Why Ethereum’s price rise is not cause for celebration yet

- Ethereum’s price increased by nearly 2% in the last 24 hours.

- However, market indicators were bearish, suggesting a change in trends.

The Binance and Coinbase episode with the US Securities Exchange Commission caused havoc in the crypto industry. It caused a decline in the supply of Bitcoin [BTC] and Ethereum [ETH] on Binance, suggesting that investors were losing confidence in CEXes.

Read Ethereum’s [ETH] Price Prediction 2023-24

Ethereum investors’ confidence in Binance declined

Glassnode’s latest tweet revealed that after the SEC incident, investors actively withdrew their ETH and BTC from Binance. As per the tweet, Ethereum’s balance on Binance was around 4.56 million to 4.2 million.

Since the SEC charges, the #Bitcoin and #Ethereum Balance on #Binance has declined by -48K BTC and -360K ETH respectively.

? BTC Balance: 706K BTC to 658K BTC (-48K BTC)

? ETH Balance: 4.56M ETH to 4.2M ETH (-360K ETH) pic.twitter.com/rOKZpfgJwn— glassnode (@glassnode) June 15, 2023

This indicated that they were losing faith in the CEX. In order to keep their holdings safe, investors were moving their assets to self-custody, or DEXes. This was evident from Dune’s data.

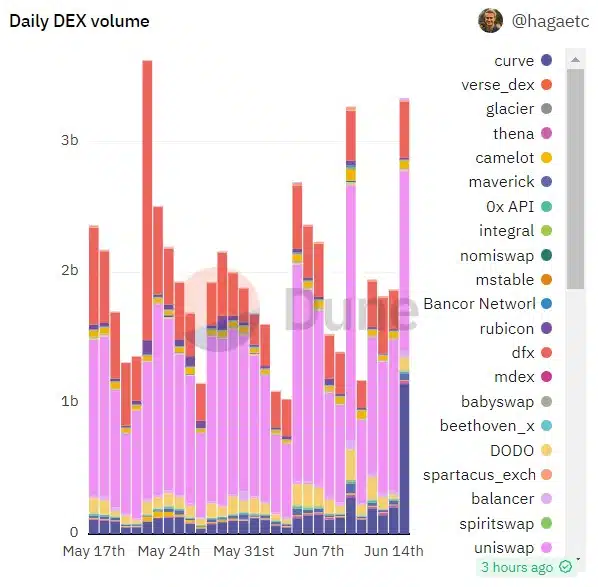

After a decline, ETH’s volume on DEXes registered an uptick, as per the chart ETH’s DEX volume has increased on multiple projects such as Curve [CRV], Uniswap [UNI], and more since 11 June.

Ethereum’s revenue has plummeted

It was interesting to see that ETH generated the highest revenue in Q1, driven by its high usage and gas fees. According to Messari’s recent tweet, Ethereum’s revenue was $457 million, almost 2.8 times the combined revenue of all other featured L1s.

.@Ethereum generated the highest revenue in Q1, driven by its high usage and gas fees. Its revenue was $457M, almost 2.8x the combined revenue of all other featured L1s.@Hedera had the most significant revenue growth, up 489% QoQ, driven by its Consensus Service. pic.twitter.com/ybTQJhIq7I

— Messari (@MessariCrypto) June 16, 2023

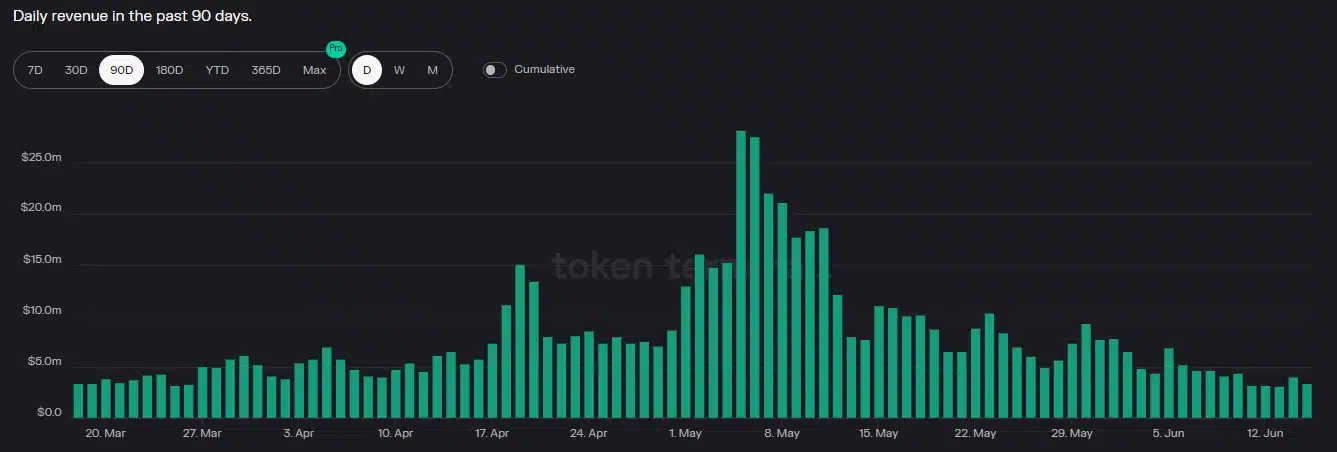

However, things changed in the second quarter of this year. Token Terminal’s data revealed that ETH’s revenue had declined. After spiking on 5 May 2023, Ethereum’s revenue plummeted sharply, which was not good for the blockchain.

ETH investors had a good day

Though ETH’s revenue declined, the token’s price moved the other way. According to CoinMarketCap, ETH’s price has increased by nearly 2% in the last 24 hours. At the time of writing, it was trading at $1,665.31, with a market capitalization of over $200 billion.

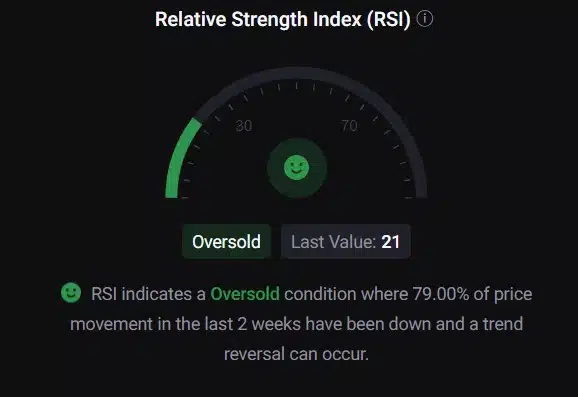

As per CryptoQuant, Ethereum’s Relative Strength Index (RSI) was in an oversold position. This might have increased buying pressure and pushed up the token’s price. Ethereum’s exchange reserve was also green, suggesting that the token was not under selling pressure.

Is your portfolio green? Check the Ethereum Profit Calculator

Here is the catch

A look at ETH’s daily chart suggested that the uptrend might continue as the market indicators looked bearish. The MACD displayed a bullish upperhand in the market.

Ethereum’s Chaikin Money Flow (CMF) also registered a downtick. Additionally, its Exponential Moving Average (EMA) Ribbon also pointed out that the bears were leading the market, as the 20-day EMA was below the 55-day EMA.