This is why Bitcoin’s value should be $55,000 right now

Even after a nearly 75% jump over the last month, the king coin still seemed to be in the undervalued zone. Now, it is true that a section of experts have always found BTC to be undervalued. However, analyst Willy Woo recently noted that his “conservative” price estimate for Bitcoin according to a metric measuring its “supply shock,” was almost $5K above BTC’s price at the time.

BTC’s price was up by 3.8% over the last 24-hours, and its metrics were turning bullish. With the supply shock valuation model into the picture, market players are expecting a long-term bullish momentum for the king coin.

Bitcoin should cost $55,000 at the moment

Woo’s Tweet stirred a wave of enthusiasm amid the stretched consolidation that Bitcoin saw at the $50K level. However, at press time, BTC was well above that psychological barrier and traded at $51,666. Now that Bitcoin’s first hurdle to its ATH, the $50K mark was breached, BTC’s path ahead looked clearer.

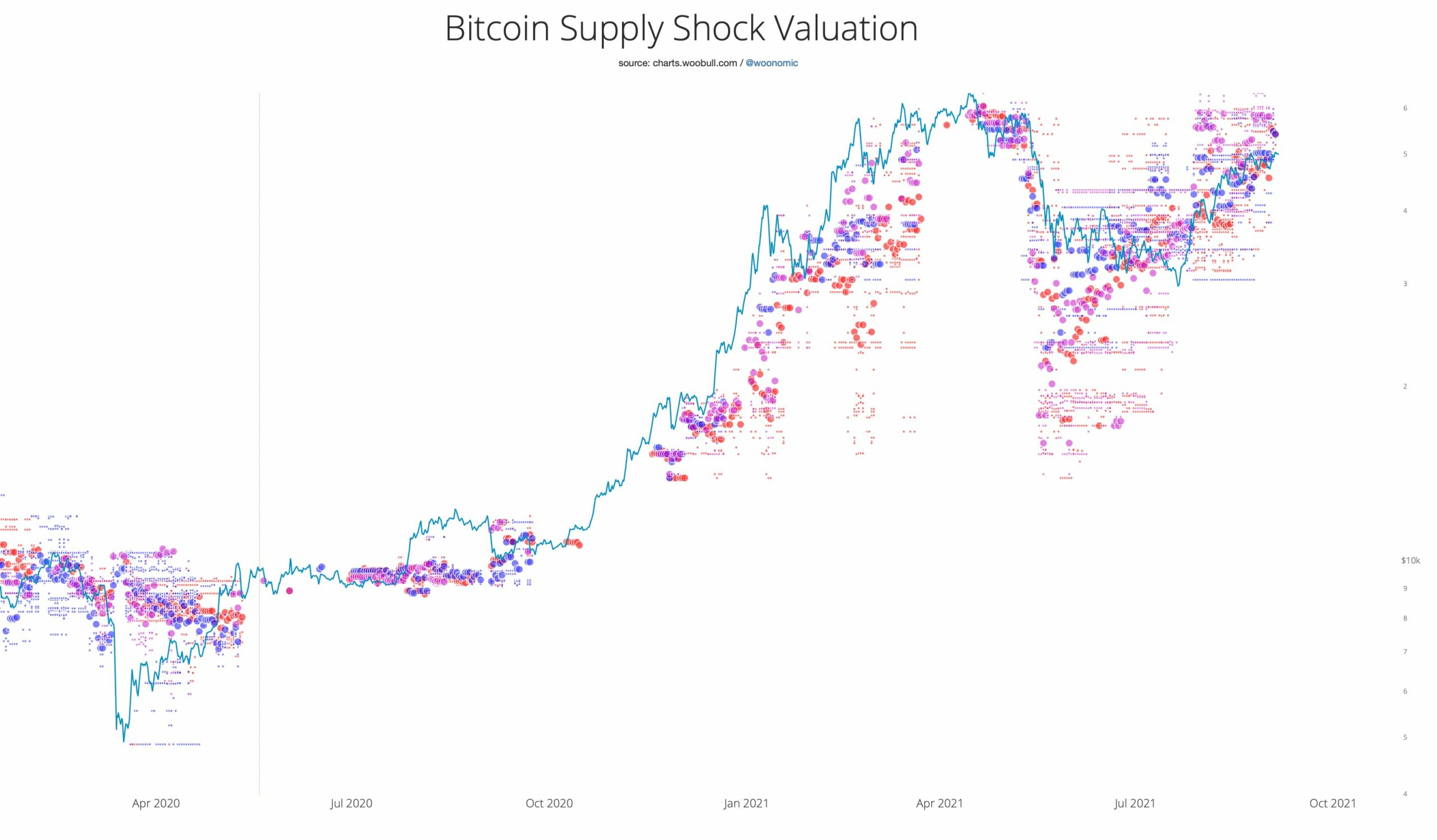

Elucidating the supply shock valuation, Woo noted that supply shock is simply the unavailable supply divided by the available supply. This is because the available and unavailable supply carry market intent. The chart below captures the time when Bitcoin’s price moved with and without any shifts in investor intent.

Additionally, the valuation model uses an algorithm to compare similar supply and demand situations with a particular time, thus producing a fair price estimate. With regard to the ratio of coins in cold storage to coins on exchange, being at record level, Woo further said,

“It’s conservative as one of the SS metrics, exchange SS, is now above all-time-high so no look-back is possible.”

There’s more to the bullish trajectory

Apart from Bitcoin’s high price valuation as per the supply shock valuation, there were other metrics too that turned positive in favor of BTC’s upward trajectory. Bitcoin’s active addresses had been on a decline since August 26, however, it noted a sharp reversal and reached a one-month ATH.

Further, the number of new addresses reached a one-month ATH too, which meant that new participants were making their way into the market

In addition to this, a Glassnode report had noted a decline in the young coin HODL waves over last week, indicating that the market preferred to HODL and not spend. Now with Bitcoin’s price gaining momentum at press time, and in light of these metrics flashing bullish signals, it could in fact reach above $55K soon.