Why Ethereum’s gas prices dropped to 5-month low

- Ethereum’s mean and median gas price declined in recent weeks.

- Active users and volume remained untouched, indicating sustained activities.

The Ethereum [ETH] network has long been criticized for its exorbitant gas prices, which have been a source of frustration for users. The fees have remained stubbornly high despite its massive user base and daily transactions. However, there is a glimmer of hope.

Read Ethereum’s [ETH] Price Prediction 2023-24

Ethereum sees gas price decline

On 18 June, a recent chart from Glassnode revealed a significant decrease in Ethereum‘s median gas price, reaching approximately 18.0 GWEI, marking a five-month low. Furthermore, as of this writing, the gas price had further decreased to around 17.8 GWEI.

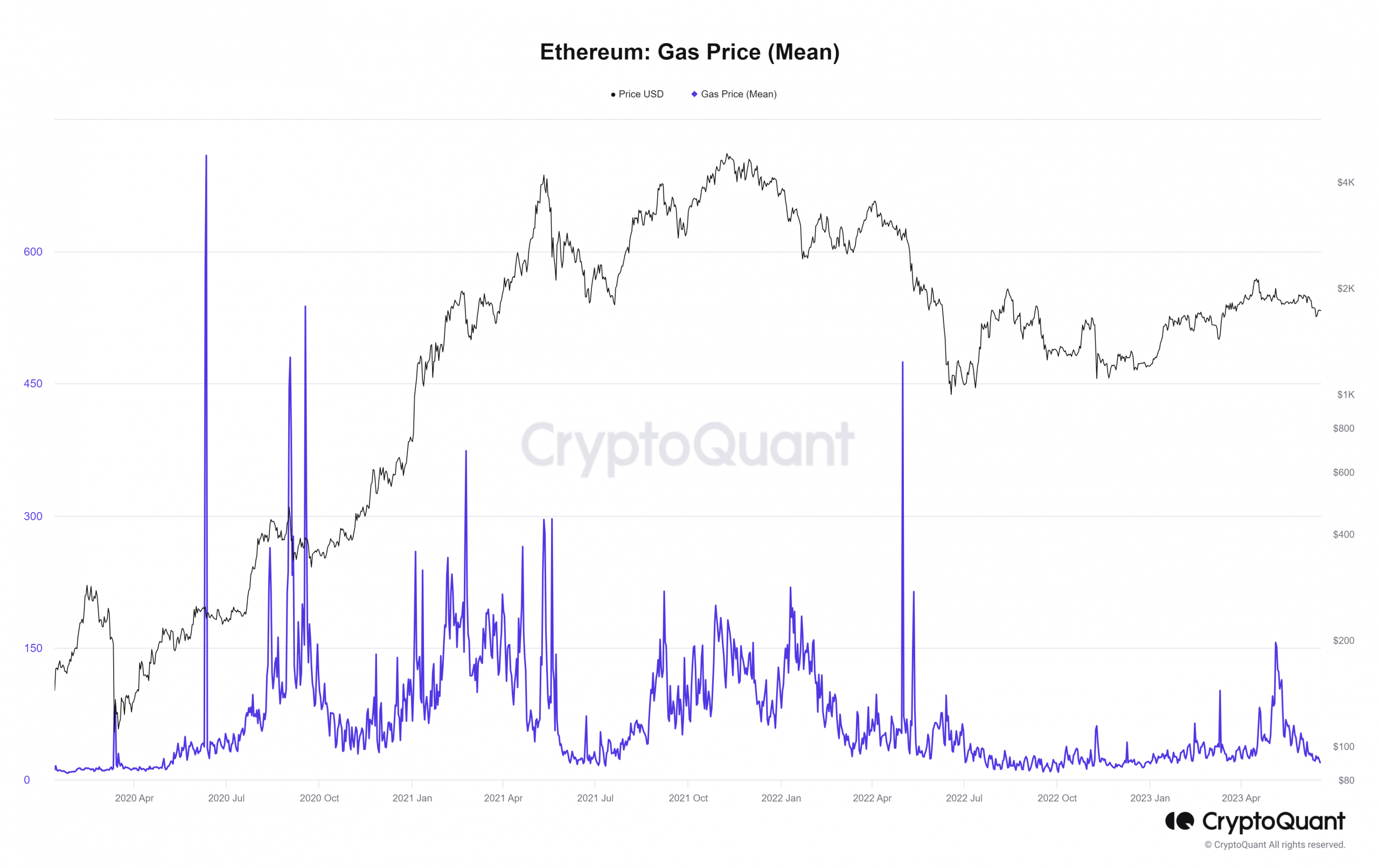

This reduction in median gas price prompted an examination of the average gas price, or mean, on CryptoQuant.

Analysis of the data on CryptoQuant demonstrated a consistent decline in gas prices. As of this writing, the mean gas price stood at around 19.2 GWEI. This level represented a substantial drop from the peak of around 150 GWEI observed in May.

Considering the reduction in gas prices, it is worth exploring whether key activities on the Ethereum network experienced a corresponding decrease.

Ethereum’s active users, fees, and volume

Despite the observed reduction in gas prices, close attention was paid to key network metrics to determine if there was a corresponding decrease in activity. An examination of the volume metric on DefiLlama revealed no noticeable drop in volume on the Ethereum network.

As of this writing, the volume surpassed $520 million, indicating sustained activity. Additionally, the active user metric demonstrated a consistent number of users engaging with the network over the past week, with over 358,000 active users currently.

Furthermore, data from Crypto Fees indicated that Ethereum continued to generate substantial fees, suggesting an increase in transactions. As of this writing, the daily fee exceeded $3.5 million, with a seven-day average exceeding $4 million.

The data indicated that the volume of interactions or transactions on the Ethereum network had not experienced a decline.

Are L2s taking the shine?

The reduction in Ethereum gas fees could be attributed to the emergence of various Layer 2 solutions (L2s). These L2s aim to alleviate congestion on the Ethereum network, which helps mitigate the escalation of gas prices.

How much are 1,10,100 ETHs worth today?

According to data from L2 Beats, these Layer 2 solutions are steadily gaining traction, as evidenced by their increasing Total Value Locked (TVL).

As of this writing, the L2 TVL surpassed $8.4 billion, indicating a growing adoption of these solutions. As the adoption of L2s expands, we may witness a further reduction in gas prices on the Ethereum network.