Why ETHPoW’s >40% surge post the Merge shouldn’t get miners all elated

ETHPoW, in contrast to its recent development, rallied 44.85% from its value on 19 September. According to CoinMarketCap, the cryptocurrency went from $0.480 to trade at $6.73 at press time.

For its investors, this could be a sigh of relief since the breakdown of servers led to a massive loss in value in one day. However, this uptick would have been impossible without applauding certain aspects of the ETHPoW ecosystem.

Stay grateful to the hash

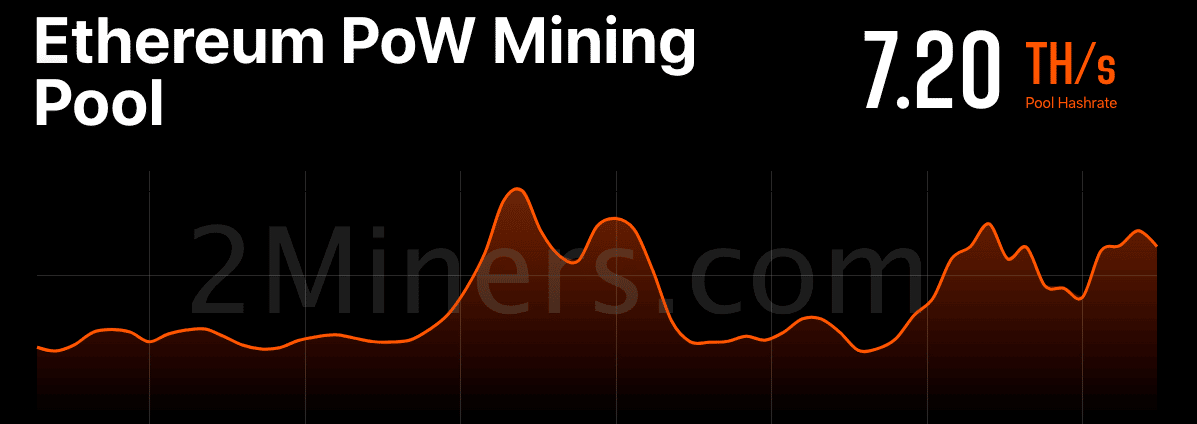

One part that was instrumental to the price increase was the hashrate. According to 2Miners.com, ETHPoW’s hashrate had increased 28.34% in the last 24 hours. At the time of writing, the hashrate was 7.20 Terahash per second (TH/s).

Before the increase, the hashrate had gone as low as 5.05 TH/s. Looking at other aspects of the mining pool, it was observed that about $15,400 had been paid to miners in the last 24 hours. With over 5483 blocks already mined, ETHPoW miners had continued mining at a network difficulty of 388.3 Terahash.

Coincidentally, the luck at which blocks were mined was the highest since 16 September. As for the block rewards, miners paid a transaction fee of $13.35 at press time.

Not yet time to jubilate

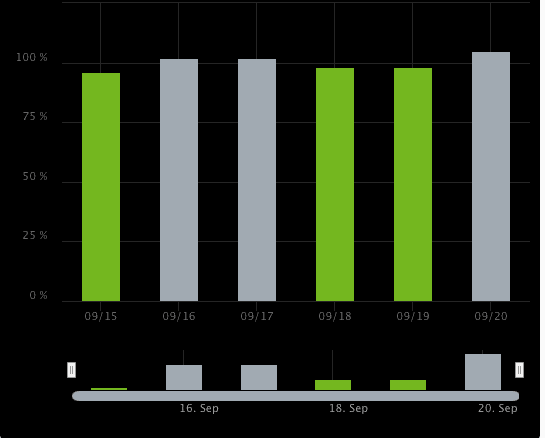

Despite the increase in hashrate, it is noteworthy to know that ETHPoW was still at a relatively low level as compared to the value it was during the Ethereum [ETH] Merge. Crypto intelligence platform, Messari, took note of this development and highlighted some possible happenings regarding the ETHPoW chain.

$ETHW Proof-of-Work fork hasn’t been able to sustain high levels of hashrate post-Merge. It isn’t likely to recover.

Without any catalysts for economic migration to $ETHW, the chain won’t be able to support a valuation that would make mining ETHW worthwhile. pic.twitter.com/89RAGUgmd1

— Messari (@MessariCrypto) September 19, 2022

Furthermore, with Messari’s projection, ETHPoW may struggle to keep its miners as profitable as possible. Nonetheless, it may seem too soon to assume that ETHPoW is “done for.” As conversations continue to merge on the sustainability of the chain, ETHPoW looks like it’s concerned about developing its network.

Recently, the ETHPoW official handle shared a tweet that it had launched a new bridge on its mainnet. According to the update, the new bridge would support ETH on Proof-of-Stake (PoS), USDT, and USDC.

New bridge launched!! https://t.co/KKytqS4QEC

Support for $ETH $USDT $USDC Ethereum <-> EthereumPoW.

Contracts on ETHW:

ETH (PoS): 0xB007f6c4511fD2b70a02BfcFAb6072BcEf21788d

USDC: 0xC675FDBe260e1ee93106Ee596B916952a9344f44

USDT: 0xB6334BeDf341d111525A1Db8fBE7805dE57De957$ethw pic.twitter.com/Hhetlfl9A1— EthereumPoW (ETHW) Official #ETHW #ETHPoW (@EthereumPoW) September 20, 2022

However, some members of the crypto community argued that the supposed bridge ability was impossible. A number of the comments were of the opinion that the new bridge could only bridge to ETHPoW but could not bridge back.

While the ETHPoW price continued to soar, it was a different case with its volume as it recorded 1.04% decline to $154,276,429.