WIF: Is a $10 billion valuation in sight for the memecoin?

- Surging Open Interest was one of the reasons for its parabolic rally.

- A thorough analysis showed that WIF’s price might retrace before it aims for a $6 billion market cap.

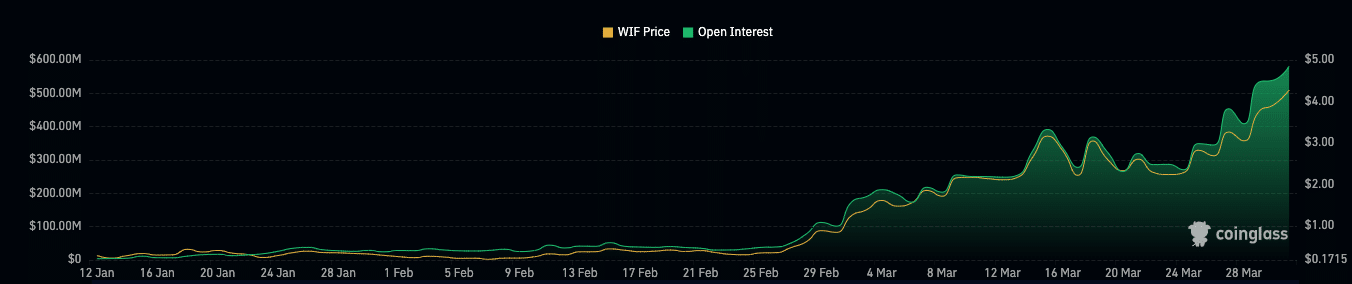

It has been an exhilarating ride for dogwifhat [WIF], now ranked as the 29th most valuable cryptocurrency in the market. However, a lot of participants might not know this but the Open Interest (OI) in the derivatives market has been a major reason WIF has been climbing.

OI is the total value of open contracts in the market. At press time, WIF’s OI was $654.01 million, according to data from Coinglass. But one thing AMBCrypto observed was how the value about a month ago was lower.

For instance, the Open Interest on the 27th of February was less than $60 million, meaning the indicator has risen 10x in value since then.

From a trading point of view, the increase in OI suggested that buyers were more aggressive than sellers. As a result, the large OI, backed by a lot of liquidity helped WIF pump.

It’s time to cool off

As of this writing, WIF’s market cap was $4.22 billion. However, it does not seem like the interest in the perp side of the market would wane anytime soon. If this is the case, the memecoin’s valuation might double within the next few weeks.

Furthermore, AMBCrypto admitted that the OI alone cannot determine the price direction. But one can look to other actions taken by traders to predict where next WIF might head. This time, we considered the Funding Rate.

According to data from Coinalyze, WIF’s Funding Rate was 0.067 at press time. But the predicted rate was 0.078. However, the price of dogwifhat has been decreasing in the last four hours.

As Funding becomes higher and the price moves lower, perp buyers might be in disbelief and this could be bearish. Consequently, this could cause WIF to drop below $4.45 in the short term.

Is $6 billion the next target?

On the other hand, if the price bounces while the Funding Rate stays positive, the token’s value might probably surpass $5. Should this be the case, the market cap of dogwifhat could inch closer to $6 billion.

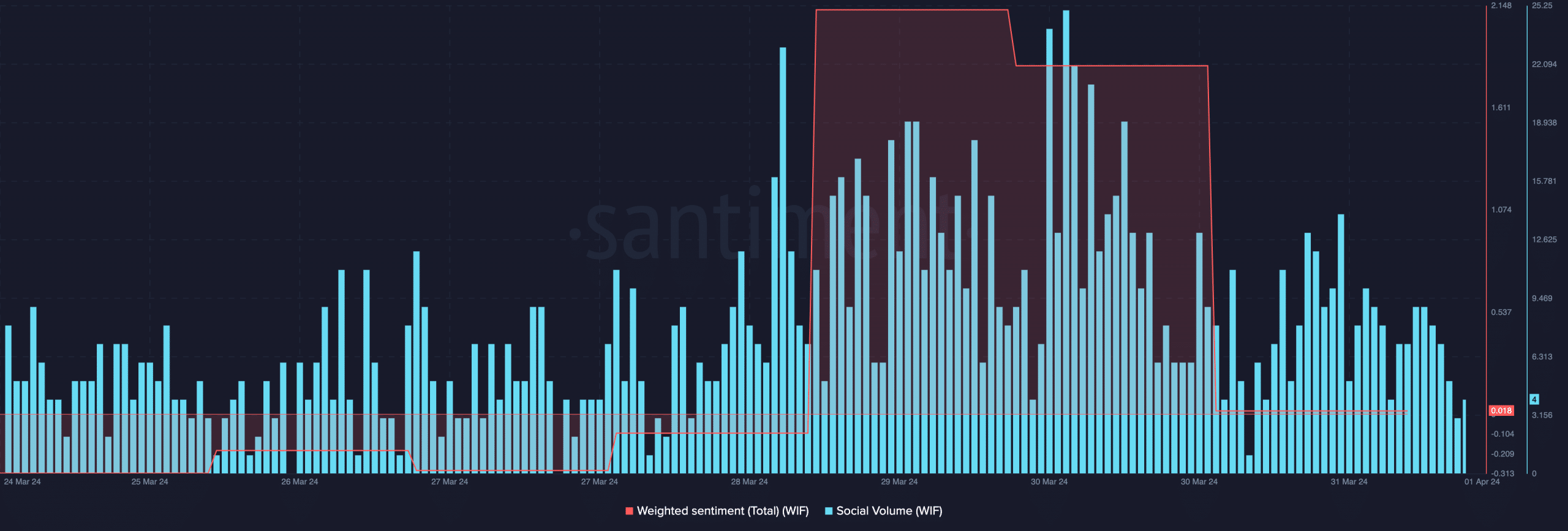

However, on-chain data provided by Santiment showed that market participants had lowered their expectations of WIF. As of this writing, the Weighted Sentiment, which tracks positive/negative commentary had fallen to 0.018.

This decline proved that the rate of optimistic remarks about the project had significantly decreased. Like the sentiment, the social volume around WIF dropped, suggesting that the search for the memecoin had fallen.

Realistic or not, here’s WIF’s market cap in SHIB terms

If search for WIF decreases, it means that demand for the cryptocurrency might also fall. Should this be the case, WIF’s price might slip below $4.45.

However, a resurgence in buying pressure could push the value higher, and the market cap might jump. But for the time being, WIF might remain between the 25th and 30th position where the market cap was less than $10 billion.