Why Polkadot’s long-term prospects might be almost guaranteed

Polkadot is one of the few altcoins that has been able to carry forth its independent rally amidst the not-so-favorable broader market trend. With only 14 red candles on the daily chart since 21 July, the crypto has managed to appreciate by over 177% since. At the time of writing, DOT was trading just above the $32-mark.

Record-breaking spree

At the $31-$32 billion juncture, DOT managed to flip SOL on the market cap rankings list less than 24 hours ago. Needless to say, many have been excited about DOT’s rise, with the same evident when the crypto’s social stats are looked at too.

According to Santiment, the discussion rates for Solana have ballooned to levels last seen in March. In fact, DOT made up for 3.3% of all crypto-related mentions on social media on Tuesday.

Enthusiasm expressed by market participants has, more often than not, aided DOT’s major rallies. Take the case of March, for instance. With every social dominance spike, the alt’s price parallelly rose on the charts.

Source: Santiment

A momentum-backed rally

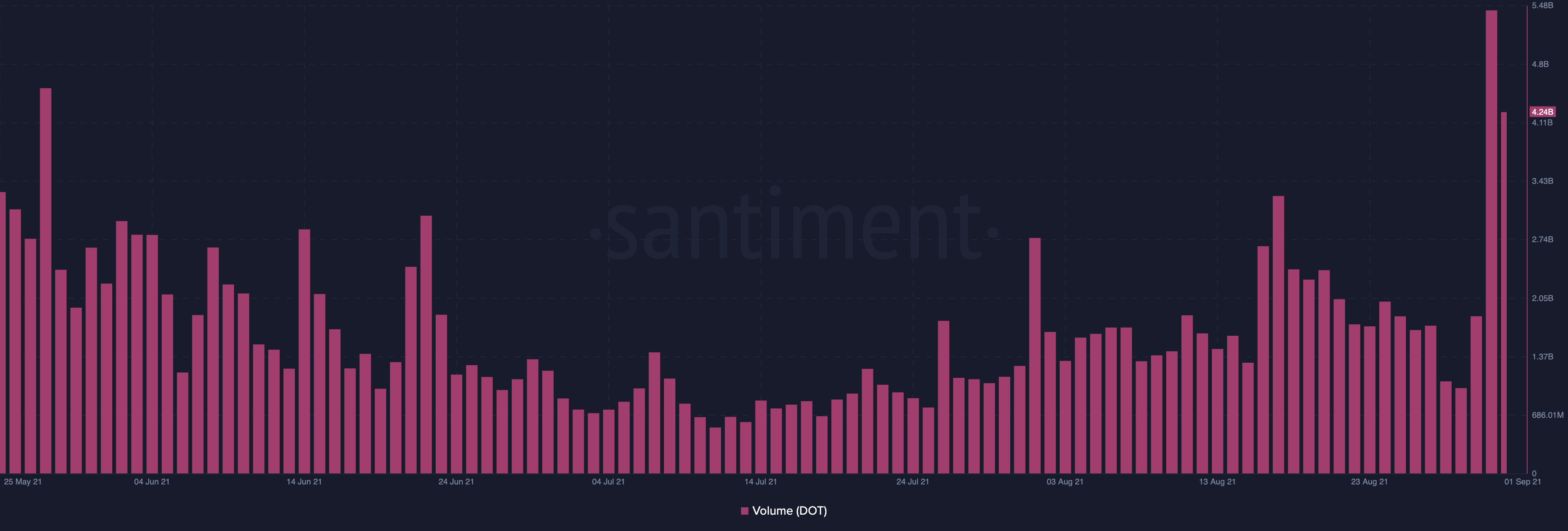

Well, DOT’s price-rise phase has been genuinely aided by rising market interest. Trading volumes have gradually increased since mid-June and eventually stood at a peak of 5.4 billion a day ago. The press time volume also seemed to be closely revolving around the said level.

Source: Santiment

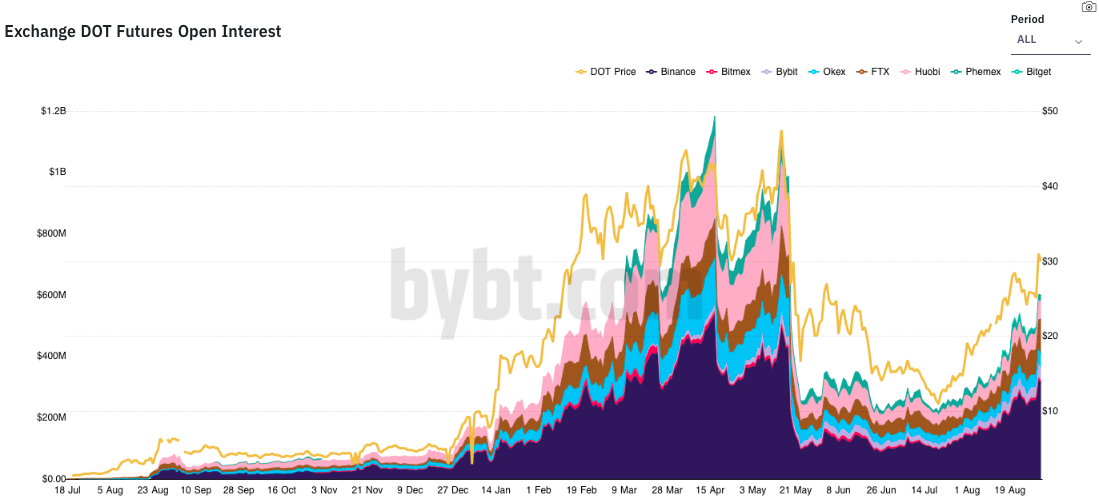

What’s more, the altcoin’s Open Interest has also gradually hiked with time – A healthy sign. Notably, the press time levels [around $600 million] seemed to be at par with what the altcoin recorded during the initial few days of March this year.

Thus, if the trend continues in the same direction, DOT’s rally will most likely end up extending itself.

Source: ByBt

Short-term concerns

Curiously, data from the Futures market did not seem to be quite encouraging. The funding rate and liquidation data, for instance, did not paint a bullish picture. The former, across all major exchanges, remained negative [Binance: -0.04%, OKEx: -0.14%, Gate: -0.03%], at the time of writing.

Further, as per the latest liquidation data, $132 million long contracts had been liquidated in 24 hours, compared to that of $100 million short contracts. The state of these two indicators essentially implied that the market is currently favoring short traders.

Shielded long-term future

The DOT ecosystem has been developing at an impressive pace of late. For instance, Referendum 33 which aims to upgrade Polkadot’s runtime to v9090 is now up for vote. If approved, Polkadot’s chain logic would be modified, without undergoing a hard fork.

Further, the parachain auctions have the potential to induce additional momentum into the Polkadot ecosystem. As part of the parachain crowd loan process, users would vote for the projects by locking up DOT tokens for a stipulated period. In retrospect, the circulating supply of tokens available would drop and would end up having a positive impact on the alt’s price.

For now, auctions are going on Polkadot’s sister network – Kusama. Polkadot will undergo its own auctions as soon the same gets completed on its parallel network. People from the community are, in fact, already excited about the same. Ergo, the long-term prospects of DOT seem to be fairly guaranteed.