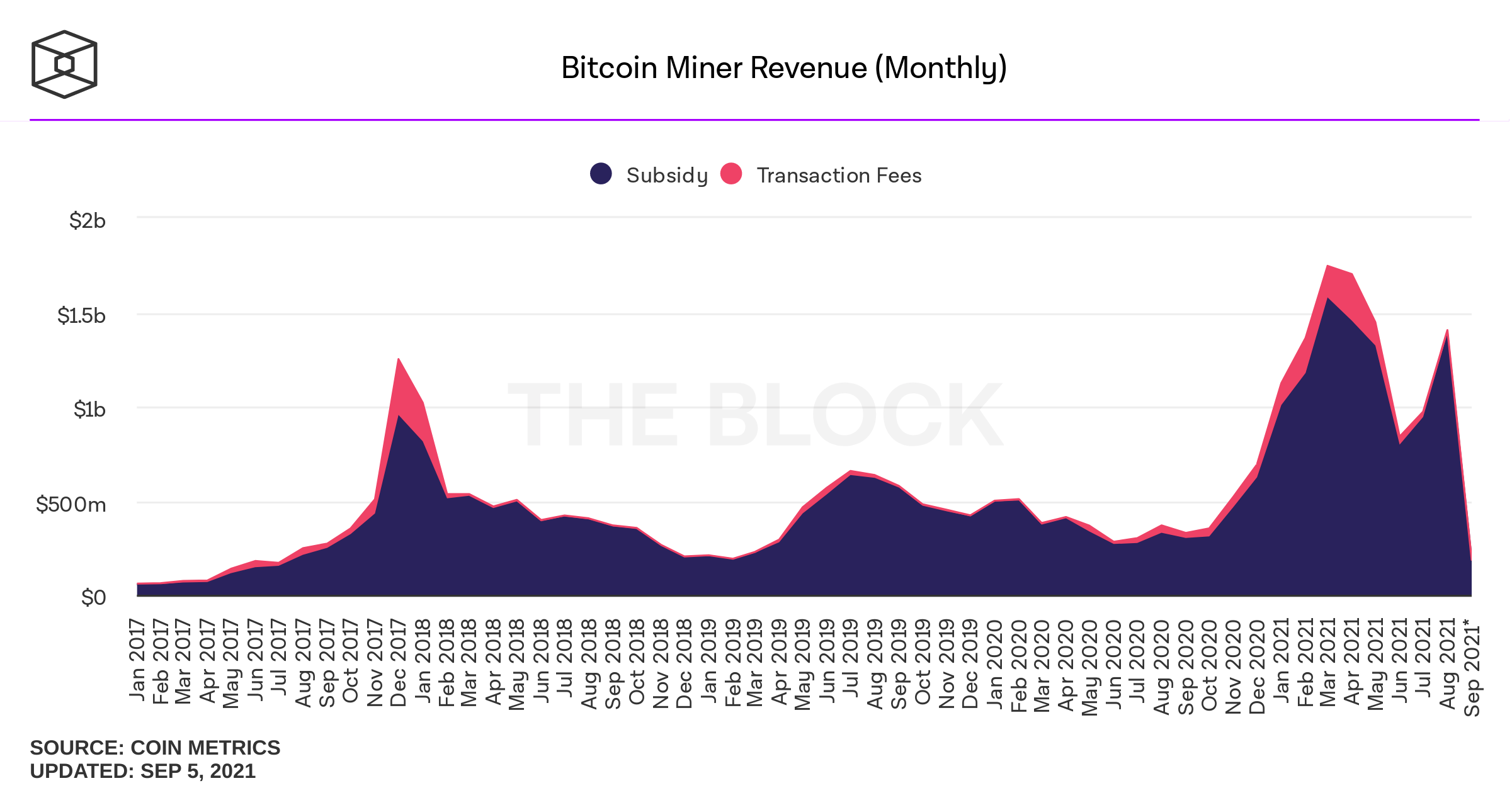

August data showed that ETH miners earned $1.98 billion in revenue while BTC miners made $1.4 billion. Both, transaction fees and block rewards constitute mining revenue along with the price of the asset at that point. And ETH miners made over $690 million in transaction fees against $18.72 million made by Bitcoin miners in August.

BTC miners seem to make a large part of their revenue from mining rewards of 6.25 BTC per verified block instead of transaction fees. As per research, this is the longest period in history, that ETH miners beat BTC miners in revenues.

But, will higher revenues alone determine profitability?

Not necessarily. Bitcoin has a high operating cost and ETH EIP-1559 can impact the revenues in the short term, for Ethereum. However, that was not the case so far. Up until August, both transaction fees and the price of ETH supported ETH mining revenue.

The burn rate of base fees after the upgrade has also been covered by priority fees and tips. At press time, the burn rate stood at 7.11 ETH/min. Increased activity and bullish prices further seem to support the revenue as well.

Based on cost computing, including electricity, analysis by CoinWarz, ETH mining revenue amounted to $38.23 and profit was at $36.43 per day. Due to high electricity cost, revenue for BTC mining was $39.02 and profit was $31.22 per day, at press time. Therefore, the ETH mining profit-margin stood at over 94%, which was higher than that of BTC, at 90%.

Meanwhile, the latest data by Glassnode points to Miners’ Netflow Volume. It is currently at a one-month low, down by -15.913 BTC on September 5. Simply put, negative flows reflect liquidation by BTC miners. Also it can precede a difficulty upgrade on the Bitcoin network. \

BTC is expected to revise its difficulty from 17.62 T as the hash rate is constantly improving and stood at 128.53 EH/s at press time. A higher difficulty can, therefore, further impede the income of BTC miners.