Why you should be wary if you’re a Chainlink investor

Chainlink has been seeing an outstanding 2021. And yet, it is not blowing the competition out of the water like it did in 2020. The crypto-asset has risen by more than 200% since the start of the year, but its position in the market is now outside the top-10.

With respect to development as well, other projects have seemingly stepped up and they are currently taking away more attention. Staying relevant in this space is as important as functionality, therefore, is Chainlink moving towards the non-essential bracket now (figurative speech, not literal)?

On-chain dive: Yay or Nay for Chainlink?

While the YoY statistics do highlight credible growth for LINK, its addresses do not exhibit the same level of profits.

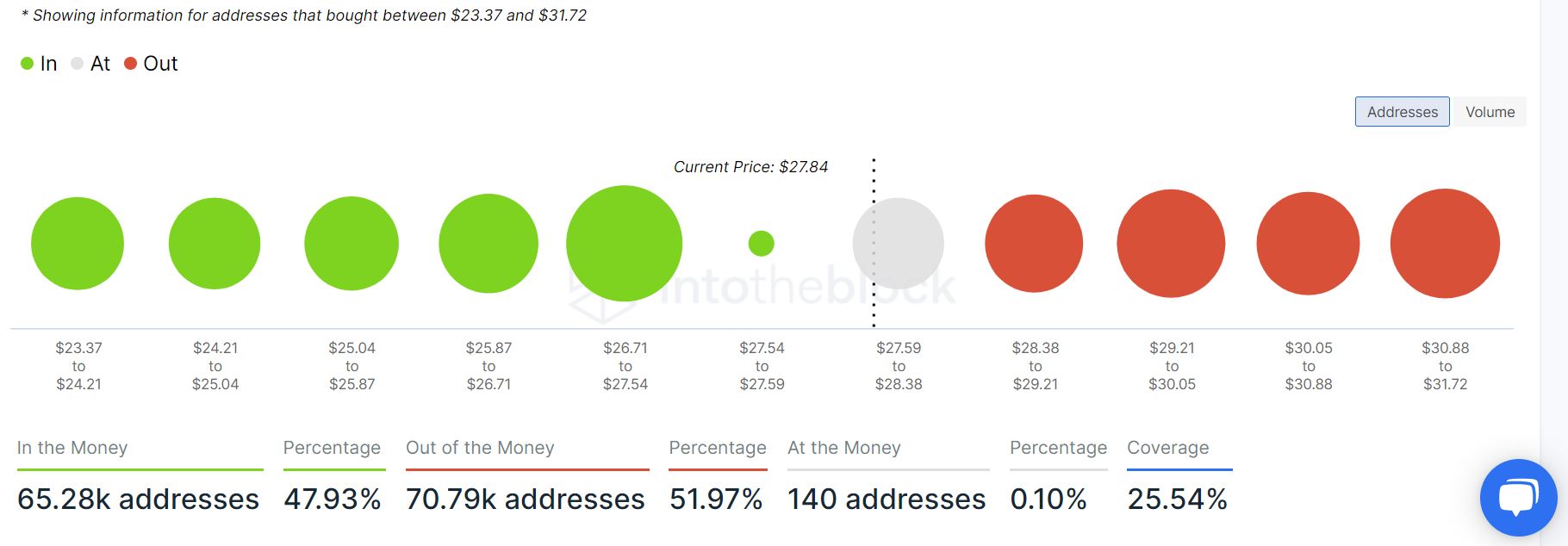

According to IntoTheBlock, the number of addresses that bought LINK between the price point of $23-$32 was more out of the money, at press time. 47.93% of 70.79k addresses were still in profit, but close to 140k addresses were out of the money. Here, it is important to note that these statistics don’t include investors from last year, something that means that overall the traders might be in profit.

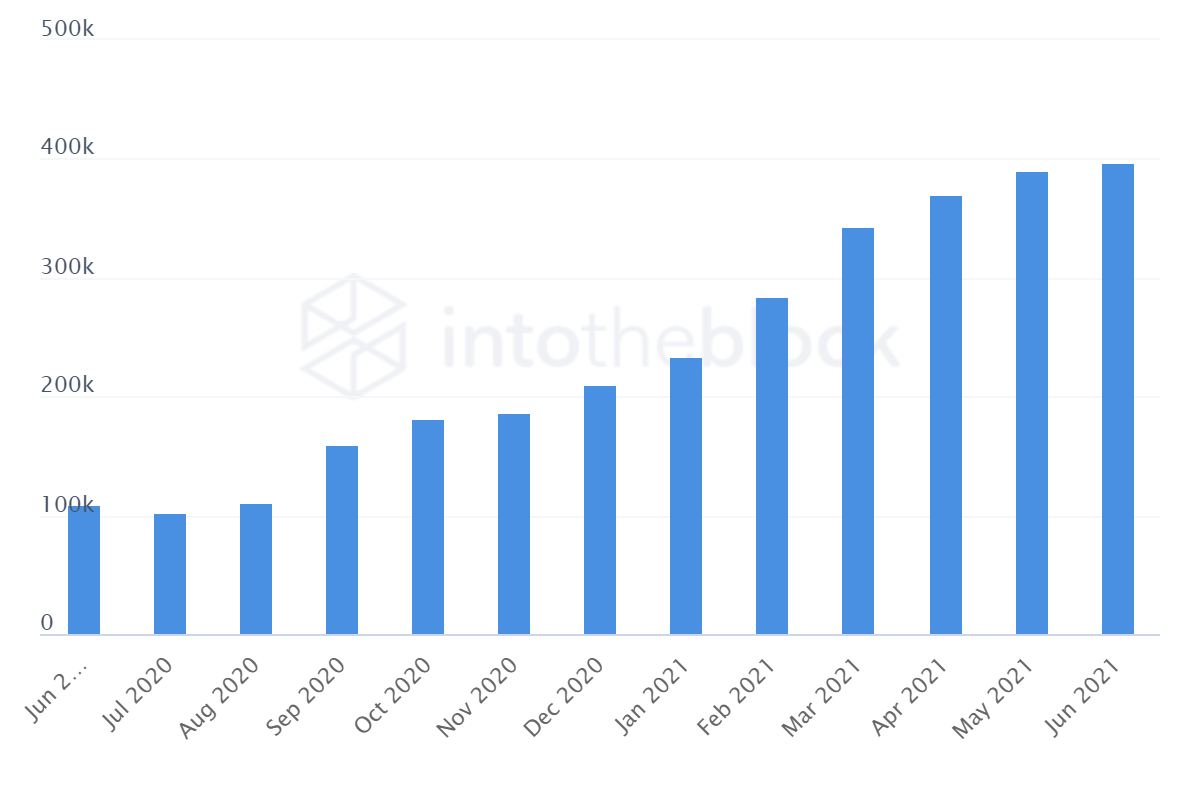

The aforementioned fact can be backed by the number of cruiser addresses increasing in 2021. Cruisers addresses are the ones holding LINK for 1 month-12-month period, which means most of the count increased due to consistent hodling throughout 2021.

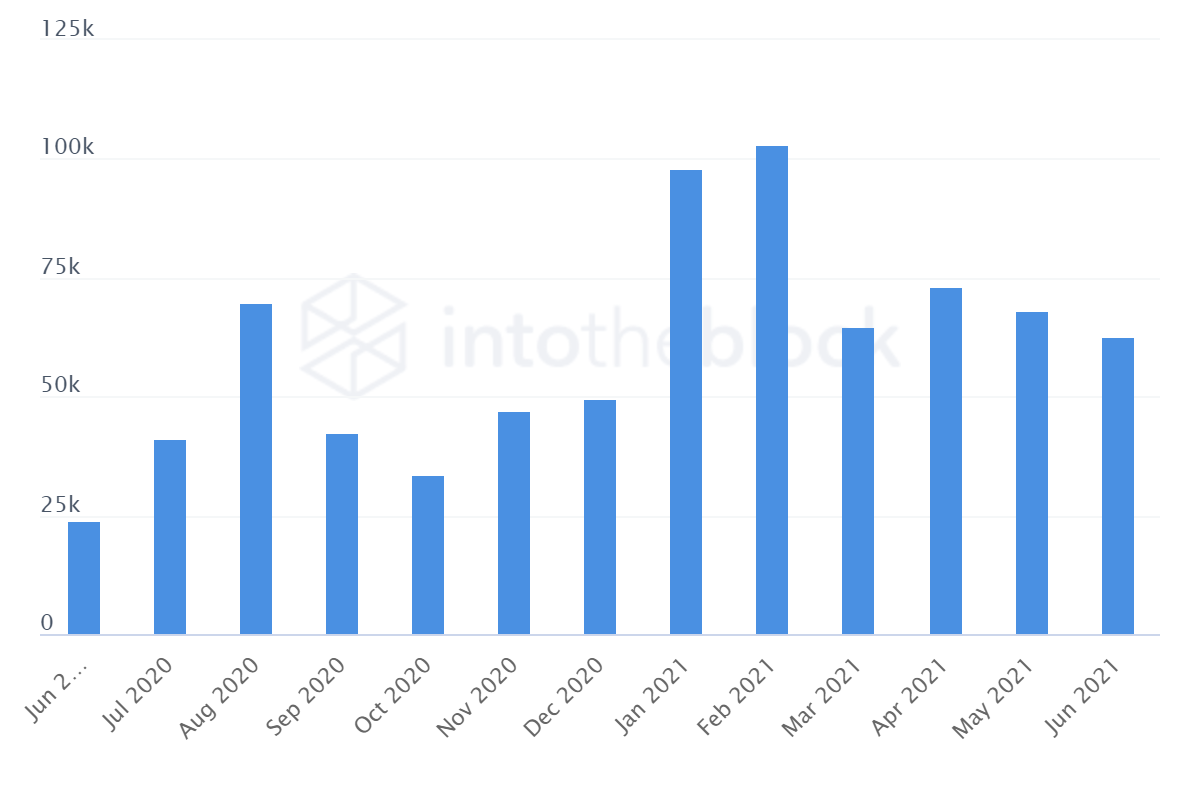

On the flip side, it has not been attracting any retail traders over the past few months, something that is detrimental to the overall market momentum.

Trader addresses (holding LINK less than 1-month) have drastically dropped in numbers too and it means investors are lacking to identify bullish momentum with Chainlink. In the long-term, it may not matter much but keeping up with current market profitability and trend, retail traders are essential for LINK to maintain its upper range.

Additionally, active addresses have been exhibiting low levels witnessed previously during the end of 2020. Right now, it is difficult to identify consistent bullish traits for LINK via on-chain metrics, but Chainlink still seems to be pretty relevant.

Revolut is a major tick-box checked

Now, Chainlink from a partnership perspective continues to grow in the space, and it was recently added by Revolut financial application. Revolut is a major company that manages different investments for users and LINK being accepted under its name is a positive statement for the ecosystem.

It also received props from one of the most respected crypto-traders in the industry.

#Chainlink is one of the strongest assets out there, I think.

It will surprise many people.

The entire oracle section.

— Michaël van de Poppe (@CryptoMichNL) May 28, 2021

Overall, Chainlink is still considerably in limbo, but it is not completely down and out. A persistent bear market may do more damage to its value. Ergo, LINK may need the bullish cycle back, more than the other altcoins at the moment.

![Uniswap [UNI] price prediction - Traders, expect THIS after altcoin's 14% hike!](https://ambcrypto.com/wp-content/uploads/2024/12/UNI-1-400x240.webp)