Why LINK investors might be sitting on a goldmine thanks to proof of reserve

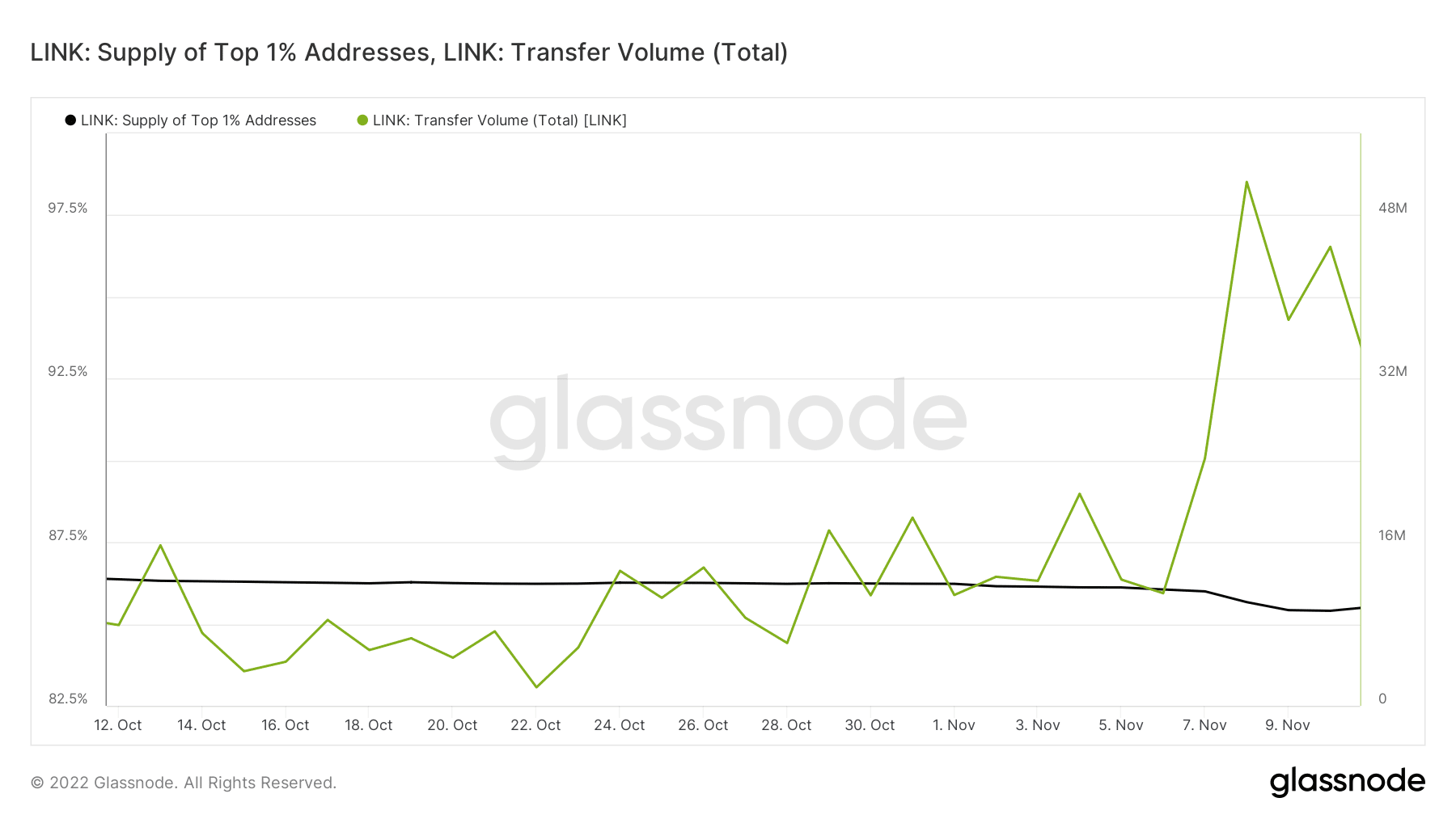

- LINK’s velocity and supply in smart contracts dropped significantly in the last five days

- However, LINK held in smart contracts grew substantially during the last four weeks

It is often difficult to find winners in the crypto market during a major crash but Chainlink [LINK] might be it. Even though its native currency LINK suffered significant downside so far this month, the Chainlink network continued to see wins as a potential solution.

Read Chainlink’s [LINK] price prediction 2023-2024

Chainlink can facilitate the proof of reserve which might be the ideal solution that may help solve some of the cracks unveiled during 2022’s market crash. During a recent interview, Chainlink’s CEO Sergey Nazarov highlighted how proof of reserve may have helped investors identify risks that led to FTX’s insolvency.

#ProofOfReserve shines a light on the black box of financial markets.@JillMalandrino and @SergeyNazarov discuss how #Chainlink Proof of Reserve can help prevent contagion and systemic risk: https://t.co/YCpEVrDrSL pic.twitter.com/0zkV8ouen5

— Chainlink (@chainlink) November 12, 2022

According to the Chainlink CEO, proof of reserve may help overcome systemic financial risks, as well as contagion risk. Chainlink as an oracle services provider stood in a position to help facilitate a large-scale adoption of proof of reserve. Additionally, looking at the current scenario of the market, it could be considered as more of a necessity than an option. The good thing is that it also offers an opportunity for the market to adapt and grow from recent challenges.

The need for large-scale proof of reserve adoption further outlines an opportunity for Chainlink’s adoption. It underscores yet another reason why Chainlink’s offerings continue to add value and why the network has robust long-term potential. Healthy long-term adoption might contribute to more value for LINK.

Chainlink did register healthy growth in the last 30 days. For example, its supply of LINK held in smart contracts grew substantially during the last four weeks. The same was observed for its velocity.

Both the velocity and supply of LINK in smart contracts dropped significantly in the last five days. This reflected the impact of last week’s crash on Chainlink’s performance. But will we see a recovery this week?

One of the best ways to assess demand was to look at the balances of top addresses. LINK’s supply of top addresses registered a sizable drop in the last five days. However, the good news was that the whales/top addresses are no longer selling. Regardless, we were yet to see a return of strong buy pressure.

Chainlink’s transfer volume also took a bit of a hit in the last few days. Investors should thus, keep an eye out for the transfer volume to pivot as a confirmation that demand recovery.

LINK’s price action

The above observations may explain LINK’s current performance. LINK traded at $6.17 at press time, which was still within the range of it 2022 bottom.

While there still stood the possibility of more downside, LINK’s current price action did offer an opportunity considering Chainlink’s long-term potential.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)