Why XRP might have a shot at $4 in the next 2 weeks

The collective crypto-market is in a strange position at the moment. Bitcoin is indicative of a strong de-correlation with the likes of Ethereum and Cardano. And, while the long-term bullish structure remains intact for most, there still seems to be panic amidst BTC’s recent plunge to $60,380.

However, for XRP, the trend might be setting up for an explosive couple of weeks ahead. Especially since a possible new all-time high might be on the cards.

Now, the article might be berated by Bitcoin fanboys. But, this isn’t your coin so, why do you care?

XRP – daily and weekly game strong?

In a previous article, we discussed XRP’s consolidation within the symmetrical triangle pattern, with the narrative moving towards a bullish breakout. However, on 27 October, the breakout was southbound.

And yet, at the time of writing, the drop can be seen as a mere speed bump since immediate recovery was made and XRP moved above $1.10 within a week. Technically, the daily candle closed above the Exponential Moving Average-20 or EMA-20 within 3 days, indicative of strong bullish momentum.

Now, in light of the aforementioned structure, the weekly chart maps out perfectly for XRP.

Fractal formations over a longer timeframe usually dictate the direction of a trend and XRP’s recent patterns have been salivating. As can be observed above, the weekly chart for XRP registered a similar local top, local bottom, and a positive symmetrical triangle breakout in Q1 2021 and Q4 2021.

The only missing part of the continuation chart has been the explosive returns. These took XRP to $2 during April 2021. A similar unfolding would push XRP easily above $3, hitting $4 at its potential best over the next couple of weeks.

Theory to support and counter?

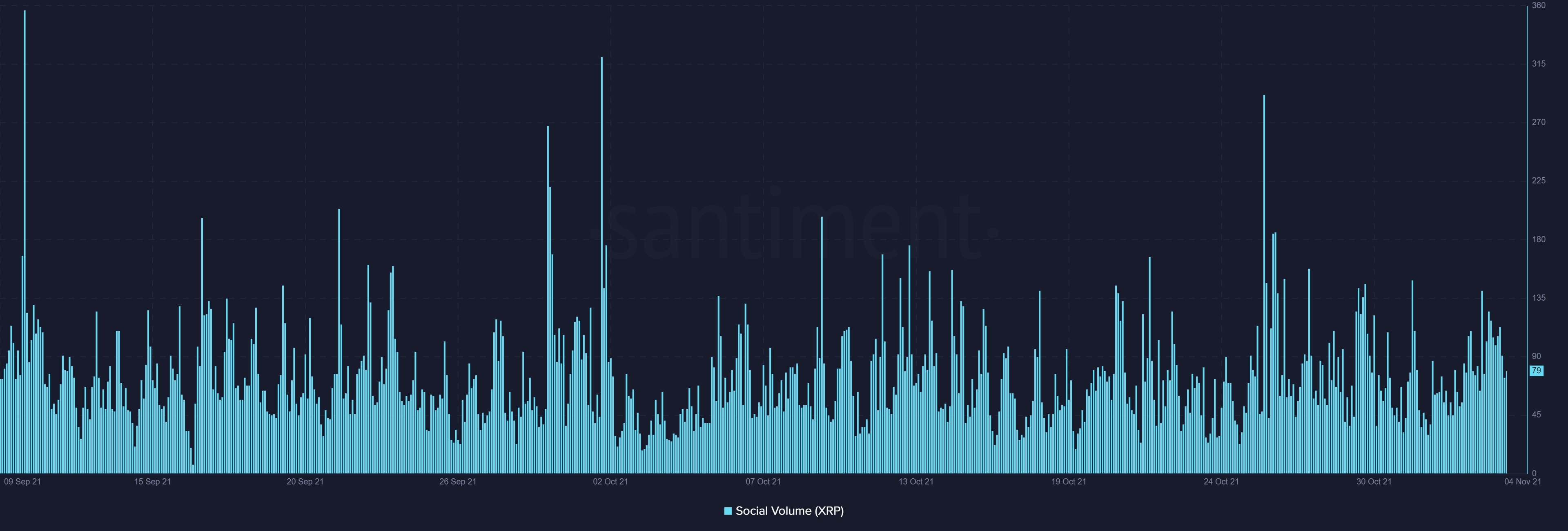

Source: Santiment

Now, the counter-argument to the $4-summit could be the lack of social volumes. Q1 2021 saw massive engagement for XRP. The same, at the moment, however, isn’t very evident.

As illustrated below, social volumes haven’t been anything extraordinary. This may indicate the lack of retail interest or general public enthusiasm.

However, on-chain activity is nothing to be worried about. A sharp bullish divergence was observed between rising active addresses and dropping prices a week back. Now, the recent spike in value is emerging as a fundamental catalyst.

Rising daily active addresses mean engagement is on the rise. By implication, this means XRP is getting the attention of its users.

Final Words

To be fair, a moonshot to $4 is still extremely speculative, even though the market structure and fundamental reasoning hold through.

Any sharp correction on BTC’s side may witness a collective altcoin dump as well. However, XRP has navigated through a bullish period despite BTC’s involvement in the past. Hence, there isn’t any reason to believe it might not do it again. As always, Do Your Own Research.