Why this institution is ‘going to stick to Bitcoin’

Investors, mostly the institutional ones, continue to solve the mega puzzle. Should they buy Gold or instead go for cryptocurrencies which certainly got traditional institutional recognition over the past year.

Bitcoin, Ethereum, and other top 10 coins have created a lot of buzz around the market. Many individuals/firms even boarded this bandwagon before FOMO set in. Whereas, Gold mostly showcased a sideways trend.

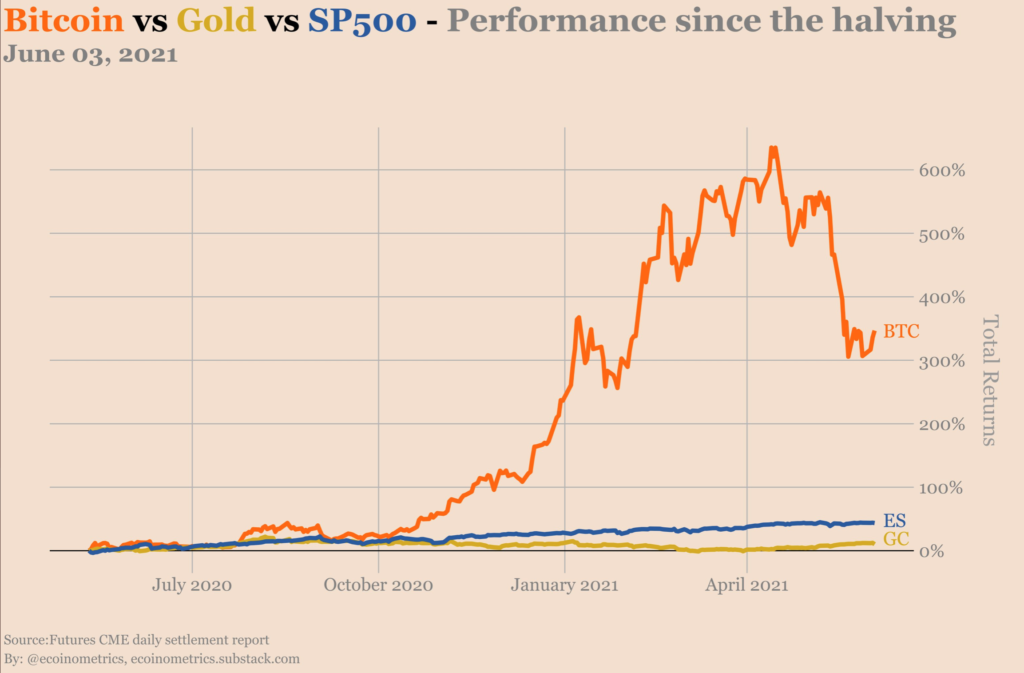

Here’s a performance-wise breakdown since the Halving, BTC +347% ; SP500 +43.6% ; Gold +10.1%

Source: Econometrics

Now, zooming out a bit, the entire community still remains divided. According to the latest report from Bloomberg, Troy Gayeski, co-chief investment officer and senior portfolio manager at SkyBridge Capital was the latest addition to voice his support towards Bitcoin. He said:

“We’re going to stick to Bitcoin and crypto because we just think there’s more upside. While there’s more volatility, you’re going to capture a little bit more juice than you will in gold from that same phenomenon.”

Furthermore, he added that ‘fiat alternatives’ be it Bitcoin or Gold, “…are in a much better place now to handle that eventual taper and gradual slowing of money-supply growth, than they were as they were making higher-highs after higher-highs.”

Source: Bloomberg

Contrasting the two assets, Bitcoin reached a new ATH near $65,000 in April, before plunging; the asset was around the $36,600 mark. Gold contrastingly painted a completely different picture. It came close to sinking into a bear market in March but surged upward to erase year-to-date losses.

SkyBridge Capital and Bitcoin

The firm in question and its founder, Anthony Scaramucci not so long along collaborated with First Trust Advisors on an exchange-traded fund to buy and sell Bitcoin. Although hopeful about the product’s approval by the SEC, Gayeski stated:

“The only reason we exist professionally is to find interesting ways to generate attractive non-correlated returns that also have an attractive risk-reward profile. The mix of strategies in our broader portfolio is amplified by having a small-but-meaningful position in alternatives to fiat currencies like Bitcoin.”

Why do investors choose Bitcoin over Gold?

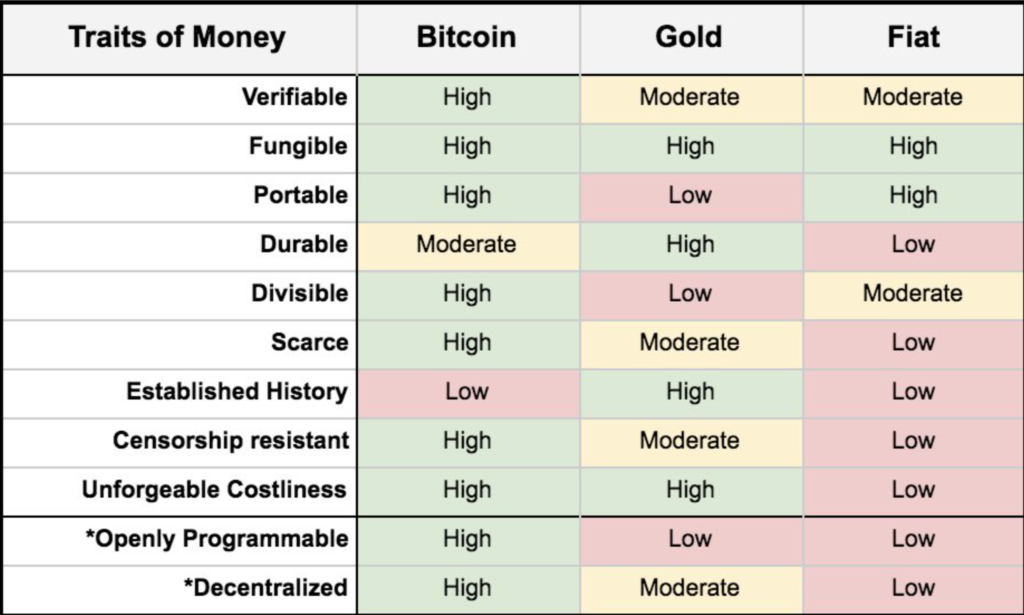

Now, both of these fiat alternatives provide a hedge against inflation. However, Bitcoin has a distinct advantage over gold.

Source: Twitter