Why ‘Ethereum’s woes’ have turned into Polygon’s wins?

The Polygon network emerged as an alternative to decentralized finance users amid the volatility-driven period. It not only posed as a competitor to the established Ethereum network but also Binance Smart Chain. According to data, in the past week, the top 10 DeFi applications on the Polygon network attracted just over 242,000 unique active wallets.

Meanwhile, the unique active wallets count for the top 10 Ethereum DeFi apps remained limited to 100,000.

It was clear that despite the current drop in the gas fees on Ethereum, users preferred using the Polygon [MATIC] network. DappRadar explained:

“Ethereum’s woes have turned into Polygon’s wins lately as the sidechain has experienced record growth amidst high gas fees. Now, as gas fees start to return to normality many expected investors to flood back to Ethereum dapps – instead we see Polygon DeFi experiencing record growth.”

Even the reduced fees on Ethereum were high for average investors. Polygon’s network was cheaper, with high introductory returns, and a deluge of competing DeFi apps.

MATIC’s progress in numbers

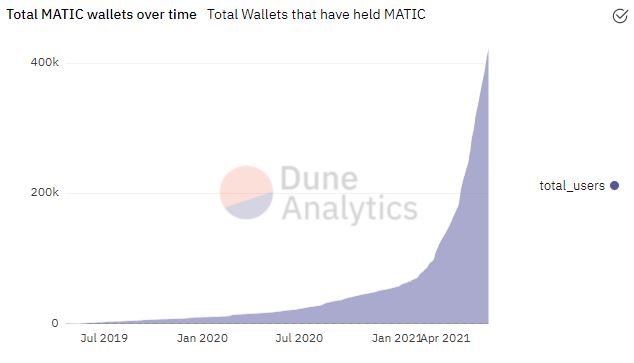

Polygon’s MATIC has noted tremendous growth in the market owing to the network’s progress. This growth can be visible with the parabolic increment in unique wallets on the network.

Source: Dune analytics

The above chart suggested that Polygon hosted over over 423k unique addresses, at the time of press.

Meanwhile, the total value locked in the project has also hit a new all-time high. The first quarter had remained devoid of much progress for Polygon, but come Q2, the progress line showed an upwards trend. The total value hit a peak at $11.84 billion on 15th June and was currently at $8.65 billion.

As the project continued to evolve, MATIC price was currently witnessing strong selling pressure, due to Bitcoin’s fall. At the time of press, MATIC was being traded at $1.01 and noted a loss of 30% within two days.