Why this analyst’s ‘Bitcoin to go to $15k’ claim might be unfounded

Bitcoin, over the years, has earned its fair share of supporters and detractors. Now, there are many analysts who analyze and predict a future for the king coin. But sometimes, those predictions fail.

More often than not, what works best is a look at on-chain metrics. On observing some of those, it can perhaps be argued that one such assertion made by a popular analyst might turn out to be wrong.

If #Bitcoin corrects from here (which would be quite healthy), the bears will come out in full force, projecting #Bitcoin to go to $15K.

It will be fun.

— Michaël van de Poppe (@CryptoMichNL) August 1, 2021

Bitcoin to $15,000?

Not really. From the perspective of a correction, a slight fall would make sense and it would also be healthy. However, an almost 62% drop sounds rather unlikely. Even for cynics.

This is primarily because the numbers seemed to point to consolidation at best, discounting the possibility of a sharp fall. In order for a fall to $15k to become a reality, the market would have to sustain months-long bear pressure or a freefall. At this point, neither scenario seems possible.

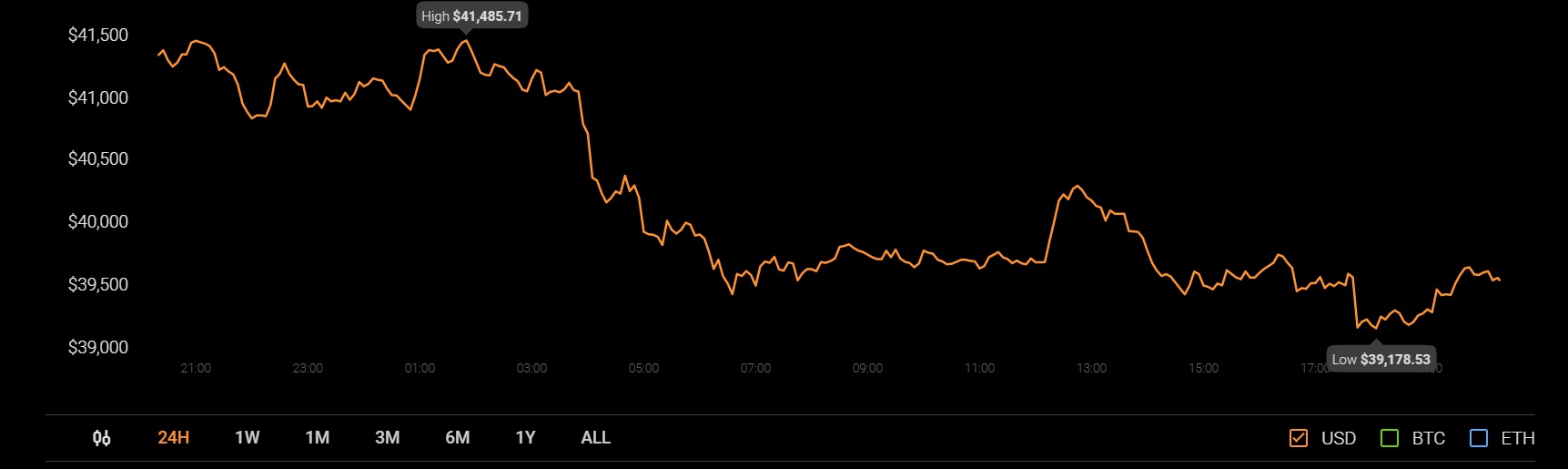

Source: Coinstats

At the time of writing, BTC’s supply in profit was up by 17% from 65.8% to 82.5% in just 13 days. What’s more, realized profits registered by the market are at a 3 month high too.

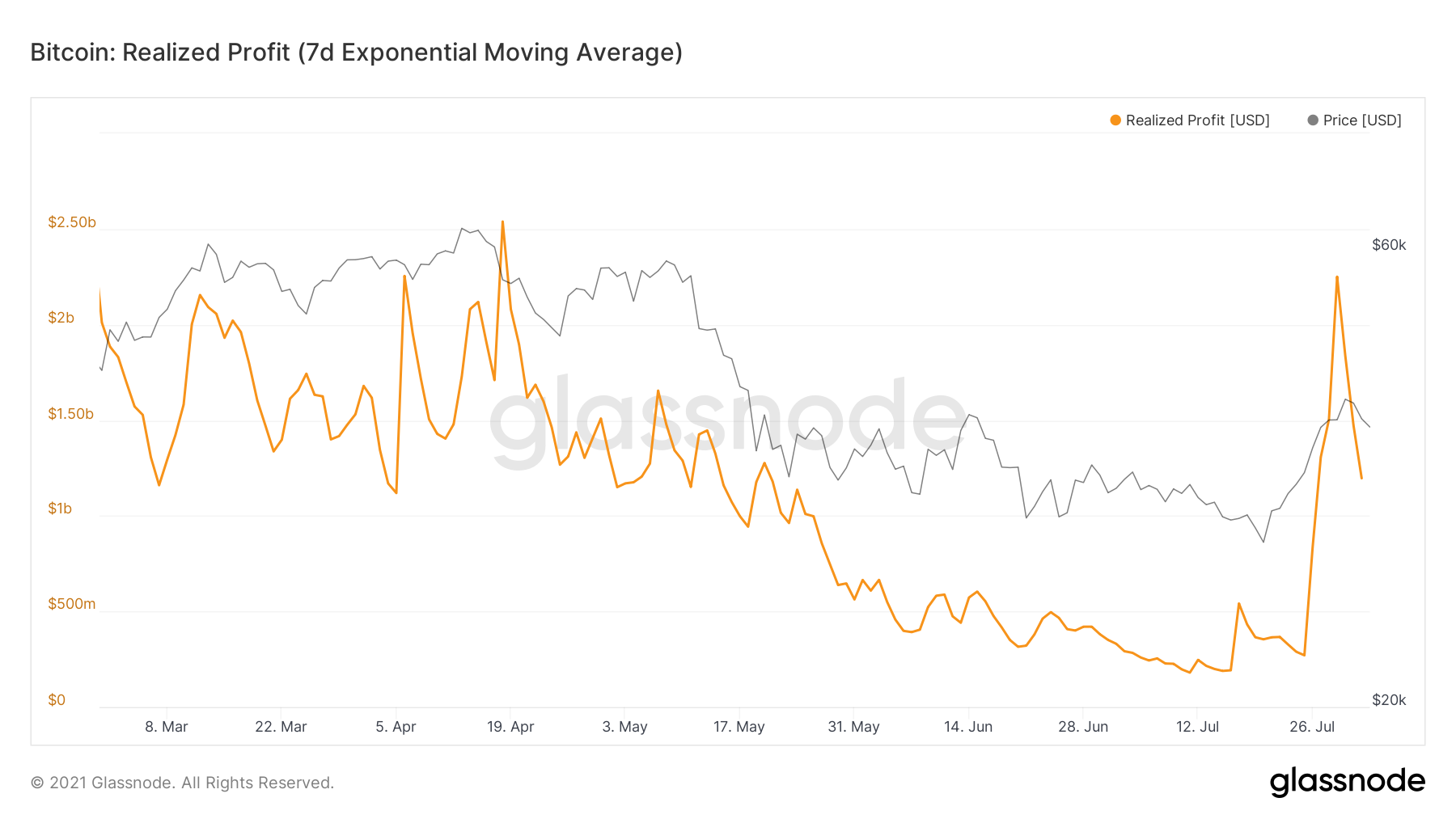

Bitcoin realized profits | Source: Glassnode – AMBCrypto

This is the biggest proof that a bear run is unlikely right now. Additionally, the liquid supply which represents cumulative inflows and outflows over the entity’s lifespan is at an all-time high.

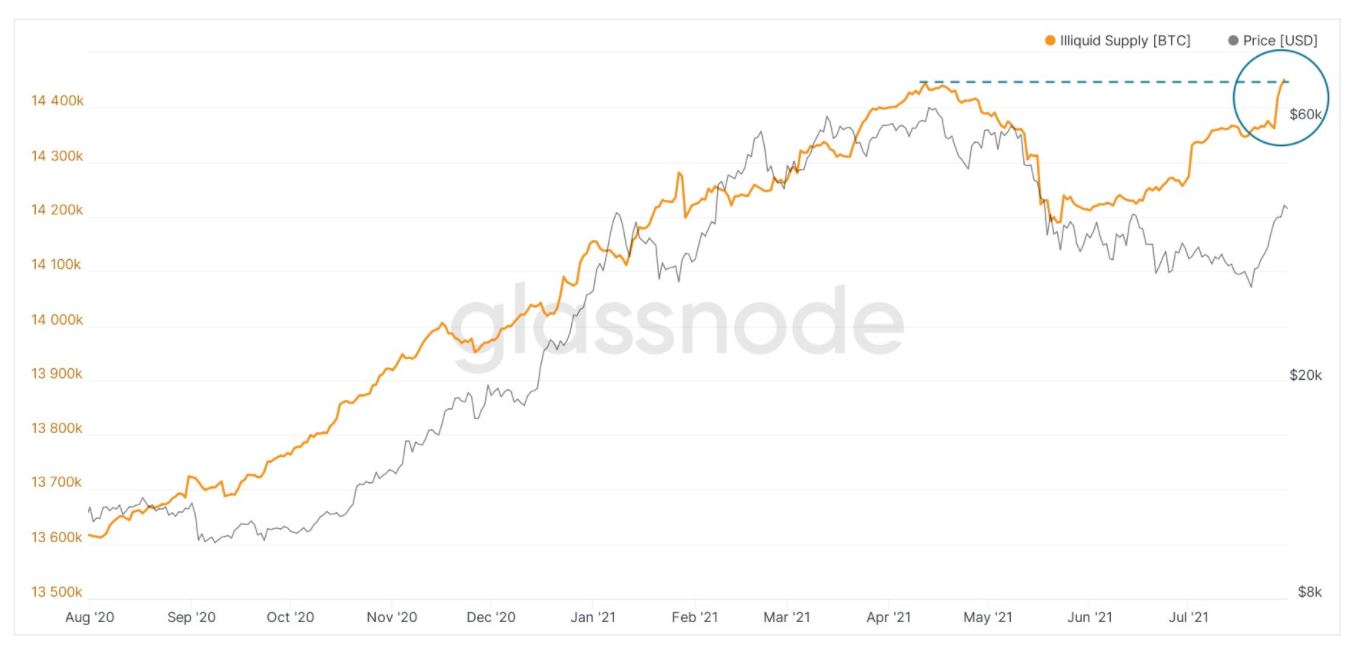

A hike such as this is proof that a) Bitcoin is moving from smaller hands to bigger hands, and b) No bear market or bears pulling BTC to $15k

Bitcoin liquid supply | Source: Glassnode

What about investors?

Right now, investors too seem to be supporting bullish price action on the charts. This can be supported by rising investor sentiment and the increasing number of addresses on a daily basis.

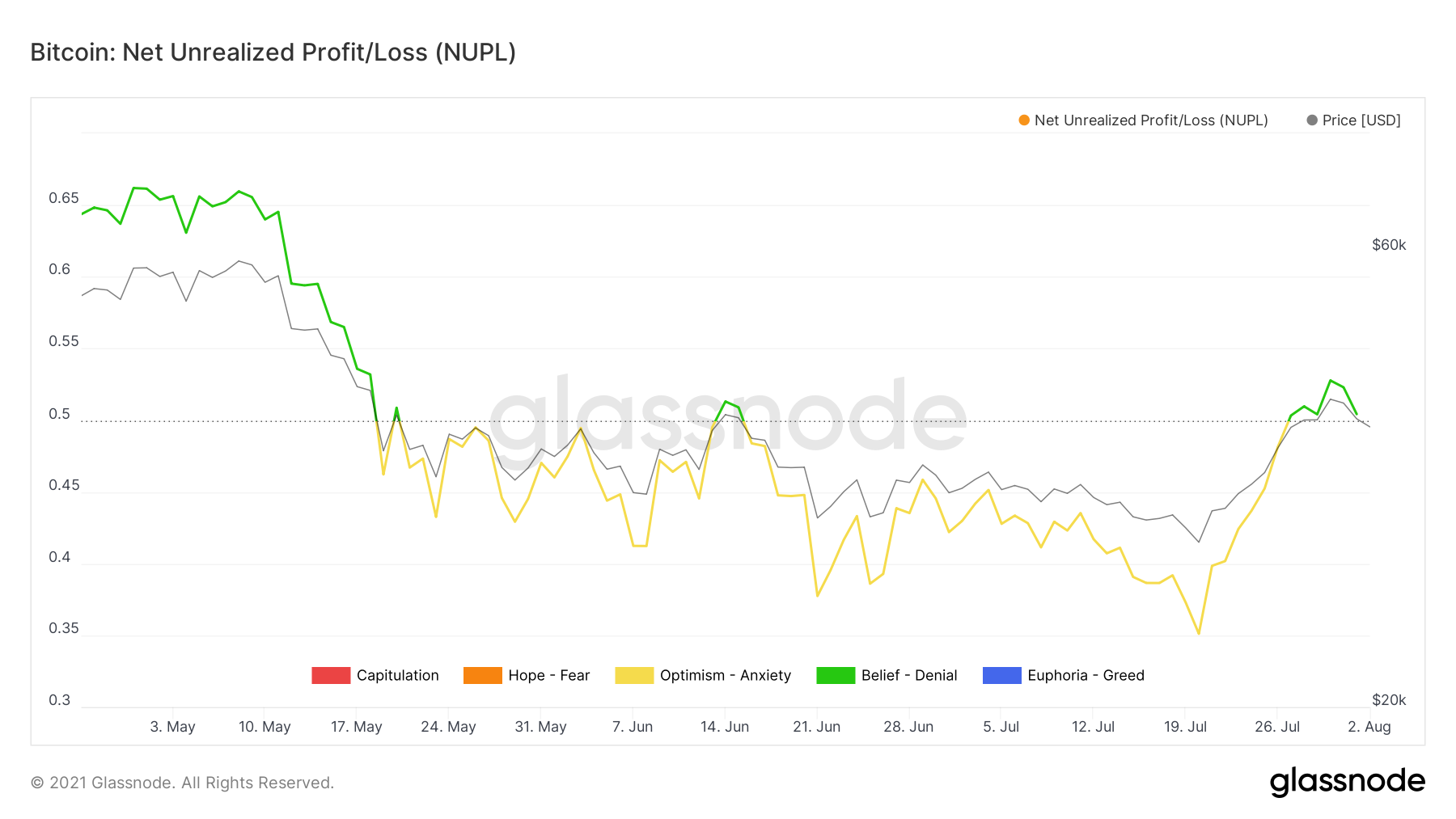

The probability of a drastic price fall can also be disproven by the MVRV ratio. According to the same, Bitcoin is well-positioned in the positive zone. Finally, the NUPL also found that BTC is in the zone of Belief-Denial – Another good sign for the market.

Bitcoin NUPL | Source: Glassnode – AMBCrypto

Once again, the cryptocurrency market is one without rules. So, there might just be a small chance that these on-chain metrics are wrong and might switch at the drop of a hat. If so, and if BTC does fall to $15k, despite all the evidence suggesting otherwise, wow.