Why hike in Polkadot staking has not helped DOT’s prices

- The total number of staked DOT tokens increased over the last few days.

- DOT was down by 16%, but a few indicators looked bullish.

As we enter the second week of 2024, Polkadot [DOT] has some positive news related to its staking ecosystem. Notably, the ecosystem witnessed a rise in the amount of DOT staked.

To better understand how Polkadot’s staking ecosystem was doing, AMBCrypto planned to take a closer look at the blockchain’s state.

A closer look at Polkadot staking

Tony, a popular crypto analyst, recently posted a tweet highlighting the fact that Polkadot was increasing the amount of DOT blocked in staking.

As of the 7th of January, DOT had a total issuance of over 1.3 billion, out of which more than 52% were blocked in staking.

#Polkadot #DOT continues to increase the amount of $DOT blocked in #Staking ????? this is great ??https://t.co/tYxEY57lJo https://t.co/ETj6LpcpoH pic.twitter.com/9qfLAkmtAs

— Tony ₿itcoin⚡ (@Toni_Bitcoin) January 7, 2024

To better understand Polkadot’s stalking ecosystem, AMBCrypto took a look at Staking Rewards’ data. We found that the number of DOT tokens staked has gained upward momentum in the recent past.

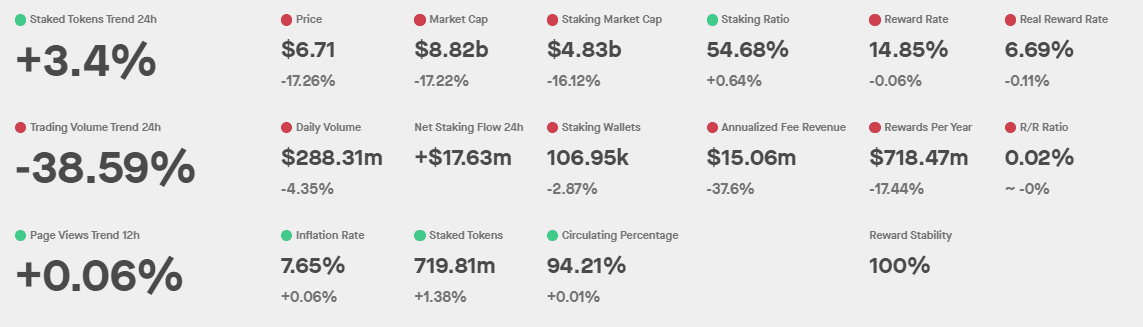

At press time, the total number of DOT staked was 719.81 million, with a reward rate of over 14.8%. Polkadot had a total of nearly 107k staking wallets, with a stalking market capitalization of more than $4.8 billion.

A possible reason behind the uptick in staking metrics could be investors’ confidence in DOT, as they hoped to earn more rewards over the months to follow. Therefore, it looked important to check market sentiment around DOT.

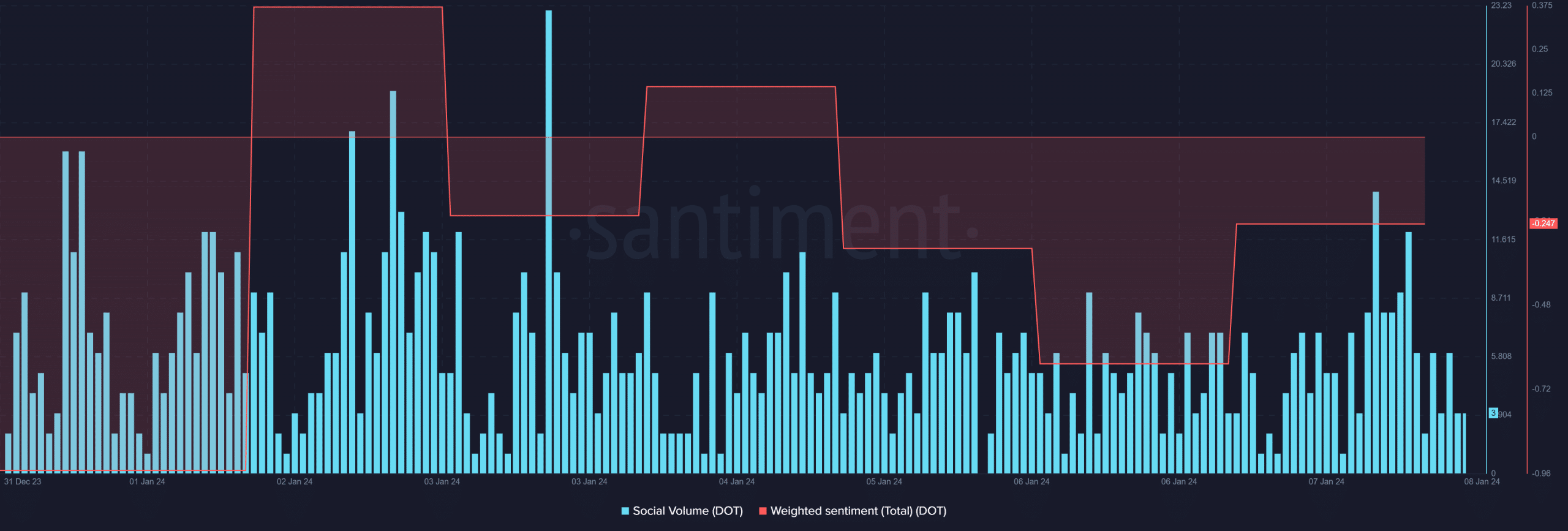

AMBCrypto’s analysis of Santiment’s data revealed that the token’s Social Volume remained relatively high throughout the last week. However, bearish sentiment around DOT was dominant, as evident from its negative Weighted Sentiment graph.

DOT is bleeding

The reason behind the bearish sentiment around DOT can be attributed to its negative price action. According to CoinMarketCap, DOT was down by more than 16% in the last seven days.

At the time of writing, DOT was trading at $6.80 with a market cap of over $8.6 billion.

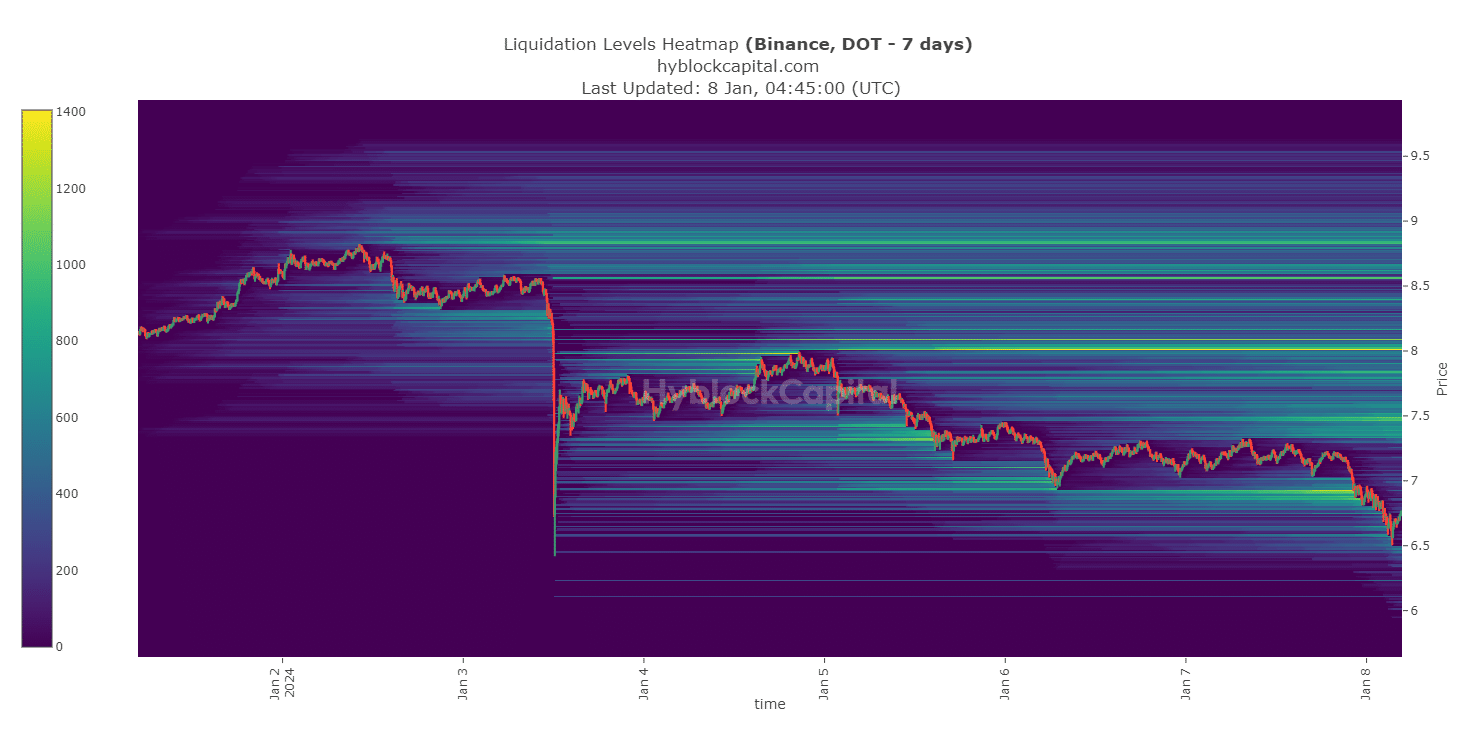

Our look at Polkadot’s liquidation levels revealed that the token witnessed a massive sell-off near the $8.8 mark. Soon after that, another sell-off spree began near $8.6, causing a price correction.

Since then, several more zones of high liquidation were noted, which pushed the token’s price further down.

Read Polkadot’s [DOT] Price Prediction 2024-25

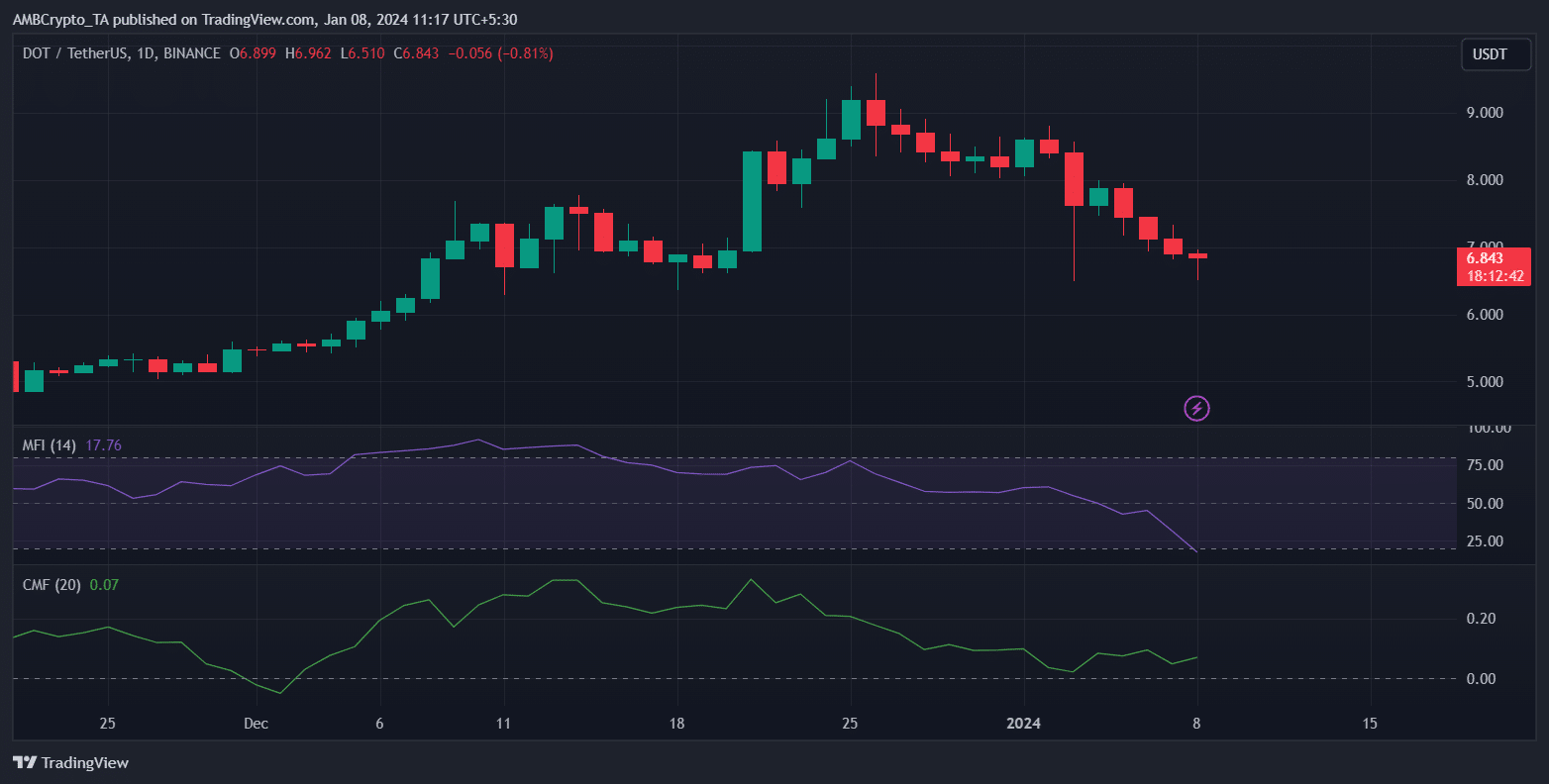

Though the aforementioned data looked concerning, things might soon turn out to be in investors’ favor. AMBCrypto’s look at Polkadot’s daily chart pointed out that its Chaikin Money Flow (CMF) registered a slight uptick.

Additionally, its Money Flow Index (MFI) was just about to enter the oversold zone. This could exert buying pressure on DOT, in turn pushing its price up.