Why Solana’s jump beyond $50 remains an opportunity for onlookers

- On a Year-To-Date (YTD) basis, SOL has increased by 448%.

- The tremendous price increase in the last 24 hours does not mean that bulls are in danger.

When the year began, almost anyone who publicly considered investing in Solana [SOL] was tagged delusional by many market participants.

At that time, no one could fault the stance of the prophets of doom. One of the reasons was that the token, which was tipped as a strong competition to Ethereum [ETH], tumbled after the FTX exchange collapsed.

As a result, many opined that a recovery for SOL to 2021 levels when it tapped $250, would be impossible. Fast forward to the latter parts of 2023, Solana has outperformed all the coins in the top 10 including the king Bitcoin [BTC].

SOL leaves the market behind

But after it tapped $40, there were predictions that it was time for the price action to cool down. Unfortunately for the bears, that was not to be the case. To cut the story short, SOL jumped to $54 as the trading day of 10th November drew to a close.

According to Santiment, SOL’s price increase has resulted in a market admittance that the token does not need to correlate strongly with Bitcoin or Ethereum. Rather, it had the capability to carve its own path.

As a result of this, conversations around Solana continue to hit new peaks, as indicated by the social dominance. Similar to social dominance, the funding rate also jumped. This rise in the funding rate suggests a surge in the bullish sentiment of traders.

? #Solana has now surpassed $54 for the first time since May, 2022. Discussion rates on $SOL have again spiked, indicating the mainstream crowd recognizes the asset's decoupling from other assets. Funding rates are high, but not in a 'danger zone' yet. https://t.co/Tl9jlAsOx5 pic.twitter.com/sG97sCU9Br

— Santiment (@santimentfeed) November 10, 2023

Typically, a combination of a surge in social dominance and funding rates means that a cryptocurrency’s price may have hit a local peak. Most times, it also means that it’s time to cool down on opening buy orders.

However, Solana seemed to be evading this rule. To buttress this point, on-chain data from Santiment showed that SOL was still in an opportunity zone.

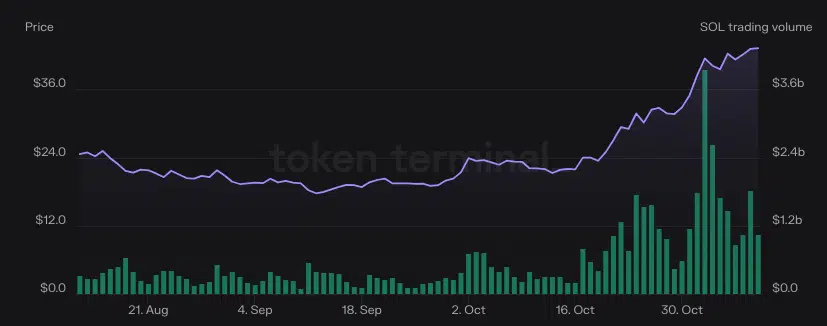

In the aim to confirm if it could still be the right time to buy SOL, AMBCrypto decided to look at the trading volume. According to Token Terminal data, Solana’s trading volume was around $1.48 billion at press time.

Overcoming fear and rising confidence

Like the price action, the value of the trading volume represents an 18.29% increase in the last 24 hours. Usually, rising volume alongside rising prices suggests increasing upward momentum.

Thus, it is possible for Solana to cross $55 and inch towards $60 in the coming days. That is if the volume stays the same and there’s enough buying pressure to keep the price in the upward direction.

AMBCrypto’s analysis of SOL’s price on the 4-hour timeframe indicated that the alt could be in price discovery mode. Largely driven by demand and supply, price discovery shows how a cryptocurrency’s value is being set by buyers and sellers.

At press time, SOL’s price was on the demand side. Also, the 0.382 Fibonacci retracement level was around $43.44. This means that it was at this price that the market overcame fear and bounced on an uptrend.

Subsequently, there was also strong support at $44.81, backed by the 0.236 Fib level. Should SOL retrace, there is a solid chance of finding a good buy position at the said price or above it.

Additionally, the Relative Strength Index (RSI) indicated that SOL was overbought.

Read Solana’s [SOL] Price Prediction 2023-2024

Meanwhile, it is likely the overbought condition (which usually leads to a reversal), halts SOL’s upward movement in the short-term.

While SOL has the potential to drop to $50, it might only require a bit of accumulation to send it back in the $60 direction.