Why Solana’s [SOL] recent gains might be undercut by this metric’s findings

- ‘Overvalued’ Solana’s indicators seemed to indicate the arrival of market bears

- On the contrary, SOL’s demand across the derivatives market increased

TK Ventures and CoinWire’s data revealed that Solana [SOL] is now the most overvalued blockchain. This was determined using the market capitalization/TVL metric. When a network’s market cap to TVL ratio is above 1.0, it means that the network is overvalued, which can result in a price correction. As Solana’s MKC/TVL value was 17.5, the probability of increased selling pressure can be considered to be high.

According to the MKC/TVL ratio, @solana seems to be overvalued compared to other blockchains.

What is your opinion on this statement?

✨ Read Crypto Report 2022 below to gain more informationhttps://t.co/uHdBOBVQiC pic.twitter.com/59Z8OrEIrt

— Solana Daily (@solana_daily) January 30, 2023

Read Solana’s [SOL] Price Prediction 2023-24

However, Solana’s recent price action tells us a different story. According to CoinMarketCap, SOL registered daily gains of over 6%. At the time of writing, it was trading at $25.55 with a market capitalization of more than $9.4 billion.

The bears are here

While the price action has remained dynamic, Solana’s daily chart revealed the arrival of the bears, which might cause a trend reversal. For instance, the Relative Strength Index (RSI) registered a slight downtick near the overbought zone. The Money Flow Index (MFI) went close to the neutral zone – A bearish finding.

Moreover, the MACD revealed that the bears were in a battle with the bulls. Considering the aforementioned indicators, it seemed more likely for the bears to gain an advantage in the market.

More reasons to be concerned

Not only were the market indicators bearish, but Solana’s NFT ecosystem also registered a decline over the past week. CryptoSlam’s data revealed that Solana’s total sales value in the last seven days was 27.52 million – 27% lower than the figures for the previous week. Interestingly, despite the fall in sales, the total number of transactions rose last week.

Is your portfolio green? Check the Solana Profit Calculator

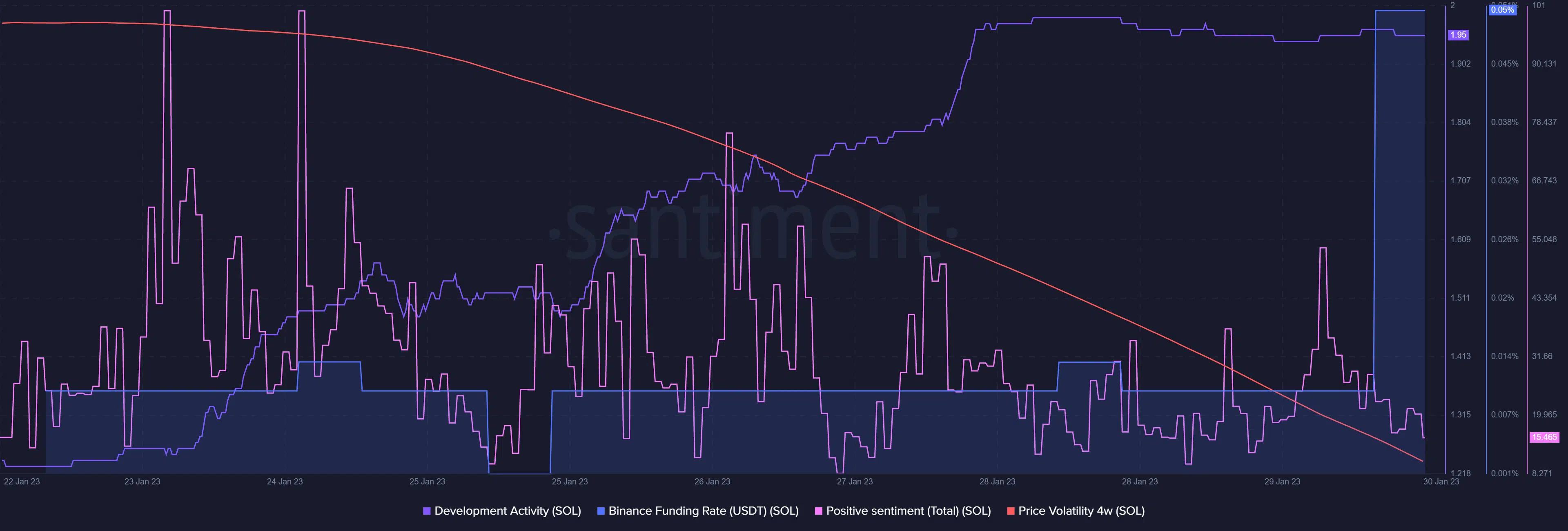

SOL’s on-chain metrics also raised alarm bells as they too looked to align with the sellers’ interest. Positive sentiments around Solana fell over the past week, reflecting the investors’ lack of trust.

Furthermore, SOL’s 4-week price volatility declined sharply, something that might restrict SOL’s price from going up in the coming days. Nonetheless, SOL’s demand in the Futures market increased as its Binance funding rate spiked. The network’s development activity also hiked, which by and large is a positive signal.