Why quantifying Bitcoin, Ethereum adoption is easier said than done

There is no doubt that the cryptocurrency space has seen a lot of adoption over the past few years. The likes of Bitcoin, Ethereum, Cardano, MATIC, Uniswap, and Solana, among others, have all registered significant activity.

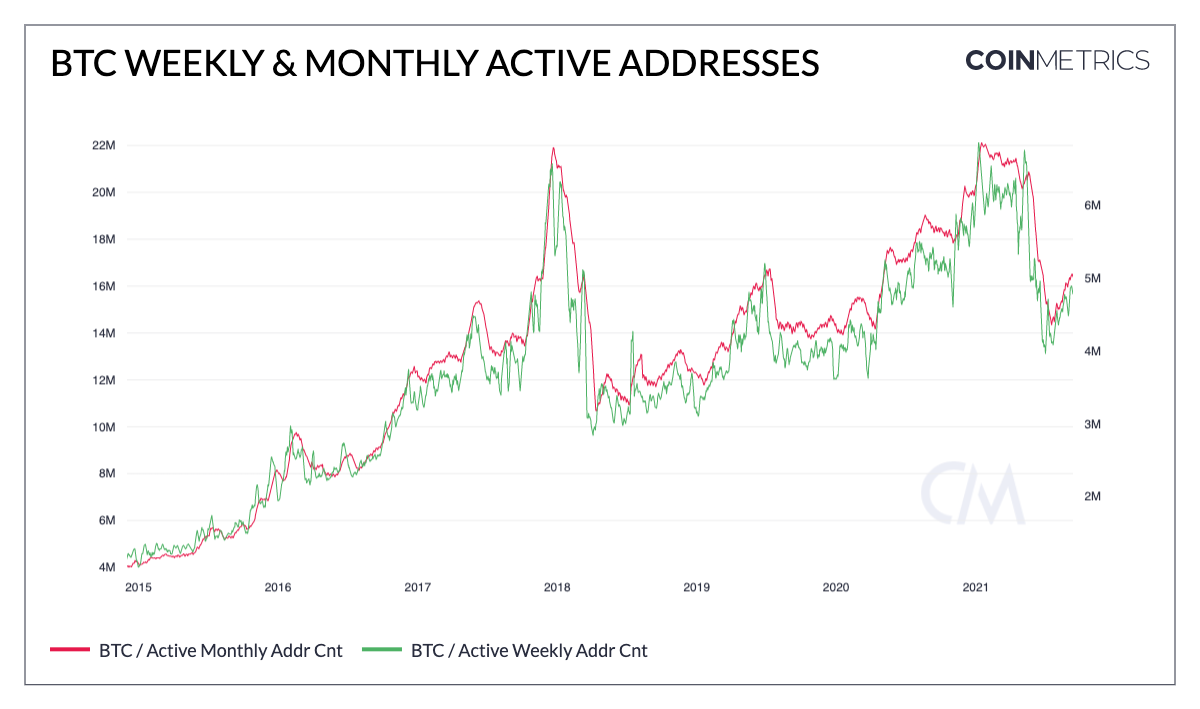

And yet, the rate of adoption is not quite quantifiable. For example, the number of Bitcoin active addresses was higher in 2017, then it declined during the 2018 bear market. It continued to remain under the 2017 high until a new ATH was achieved in 2021.

So, measuring utilization and adoption has been a crafty process. However, according to Coinmetrics, there might be a different way of looking at crypto-adoption, one which may lead to more constructive and adequate analyses over time.

Tracking monthly unique addresses is the new black?

According to Coinmetrics, analyzing ‘monthly active users’ can be utilized to determine the number of 30-day unique users of apps. Now, the idea is to track activity beyond the pseudonymous nature of crypto. Hence, tracking monthly active addresses serves as a well-defined parameter over a definite period of time.

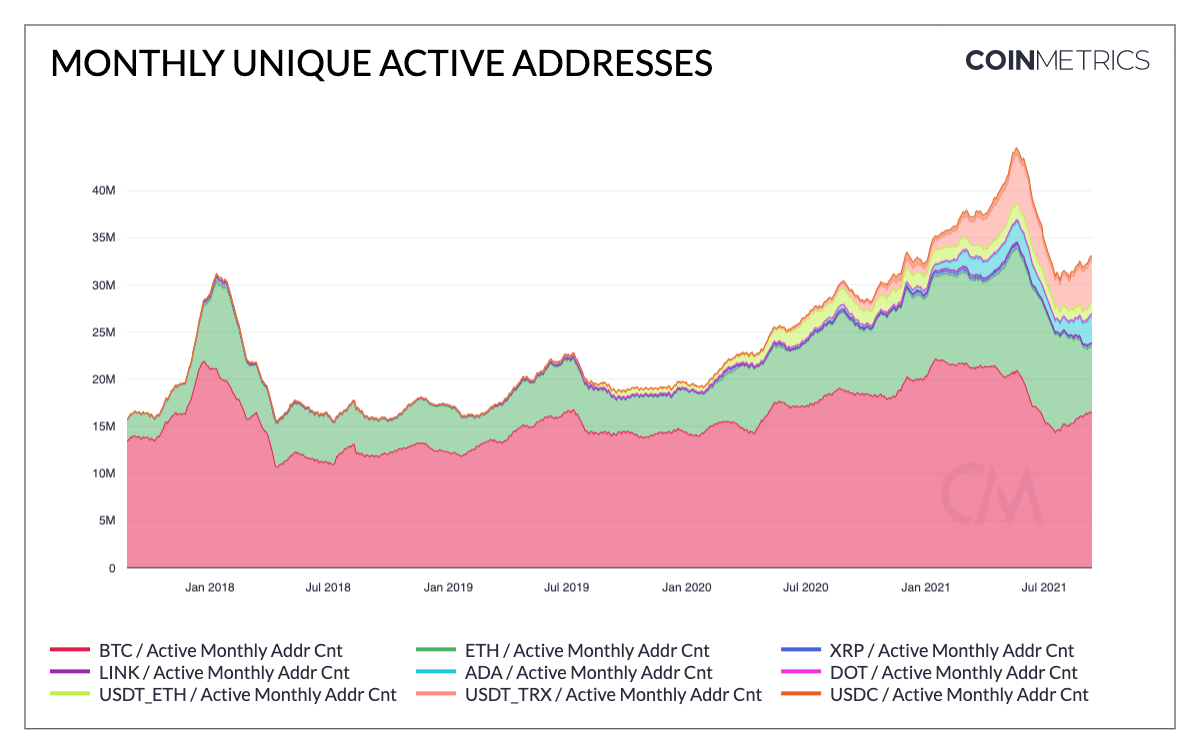

As can be seen from the attached chart, a well-defined increase in monthly unique addresses can be seen for most crypto-assets over the past 3 years, with the addresses peaking above their 2018 high around January 2021.

Coinmetrics added,

“Major stablecoins reached a peak in mid-May before the market wide crash. But it’s started to rebound since mid-July as the market recovers.”

Now, if monthly unique addresses statistics are compared with active addresses, a distinction emerges clearly. With active addresses, the peak is similar to the one between January 2018 and 2021, indicative of an unclear picture. However, unique addresses do define a proper distinction, one which indicates that the amount of activity in 2021 has been higher than in 2018.

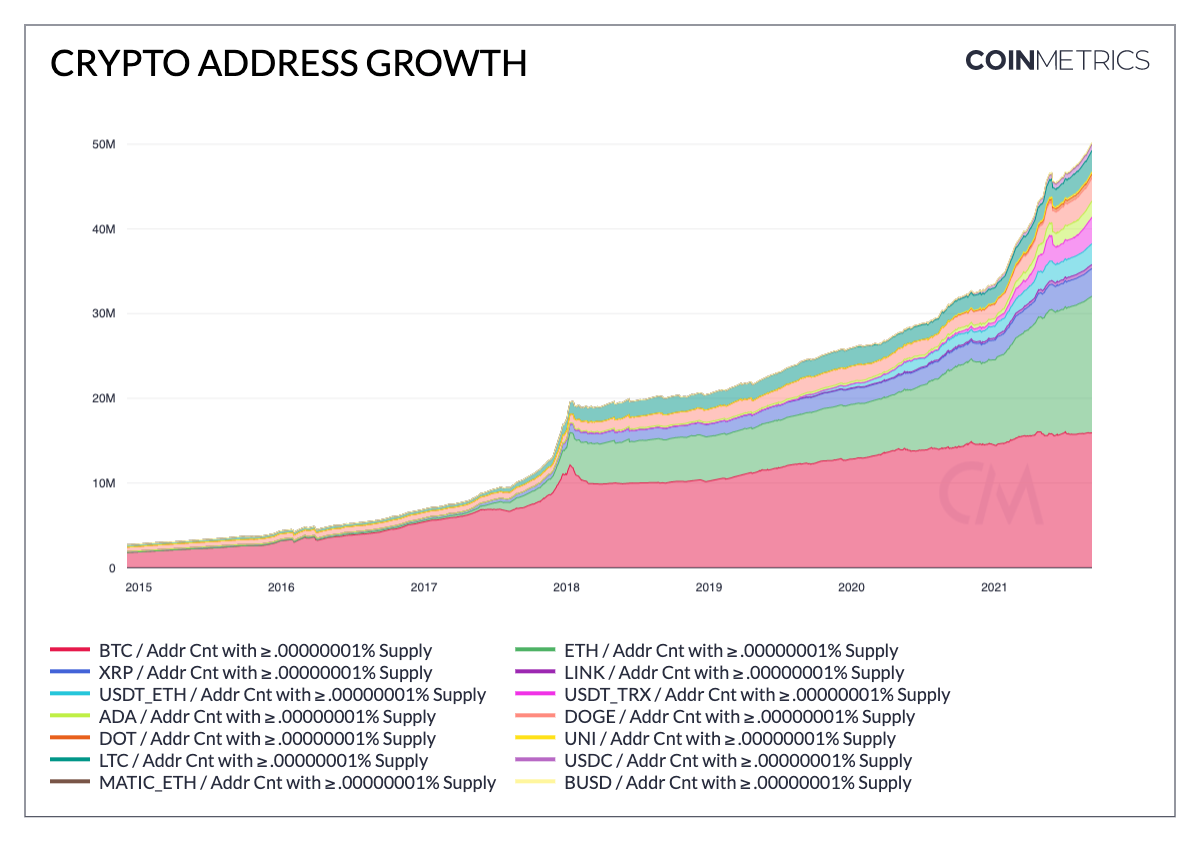

A similar trend was seen for Ethereum. Another measure that can be taken to estimate adoption is by tracking the number of addresses holding at least one ten-billionth (> .00000001%) of the total supply of various crypto-assets. This allows assessors to filter out empty addresses, as illustrated by the chart below.

So tracking Bitcoin, Ethereum monthly unique addresses is enough?

The technicality of the argument is sound. Consistent growth month over month, growth which is quantifiable, is factually determining adoption and activity. However, crypto-adoption is possibly more than that at the moment.

For an asset class, institutional interest is also primarily important since it brings more liquidity and stability to the market. Over the past 3 years, institutional interest has also spiked thanks to Bitcoin, Ethereum, and a few other alts. Hence, collective growth may be required to justify sound crypto-adoption.

Overall, the process of determining expansion remains one with no clear answers. However, it is becoming more and more conclusive and constructive by the day.