Cryptocurrency trading is an interesting area. It’s a totally new concept, a way of trading that seems to shake off a lot of the restraints of more traditional finance.

Since its inception, crypto has been more or less open to everyone, allowing people without any significant financial background to achieve massive success from virtually nowhere.

This kind of tantalizing opportunity is one of the things that has led to crypto’s booming popularity. All over the world, people see coins like Bitcoin, Ethereum, and Ripple as a way to get rich without the need for a big investment or a ton of trading expertise.

It’s hard not to get seduced by it, and it makes for a genuinely exciting and promising movement.

But as time goes on, things are changing. Is crypto becoming more and more like traditional finance — dominated by the wealthy and influential? There’s a fair amount of evidence that it is.

And that’s sad. It’d be a real shame to see that happen to an industry built on ideals of inclusivity and opportunity for everyone.

The good news is that there is still hope. But first, let’s take a look at what’s changed, and why.

Is crypto becoming a toy for the (already) rich?

In the beginning, crypto was always associated with enthusiastic fans. Dedicated and passionate about the space, these early pioneers helped build crypto into what it is today.

There were some initial big investors, but the early crypto community was mainly characterized by ordinary people who just happened to love being part of and supporting this movement. And a few of them made a lot of money from it.

Nowadays, crypto is much closer to the mainstream. Space is home to quite a few ‘Bitcoin millionaires’ who achieved early success and are now enormously wealthy as a result.

In addition to these guys, there are also plenty of established business people who made their money in other industries and have spotted an opportunity to get even richer by trading crypto.

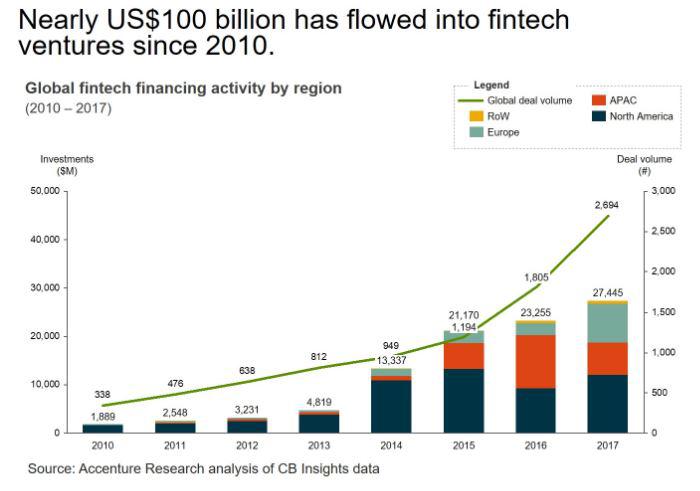

And to top it all off, we’re even seeing big financial firms looking to get involved on a fairly large scale. This graph highlights the huge and increasing amount of investment going into FinTech:

It’s great to see the crypto space growing in this way, and all this popularity, investment, and exposure certainly have its benefits.

But there are some issues, too. While ordinary people can still trade cryptocurrency the same as before, it’s becoming much harder for them than it is for their richer counterparts.

That leads to a lot of people feeling left behind and lamenting the fact that they’re at a disadvantage in a market that is supposed to be for everyone.

Why are the non-wealthy at a disadvantage?

One of the biggest reasons why the rich and well-connected are at a big advantage in crypto trading is down to automation.

Automating trades with algorithms is a huge part of finance. It’s the reason big financial firms have been using algorithms for a long time, and only seem to be using them more.

Basically, algorithms avoid a lot of the messy, clumsy aspects of human-based trading. People tend to make emotional and irrational decisions, act on impulse, and commit regular blunders. In fact, some studies suggest that human error is the leading cause of death in the USA.

This kind of unreliability can be terribly costly when trading.

Machines, on the other hand, can be more reliable, something which research is beginning to show. They can be programmed to monitor markets and trade at all times and tend to follow their instructions pretty closely without any strange or unpredictable actions.

In crypto trading, this kind of thing is even more significant. Crypto markets are 24/7, and it’s no secret that they can be highly volatile, as the chart below shows. So, having an algorithm that can monitor the markets constantly and make decisions when all the humans are asleep? That’s a really big advantage.

Bitcoin charts | Source: CoinMarketCap

Unfortunately, algorithms are expensive. Unless you’re a master programmer, you’ll need to invest in someone to build your algorithms for you. For most people, these services don’t come cheap.

The result is that the rich and well-connected players in the space have a clear advantage. How do we level the playing field and restore power to ordinary people?

Bringing algorithms to the people

There are currently several new companies dedicated to making it easier for people to build their own algorithms.

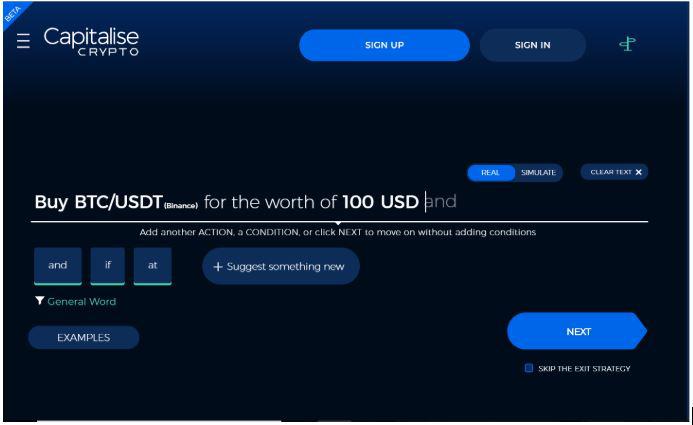

One example is Capitalise.

Their SaaS platform allows users to enter instructions in plain English — like ‘buy X amount of ETH at x time if Y happens’ and much more complex. Their interface is incredibly user-friendly and simple, and looks like this:

Source: Capitalise

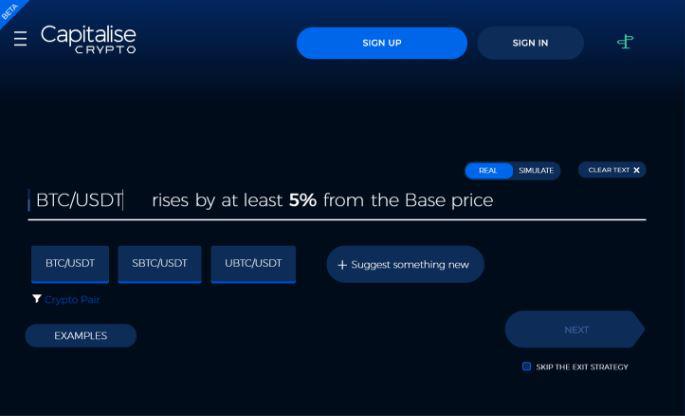

Users can simply enter how much Bitcoin they wish to buy in U.S. Dollars, and let the program do the rest. They can also take things up a notch, adding conditions such as ‘if the price of BTC/USDT rises by at least 5% from the base price.’

Source: Capitalise

There’s a whole range of directions users can take with their automation. It’s even possible to run a simulation in the platform, to test out and build an algorithm with no risk.

This could really change the way crypto trading works. By giving algorithms to everyone, not just those with the means to pay big money for them, crypto becomes a much more inclusive space.

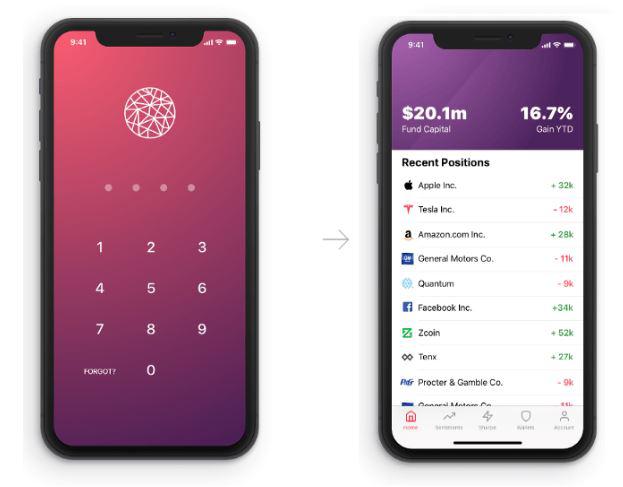

Sharpe Capital are using blockchain technology to reward users with Ether for sharing accurate crypto trading predictions. Users who consistently provide accurate sentiments will earn more long term.

Source: Capitalise

By building a platform that incentives users for correct predictions, Sharpe is creating an engaged community that utilizes the wisdom of the crowd and various expertise for cryptocurrencies.

Projects like these are really just the beginning for the crypto trading industry. It’s a huge market (the total market cap for all cryptocurrencies is currently sitting pretty at nearly $400 billion) with huge and growing potential.

Making the space more accessible to everyone could spell a return to crypto’s founding principles of decentralization and equality and create opportunities for everyone to profit.